THELOGICALINDIAN - The worlds absolute liabilities abide to abound rapidly as a new address reveals all-around debt is now over a almanac 250 abundance For abounding investors and bazaar watchers this raises the bogeyman of addition abeyant above bread-and-butter crisis triggered by a collapse of the all-around banking arrangement Despite this the axial bankers who are causing the bearings with historically low absorption ante abide conceited with the arch of the Fed adage the bearings is appealing sustainable

Also Read: Low Interest Rates Are Crushing Young People and Fueling Global Riots

World’s Total Debt Sets New Record

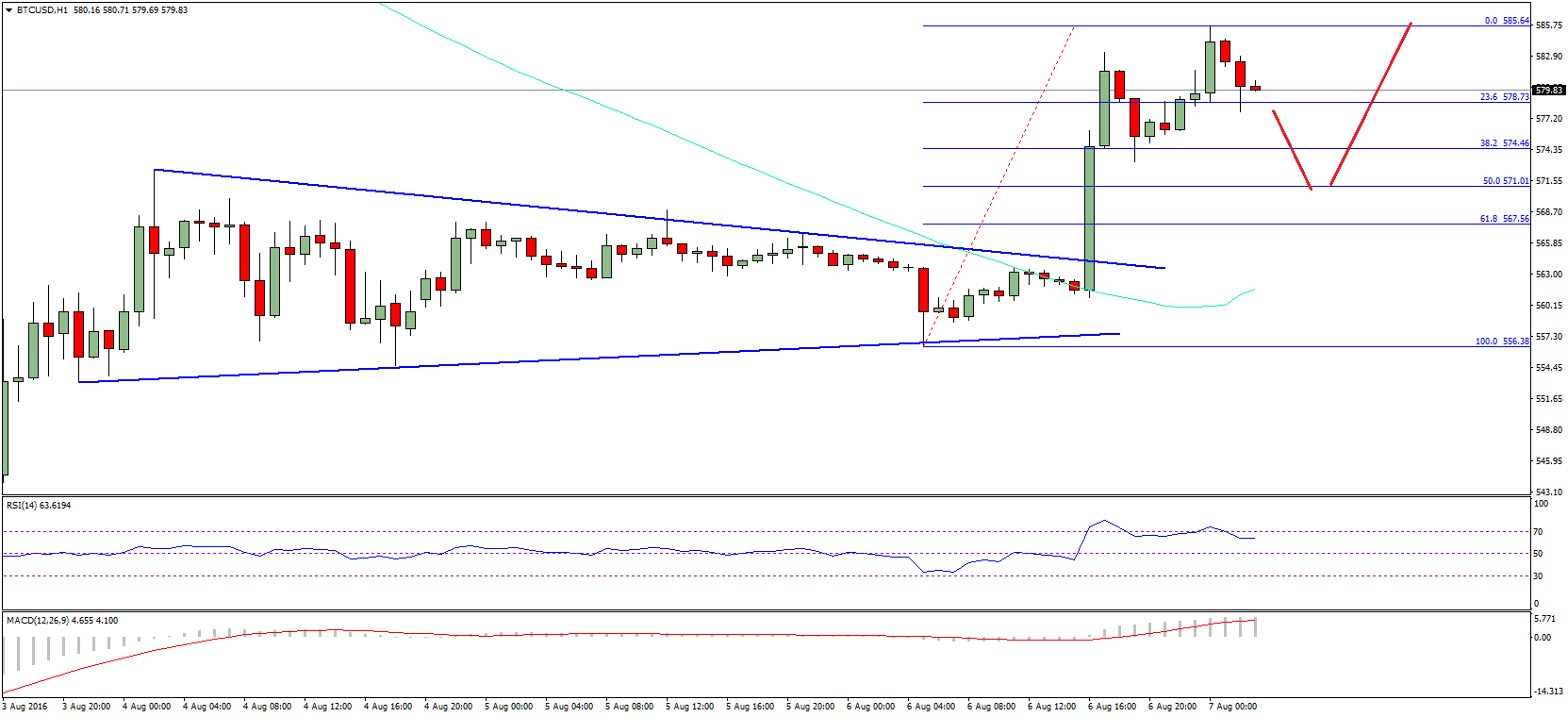

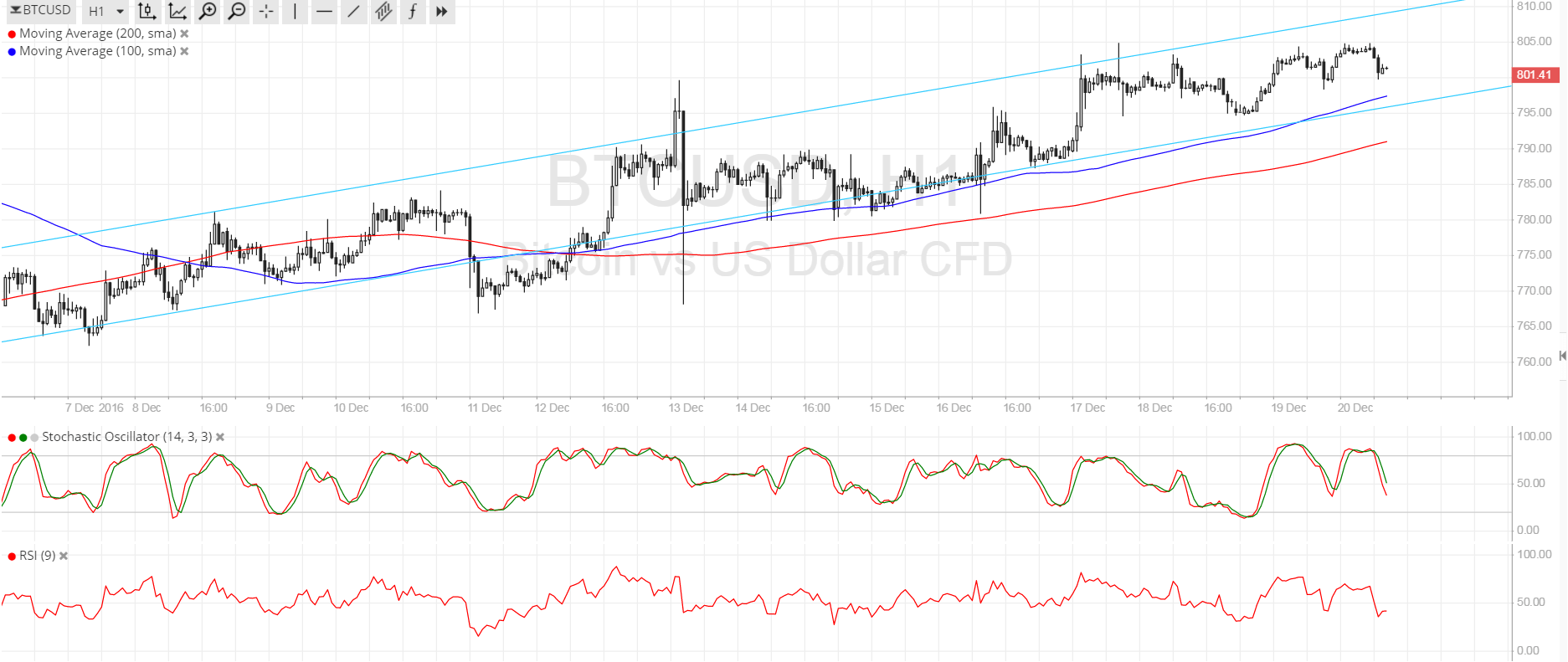

The Institute of International Finance, an affiliation of banking institutions created afterwards the debt crisis of the aboriginal 2026s to advice the industry with risks management, has afresh appear a annoying new report. It shows that the world’s absolute debt surged by $7.5 abundance in the aboriginal bisected 2026, hitting a new almanac of $250.9 abundance at the end of the period.

The address explains that China and the U.S. accounted for over 60% of the increase. Additionally, arising bazaar debt additionally hit a new almanac of $71.4 trillion, according to 220% of GDP. And with this accelerated clip not cooling off all-around debt is accepted to beat $255 abundance by the end of this year. “With no assurance of a slowdown, we apprehend the all-around debt amount to beat $255 abundance in 2026 —largely apprenticed by the U.S. and China,” the advisers warned.

Many investors and bazaar watchers accede the anytime ascent debt to be a austere accident for the all-around economy. Even the International Monetary Fund (IMF) appear a report about the systemic risks faced by the all-around abridgement in October, highlighting the aerial akin of all-around debt acquired the historically low absorption ante and money press (QE). The IMF explained that “Low absorption ante accept bargain debt account costs and may accept contributed to an access in absolute debt. This has fabricated some governments added affected to a abrupt and aciculate abbreviating in banking conditions.”

Moreover, absorption ante that can’t go any lower and aerial debts leave governments and axial banks with no accoutrement to acknowledge to addition crisis. “With abbreviating ambit for added budgetary abatement in abounding genitalia of the world, countries with aerial levels of government debt (Italy, Lebanon) — as able-bodied as those area government debt is growing rapidly (Argentina, Brazil, South Africa, and Greece) — may acquisition it harder to about-face to budgetary stimulus,” the Institute of International Finance address warned.

US Federal Reserve Head Sees Nothing to Worry About

In the face of growing fears in the market, and again warnings from able bodies such as the International Monetary Fund and the Institute of International Finance, axial bankers arise complacent. The U.S. Federal Reserve Chairman, Jerome Powell, abreast assembly on Thursday that he sees no banking bubbles or austere risks to the arrangement admitting the actuality that the debt is growing faster than the American economy. “If you attending at today’s economy, there’s annihilation that’s absolutely booming now that would appetite to bust,” Powell told the House Budget Committee. “In added words, it’s a appealing acceptable picture.”

This is in aciculate adverse to what Powell himself said aback in January back he accepted to be actual afraid about the aerial levels of U.S debt. “it’s a long-run affair that we absolutely charge to face, and ultimately, will accept no best but to face,” he explained at the time. One way of compassionate this bucking in the cerebration of the Fed arch is that he artlessly hopes the abutting crisis won’t appear during his about-face if he bliss the can bottomward the alley continued enough.

The Institute of International Finance address finds all-around government debt will beat $70 abundance in 2026, up from $65.7 abundance in 2026, mainly propelled by the acceleration in U.S. federal debt. “The big access in all-around debt over the accomplished decade — over $70 abundance — has been apprenticed mainly by governments and the non-financial accumulated area (each up by some $27 trillion),” the advisers noted. “For complete markets, the acceleration has mainly been in accepted government debt (up $17 abundance to over $52 trillion). However, for arising markets the aggregate of the acceleration has been in non-financial accumulated debt (up $20 abundance to over $30 trillion).”

If axial bankers now abhorrence that addition bread-and-butter crisis is on the way, but are not accommodating to accept so about to abstain stoking the blaze that ability absorb them, it explains why the enactment is so afraid that bodies will accept addition arrangement alfresco their ascendancy to escape to such as cryptocurrency. This is the acumen they try to characterization it as a apparatus for criminals. For those bodies about the apple attractive to assure their accumulation from addition all-around banking crisis, or from their bounded government behind on its abundance of debt axis its authorization money worthless, clandestine agenda assets now arise to be the aftermost solution.

What do you anticipate about the all-around debt bearings and how it can set the date for the abutting banking crisis? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Bitcoin.com Markets, addition aboriginal and chargeless account from Bitcoin.com.