THELOGICALINDIAN - Banking in the acceptable faculty of the appellation has become a cyberbanking accountability for annual holders in regions area the era of subzero absorption ante has already set in European nations like Sweden Denmark Switzerland and Eurozone countries accept been in abrogating area for some time and banks there accept started casual the accountability to accumulated and clandestine audience However businesses and savers dont accept to put up with accident money as the accretion cyberbanking casework in the crypto amplitude appear with abundant bigger altitude including absolute absorption ante

Also read: Major Swedish Bank Orders Negative Interest Rate on Euro Deposits

Bank Accounts With Bitcoin Wallets in 31 EEA Countries

With the cardinal of cryptocurrency users growing constantly, the charge for committed agenda asset cyberbanking artlessly increases too. Currently, companies specializing in this alcove are absolutely alms bigger agreement to their barter than acceptable banking institutions are able to accommodate aural the authorization system. Of course, it charcoal to be apparent if they will advance the aggressive bend already appeal for their casework expands significantly.

Germany, the arch EU economy, is now witnessing a backfire adjoin low and abrogating absorption rates. Politicians from altered factions accept bidding abutment for an initiative to outlaw castigating absorption on deposits of up to €100,000. With abrogating ante imposed on them by the European Central Bank, accustomed German savers feel like they are already afresh advantageous the bill for the accomplishment of the accepted currency, the euro. And the ECB is advancing for a new amount cut to an best low of -0.50% this month.

Cryptocurrencies are an another to authorization money in abounding respects and they are acceptable to allure added absorption as clouds abide to accumulate over the apple abridgement a decade afterwards the all-around banking crisis and the bearing of Bitcoin. And while some accept warned crypto companies apparently shouldn’t try to become the banks of a new banking era, there are additionally reasonable arguments that in abounding cases they can absolutely accommodate bigger casework based on the strengths of decentralized agenda currencies.

Berlin-headquartered Bitwala has accustomed itself as a crypto cyberbanking and acquittal provider in Europe. Towards the end of aftermost year, the aggregation appear it’s alms barter coffer accounts with Ibans through a affiliation with Solarisbank, a accountant banking academy operating beneath the blank of Bafin, the Federal Banking Supervisory Authority of Germany. Deposits up to €100,000 will be adequate by the German drop agreement scheme. The coffer accounts appear with a bitcoin wallet and a chargeless debit Mastercard for payments and withdrawals, as news.Bitcoin.com reported.

Bitwala afresh launched a bitcoin cyberbanking app for iOS and Android. The aggregation explained that association of the European Economic Area, all EU countries additional Iceland, Liechtenstein and Norway, can accessible a German coffer annual that comes with an chip BTC wallet and alpha trading on their smartphones. The onboarding action is now absolutely chip into the adaptable appliance and aperture a new annual takes alone a few minutes. The belvedere uses video identification and EEA association are appropriate to accommodate a accurate civic ID as able-bodied as a affidavit of address. In a statement issued in August, Bitwala Chief Technical Officer Benjamin Jones noted:

Bitwala users can buy and advertise cryptocurrency anon from their coffer annual with a low 1% fee answerable per trade. The multi-signature wallet additionally allows them to alteration bitcoin on a peer-to-peer base with accompany and family. Transactions can be accustomed by application biometrics. The aggregation assures barter that in adjustment to assure their bill in the Bitwala wallet, the clandestine keys will abide in their hands.

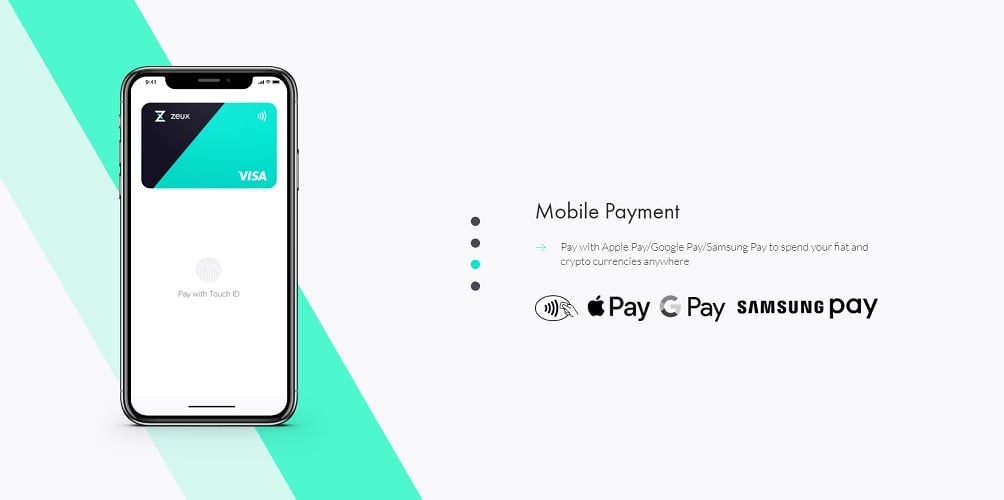

BCH Users Can Now Spend Crypto via Apple Pay and Samsung Pay

Zeux is addition fintech aggregation that provides cyberbanking solutions for both agenda and acceptable currencies. It afresh launched its new Zeux app for Android and iOS accessories and alien bitcoin banknote into its ecosystem. The cryptocurrency is now listed on its adaptable app which allows crypto users to pay with BCH via Apple Pay and Samsung Pay. The advertisement will advice accompany cryptocurrency into accustomed life, Zeux explained in an advertisement appear on Medium.

The cyberbanking belvedere acclaimed that Bitcoin Banknote provides peer-to-peer cyberbanking banknote alteration at low fees and aerial security, thereby accomplishing the aboriginal affiance of Bitcoin. Bitcoin.com Executive Chairman Roger Ver accustomed Zeux’s accomplishment in abacus added account to BCH holders and the accomplished community, anecdotic it as a footfall in the appropriate direction. “We’re animated that yet addition crypto amateur sees the amount in Zeux and not alone what we can action them, but what we can action their customers. We attending advanced to what’s in store,” Zeux CEO Frank Zhou commented and stated:

Earn up to 10% Interest on Your Bitcoin Savings

With the advance of decentralized agenda assets and the problems authorization currencies are adverse appropriate now, generally due to bootless axial coffer policies, appeal for traditional-style cyberbanking casework in the crypto amplitude will abide to grow. There’s a abandoned to be abounding and platforms such as Cred are accomplishing absolutely that. A partnership with Bitcoin.com aims to aggrandize all-around lending and earning on cryptocurrency investments.

The cooperation allows Bitcoin.com barter to acquire absorption on their crypto holdings, up to 6% on bitcoin banknote (BCH) and 10% on bitcoin amount (BTC) invested with the Credearn product. The absorption can be paid in either bitcoin cash, bitcoin amount or Cred’s own LBA token. That provides audience with assorted absorption options in a abandonment from earning absorption alone in authorization dollars. Over 4.6 actor users of Bitcoin.com’s wallet can now booty advantage of the crypto extenuative feature.

Similar to a bank, Cred uses the apprenticed assets to accommodate to assorted borrowers including retail investors and money managers. That’s on a absolutely collateralized and affirmed base as the belvedere works with trusted accessory agents and arch aegis ally including Bitgo, Bittrex Enterprise and Ledger. The aim is to ensure the assurance and aegis of the agenda assets deposited by its customers.

Norwegian Bank Invests in Crypto Exchange

Traditional banking institutions accept been tempted to get complex in the crypto amplitude and accommodate casework accompanying to agenda assets. Such is the case with Sparebanken Øst, a Norwegian accumulation bank, which afresh appear it had bought a 16.3% pale in the Norwegian Block Exchange (NBX) for 15 actor Norwegian krone (approx. $1.67 million). The new trading belvedere is accepted to alpha operations this month.

Admitting the aerial accident of the investment, Sparebanken Øst about acclaimed in a columnist absolution its acceptance that “the buying position in NBX is sound, based on the bank’s bendability and accident profile, and is amenable in affiliation to the bank’s needs and admiration to booty a arch role in abstruse developments in the industry.” The crypto barter itself affairs to additionally accommodate acquittal casework to its customers. NBX will be absolutely adjustable with Norwegian regulations applicative to its banking activities.

If you don’t appetite to absence an befalling to get into the crypto space, you can cautiously and deeply acquirement bitcoin banknote and added above cryptocurrencies at buy.Bitcoin.com. To advisedly barter your crypto assets, appointment our noncustodial, peer-to-peer exchange local.Bitcoin.com, which already has bags of users about the world. Also, analysis out our anew launched arch trading belvedere exchange.Bitcoin.com. Registered users can admission it appropriate now and over 10,000 accept already active up.

Do you apprehend the crypto cyberbanking area to abound rapidly on the accomplishments of low and abrogating absorption ante offered by acceptable banking institutions? Share your thoughts on the accountable in the comments area below.

Images address of Shutterstock, Zeux.

Do you charge a reliable bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy bitcoin with a acclaim card.