THELOGICALINDIAN - Global markets accept been activity the burden of abhorrence and ambiguity as the accessible Federal Open Bazaar Committee FOMC affairs to accomplish a accommodation on Wednesday apropos alteration the accepted budgetary abatement action and adopting the criterion absorption amount Economists and bazaar analysts abhorrence the advancing Federal Reserve will bind markets too fast afterwards the axial coffer broadcast the US budgetary accumulation like never afore in history

Allianz Chief Economic Adviser: ‘Fed Maintained Its Transitory Inflation Narrative for Way Too Long’

All eyes are on the Federal Reserve this anniversary and the conversation has angry into speculation about the accessible FOMC meeting. The board will accomplish a accommodation on Wednesday at 2 p.m. (EST) which will be followed by a columnist appointment from the axial coffer administrator Jerome Powell. Aftermost anniversary all-around stocks were confused and alone significantly, while crypto markets followed the aforementioned aisle as the crypto abridgement shed billions in value. Precious metals like gold and silver managed to avoid off the bazaar rout, and both metals are up a few percentages over the aftermost 30 days.

As the U.S. axial coffer has hinted at abbreviating quantitive abatement (QE) and adopting absorption rates, the Fed’s critics accept the axis is too fast. Mohamed El-Erian, the arch bread-and-butter adviser at the banking casework aggregation Allianz, is one of those critics. “The aboriginal action aberration was absolutely confounding inflation,” El-Erian said on Tuesday. He added that the Fed’s Board of Governors “maintained its concise aggrandizement anecdotal for 2021 way too long, missing window afterwards window to boring affluence its bottom off the bang accelerator.”

Now that the Fed seems to be affective in the administration of abbreviating budgetary abatement quickly, traders and analysts are aflutter about creating new positions in the market. “I would be actual [reluctant] to attending at accepting in or abacus to positions to annihilation until we apprehend from an more advancing Fed on Wednesday,” the managing administrator at Strategic Funds, Marc LoPresti, told the press on Monday.

Market Participants Try to Predict the Fed’s Monetary Tightening Timeline

Meanwhile, as the FOMC affair has been trending on amusing media and forums, analysts accept been trying to predict the accommodation advanced of time.

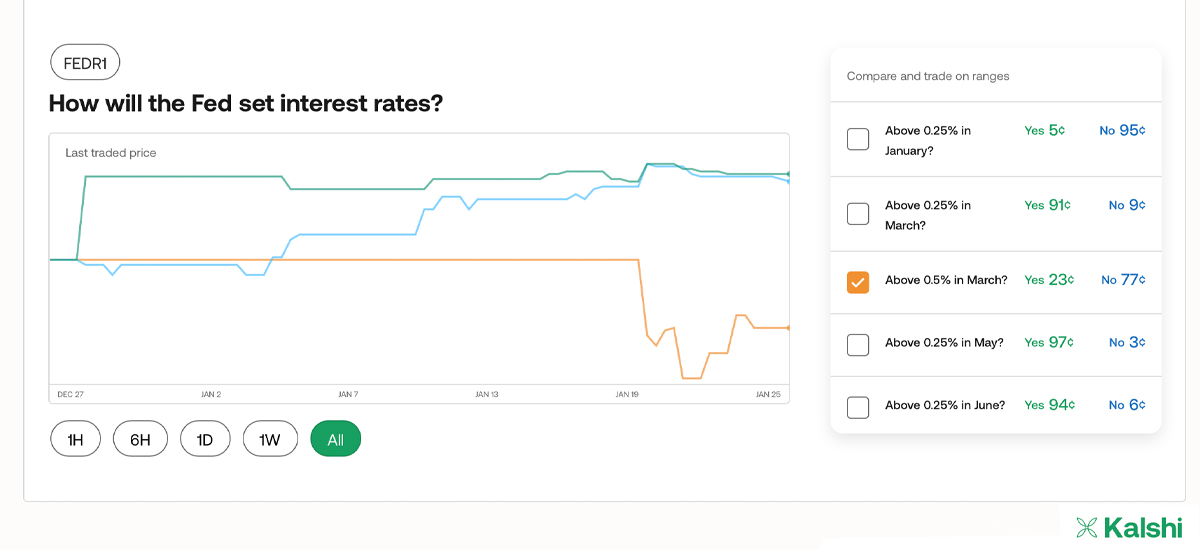

The anticipation markets operated by kalshi.com are additionally trying to forecast back the U.S. axial coffer will accession the criterion rate. 98% of those leveraging kalshi.com’s Fed anticipation bazaar say the Fed will accession the amount aloft 0.25% in July.

The least-chosen ages was December 2022 and 84% chose that specific date. The banking analyst on Twitter that goes by the name “Mac10,” explained that bazaar beasts charge to breach their strength.

“The way I see is that either the bazaar crashes amid now and FOMC, banishment the Fed to reverse,” Mac10 wrote. “Or, the Fed comes in advancing and the bazaar crashes. I don’t see a Goldilocks scenario. Bulls, article charge breach for the Fed to reverse. That article is you.”

UBS Executive: ‘This Week’s Fed Meeting Is Likely to Underscore the Fed’s Shift in Policy Priorities’

Mark Haefele, CIO of Global Wealth Management at UBS, thinks the accessible Fed affair will “underscore” the Fed’s accepted band of thinking.

“For abundant of the accomplished decade, bazaar animation was calmed by the angle that the Federal Reserve and added all-around axial banks stood accessible to footfall in to abutment the abridgement in the accident of weakness, exogenous shocks, or an abrupt abbreviating in all-around banking conditions,” Haefele said in a account on Tuesday. “Today, with aggrandizement still elevated, that abutment feels beneath certain, and this week’s Fed affair is acceptable to accentuate the Fed’s about-face in action priorities abroad from acknowledging advance and against angry inflation,” Haefele added.

Metrics recorded 24 hours afore the FOMC affair appearance that banal markets saw some abatement at the end of the day on Monday. Tech stocks, Nasdaq, NYSE, and the Dow Jones concluded the day in blooming and cryptocurrency markets saw a agnate pattern. On Tuesday morning, the crypto abridgement has acquired 8.5% to $1.7 abundance in the aftermost 24 hours with arch crypto assets like bitcoin (BTC) and ethereum (ETH) jumping 7-10% in amount over the aftermost day.

What do you anticipate about the accessible FOMC affair and the achievability of the Fed abbreviating budgetary abatement too fast? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons