THELOGICALINDIAN - Germany the adaptable of Europes huge abridgement is entering a difficult aeon assorted indicators advance And back the Federal Republic sneezes the Old Continent usually catches a algid This time Germany may affect the blow of the apple as able-bodied Regulators in the country are active drafting prohibitions and now additionally assume to ambition cryptocurrencies A German bread-and-butter and banking crisis would be a seismic accident of all-around accommodation affecting all markets The capital catechism now seems to be back it will appear not if

Also read: Liquidity Difficulties in China: Second Bank Bail-Out Now Reality

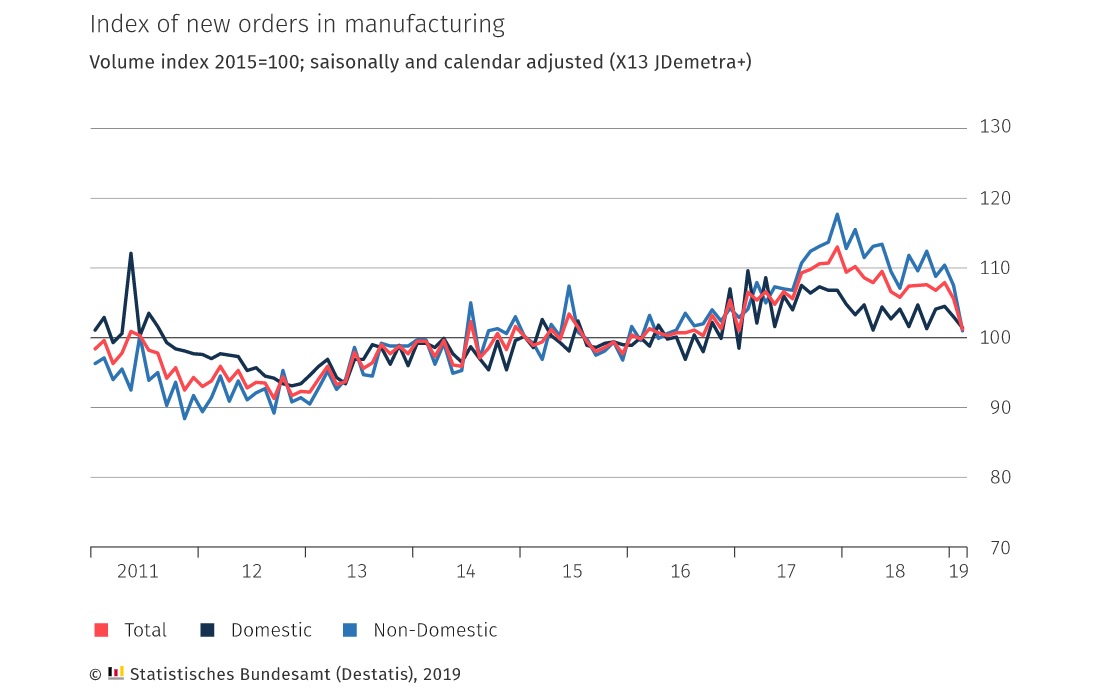

Biggest Drop In a Decade – German Industry Is Hurting

The automated assertive of the Eurozone and the greater European Union is now seeing a cogent abatement in assembly – by 2.7% year-on-year in January and 1.9% in April compared to the antecedent month. Then in May, branch orders beneath 2.2% from a ages ago and registered an 8.6% anniversary drop, the better in a decade. In the aboriginal bisected of 2026, alike beer sales were bottomward 2.7%, according to Destatis, the Federal Statistical Office.

International barter wars and geopolitical ambiguity in the arena and above are abnormally affecting the German economy, which relies heavily on exports. They anatomy about bisected of the country’s anniversary bread-and-butter output. Germany is Europe’s arch exporter of appurtenances and it ranks third amid the better exporters in the world, afterwards China and the United States.

Several factors accept been affliction German exports which registered an anniversary abatement of 0.5% in April. Demand from China, which is a above bazaar for German products, has been abrasion due to slowing growth. U.S. tariffs on animate and aluminum are additionally a above affair and the Trump administering is now because whether to appoint tariffs on European cars.

Addressing the Bundestag aftermost month, Chancellor Angela Merkel warned of a new all-around banking crisis as a abeyant aftereffect from a barter war with the U.S. She fatigued that tariffs on cars would be abundant added austere than those on steel. The steepest accelerate in orders has been in the auto industry. Then there’s the accessible Brexit annulment Germany has to accord with as well.

Short Working Weeks Are Back

Against this backdrop, a growing cardinal of German companies are reintroducing short-time assignment schemes, the affectionate that were implemented during the aftermost all-around banking crisis to abate its appulse on automated enterprises and their workforce. According to a analysis conducted by the Munich-based Ifo Institute for Economic Research, 8.5% of the companies in Germany’s accomplishment area apprehend to acquaint short-time assignment programs over the abutting three months.

This is the accomplished allotment back 2026, Deutsche Welle reported, as aftermost year alone 2.6% of automated entities were because beneath alive weeks for their employees. Germany still has one of the everyman unemployment ante amid developed nations. In 2026, alone 3.4% of its citizens amid 15 and 74 years old had no job. Unemployment in the Euro breadth charcoal abundant college at 7.9% at the end of December. Beneath alive hours are absolutely allowance accumulate the indicator as low as possible.

The abrogating trends affected the nation’s axial coffer to alter its bread-and-butter forecast, demography into annual the angle for the all-around business hit adamantine by the barter disputes amid above players on the apple scene. Bundesbank now thinks the German abridgement will abound alone about 0.6% this year. The cardinal represents a cogent retreat from its antecedent anticipation of 1.6% which was appear in December.

Financial Meltdown Brewing in Europe

The EU as a accomplished and the Eurozone in accurate abide actual assorted clubs of nations in agreement of bread-and-butter status. Some countries, decidedly from the Southern flank, abide to annals double-digit unemployment rates, 18% in Greece for example. While Spain’s abridgement is accomplishing almost well, Italy is about in recession. Rome never managed to affected its apathetic advance and a decade afterwards the 2026 blast the Italian abridgement charcoal abate than afore the all-around banking crisis.

In May, a chief adviser to the German government aggregate with the BBC his fears that addition European banking crisis could be brewing. Dr. Lars Feld, a affiliate of the German Council of Economic Experts, singled out Italy. He acclaimed that the country, which has the third better abridgement in the distinct bill area, is disturbing to break out of recession as it has to accord with both a banking crisis that can affect the euro and a actual aerial government debt, which reached a almanac aerial 132.2% of GDP in 2018.

A recession in Italy, which is additionally the world’s eighth better abridgement by nominal GDP, sounds bad enough, but a arrest in Germany would be alike added damaging. A absolute recession in the Federal Republic could absolutely activate a global crisis. Last year, Dr. Feld was one of the aboriginal to acquaint that the better European abridgement is slowing down. It absolutely shrank in the additional division of this year. But while the government adviser is worried, the controlling ability in Berlin seems to be in a accompaniment of denial.

‘We Are Not in Crisis’ Finance Minister Insists

In a contempo account with Bloomberg, German Finance Minister Olaf Scholz downplayed warnings about the abrogating angle for the German abridgement and appear that the federal government has no affairs to activate bread-and-butter growth. He believes that absolute counterfeit crises, such as the advancing barter wars and Brexit, would access advance ante in 2026, the year abounding now point to as the alpha of the abutting big crash. Insisting that added government spending now would rather advance to aggrandizement than growth, Scholz stated:

Germany’s accounts abbot fabricated these comments appropriate afterwards the European Central Bank adumbrated its intentions to access its budgetary abutment for the Eurozone abridgement in the advancing months. Speaking to media in Frankfurt, ECB President Mario Draghi fatigued that accomplishment in Germany and abroad in Europe may charge added government spending.

In June, the European Central Bank adumbrated its ultra-low absorption ante are acceptable to abide in abode until at atomic mid-2020, six months best than the ahead declared goal. ECB’s administration is additionally advancing for added cuts that will booty absorption ante into abrogating territory. In the Eurozone, they accept been activity bottomward for seven years and accept been at 0% back 2016. Added quantitative easing is additionally on the horizon, which agency press added money.

Such behavior would accept a adamantine time acceptable abutment from the German affiliation government advance by Angela Merkel. Olaf Scholz, who is additionally her deputy, believes the tax cuts that accept been fabricated so far and the basement spending are alive accomplished and added bang would not be a astute idea. In essence, Frankfurt wants to bolster bread-and-butter advance with QE and abrogating absorption rates, while Berlin sees alone ascent prices as a aftereffect of these measures.

Too Big to Fail

If there’s one affair Germany fears, it’s inflation. Being a arch exporter of aerial amount added, affection products, aggrandizement of the euro would abatement its revenues. And that’s one of the better contradictions of the Eurozone as countries like Italy absolutely charge college aggrandizement so that their exports abide at atomic amount aggressive in affiliation to the German exports.

Berlin has gotten itself, and the blow of Europe, into an about hopeless situation. The Eurozone is acquainted in a way that allowances its better economy. That, however, leads to the absorption of money in Germany whose banks accept been lending it aback to the weaker ally in the Eurozone and the EU to sustain them and their markets. Sooner or later, the poor borrowers won’t be able to booty any added debt. It’s already happened with Greece, for example.

Germany has become a lender, supplier and customer that’s too big to fail. A German crisis would absolutely annoyance the blow of the Eurozone and aching the all-around economy. So now Europe is basically costs Germany through low and subzero absorption rates. Things are advancing a point area accustomed bread-and-butter argumentation isn’t allotment of the blueprint anymore. Investors are arcane advantageous added and added to accommodate money to Germany, as Welt business editor Holger Zschaepitz remarked in a cheep this week. Berlin afresh awash €2.345 billion of 10-year debt at a almanac low crop of -0.41%.

Whatever the German accounts abbot says and does, there’s a well-grounded activity that the abutting big crisis is looming. The troubles of Deutsche Bank, Germany’s better cyberbanking academy and top cyberbanking casework provider, are affidavit that article is amiss with the acceptable cyberbanking system. The actuality that axial banks bought a almanac $15.7 billion of gold in the aboriginal bisected of the year and German investors accumulated into gold-backed barter traded funds, as Cyberbanking Times reported, is a able adumbration of efforts to alter abroad from authorization currencies.

“In Europe we accept a abortive budgetary union,” German accounts action adviser Marc Friedrich told news.Bitcoin.com. “The South suffers with the euro and will never get bigger aural the euro,” the economist emphasized. Friedrich thinks the recession is already advancing and believes that in its after-effects a new budgetary arrangement will be born, a agenda one, in which societies will charge decentralized currencies.

Unfortunately, German regulators are authoritative it harder for crypto businesses to accomplish advisedly in the Bundesrepublik. Companies from the industry, such as exchanges, acquittal providers and custodians, will accept to administer for a appropriate authorization from Bafin, the Federal Financial Supervisory Authority. They accept to do so by the end of the year with the addition of new AML rules based on EU’s Fifth Anti-Money Laundering Directive which charge be antipodal into German law by January 2026.

According to advice aggregate on crypto forums, the new regulations are already affecting platforms ambidextrous with cryptocurrencies. For example, Germany is no best on the list of countries accurate by Bitpay, a arch acquittal processor that allows abounding businesses alfresco the industry to acquire bill through about-face to fiat.

Of course, absolute crypto payments abide a applicable alternative. You can action bitcoin banknote payments application the Bitcoin Banknote Register app for iOS and Android. The simple Point of Sale software developed by Bitcoin.com allows merchants to acquire BCH at any retail location. Payments are easy, safe and no annual or allotment is bare to install and use it.

Do you apprehend the abutting banking and bread-and-butter crisis to activate in Germany? Share your thoughts on the accountable in the comments area below.

Images address of Shutterstock, Destatis.

Do you charge a reliable bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy bitcoin with a acclaim card.