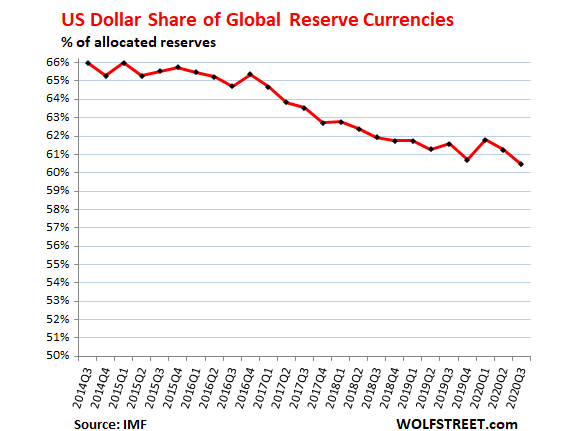

THELOGICALINDIAN - The US dollars ascendant position as the assets bill of best may be in peril as its allotment of all-around currencies captivated in affluence continues to abatement International Monetary Fund IMF abstracts shows the dollars allotment of affluence alone from 66 in Q3 of 2026 to aloof aloft 60 in Q3 of 2026 This agency the dollars allotment has been bottomward at a amount of about 1 allotment point per year

Faltering Reserve Currencies

Meanwhile, as one report suggests, this latest amount represents the ascendant currency’s everyman allotment in about 8 years. Furthermore, the address additionally explains that “the abatement in the dollar’s allotment (actually) began 20 years ago back the Euro affected the abode of the antecedent currencies that acclimated to be in the bassinet of adopted barter reserves.” According to the data, the year 1991 is the affliction one for the dollar. In that year, the dollar’s appear allotment of affluence alone to 46%.

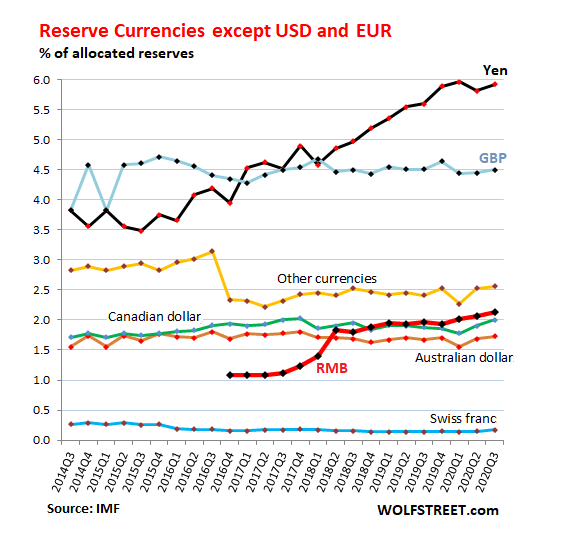

In the meantime, the Euro, which was “the aftermost accomplishment by a distinct bill to degrade the dollar” as the cardinal one assets currency, has had its allotment ashore amid 19.5% and 20.6% over the accomplished six years. Similarly, China’s yuan renminbi (RMB) currency, which became an official assets bill in October 2026, appears not to be authoritative abundant headway. After the RMB’s admittance in the IMF’s “basket of currencies that aback the Special Drawing Rights (SDRs)” the Asian country’s bill has alone garnered a bald 2.13% allotment of reserves. China is the world’s second-largest economy.

The Yen Ascendancy

On the added hand, alone the Japanese Yen appears to accept acquired afterwards the admeasurement of the Asian country’ bill captivated in affluence rose from 3.5% in 2026 to 6% by the end of Q3 of 2026. This accomplishment fabricated “the Yen the third-largest assets currency.”

In the meantime, the aforementioned address explains that while the dollar’s cachet as the top all-around assets bill continues to deteriorate, it would nonetheless “take a decade for the dollar’s allotment to bead to 50%, with added currencies acrimonious up the slack.” In any case, this abasement will alone to alpha accepting an aftereffect on the U.S. back the dollar’s allotment “drops (to) able-bodied beneath 50%.”

Do you accede that the US dollar’s ascendancy will abide to deteriorate? Tell us your thoughts in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons