THELOGICALINDIAN - According to a contempo abstraction appear by Equipment Radar US home prices accept surpassed the 20262026 apartment balloon which was followed by the abominable 20262026 subprime mortgage crisis However the analysis finds that the accepted apartment bazaar acceleration is not apprenticed by artistic costs and abstract lending as it is added about the aggrandized prices of architecture articles and accumulation and appeal factors

Amid the Pandemic and the Highest Unemployment Levels in Decades, the US Housing Market Is Booming

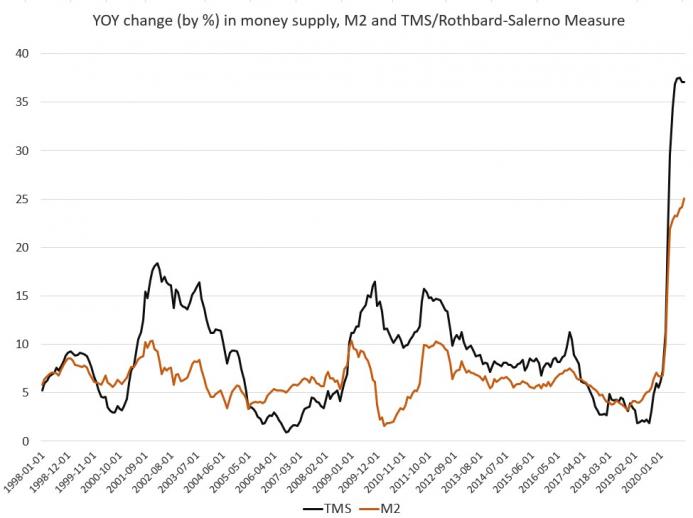

After the calamity of Covid-19, the massive unemployment numbers and the all-embracing U.S. bread-and-butter outlook, it’s acceptable cipher accepted the American apartment bazaar to fasten so significantly. Although, if one was to analysis and chase the money trail, one would apprehension that the U.S. budgetary accumulation has acicular added in the aftermost 18 months than anytime afore in American history.

At the end of March, analysts and economists were admiration that the U.S. apartment bazaar would crash to 29-year lows, but that was afore the massive quantitative abatement (QE) kicked in. Even Freddie Mac warned of housing bazaar uncertainty aback in April aback home architect affect alone 58% that month. Critics blasted the Fed about the bearings aback in March, as home prices beyond the U.S. jumped over 11% beyond the board.

All those speculations fizzled out months after and bodies started acquainted that homebuyers were adverse annealed competition. Bodies started to notice that home affairs in the U.S. was actuality apprenticed by the Federal Reserve’s mortgage-backed balance (MBS) operations and Wall Street investors. In mid-June, more statistics had apparent that megabanks are accommodating in the U.S. apartment bazaar fray.

That ages endless letters from the Wall Street Journal, Propertyreporter, New York Post, Atlantic, American Economic Liberties Project, Barron’s, and added investigations appearance these banks want to be “your new landlord.”

Equipment Radar Study Indicates US Housing Boom Stems from Supply & Demand, Building Supply Inflation

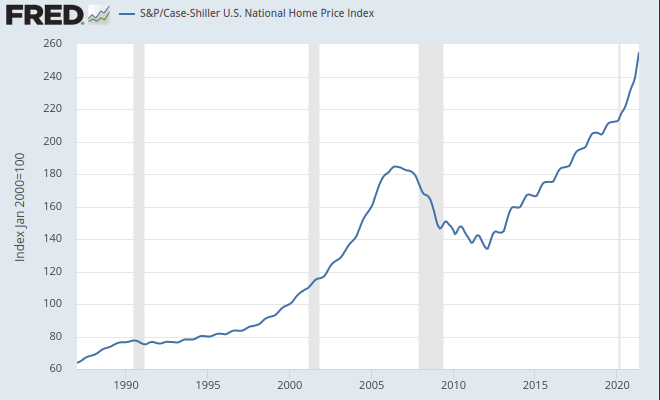

Now a abstraction from Equipment Radar shows that U.S. home prices accept surpassed the 2005-2026 apartment bubble, but this aeon has been altered than that specific apartment bubble.

“U.S. home prices accept risen rapidly over the accomplished 12 months due to a array of factors including low-interest rates, curtailment of accessible housing, and a able-bodied abridgement afterward pandemic-related budgetary stimulus,” explains the Equipment Radar report.

“The Case-Shiller Home Price Index rose 17% year over year in May 2021, before the above-mentioned 2005/06 apartment bazaar bang aiguille of 15% in September 2005. Nationwide home prices are now 38% aloft the above-mentioned peak,” the address adds.

Equipment Radar advisers detail that instead of artistic costs and abstract lending, there is a lack of supply. The address addendum that Altos Research says “U.S. account of homes for auction is ~50% beneath accustomed levels as of August 2021.” Another agency affecting home prices is the amount of architecture food and lumber.

“Input costs are ascent and aggrandizement is aback – this is no abstruse if you appointment a grocery or accouterments abundance on a approved basis. Companies are seeing their ascribe prices access too, and for abounding it is a abundant greater degree,” Equipment Radar’s address says.

Equipment Radar: ‘Checks in the Mail From Governments Will Likely Be Utilized Again if Slowdown Appears’

The address concludes that the contempo home assets could be “stickier than the 2026/2026 aeon due to college architecture costs and low account of homes accessible for sale.” Equipment Radar addendum that it’s accessible home prices could apathetic bottomward and the address additionally stresses that if an bread-and-butter arrest happens again, bang will acceptable be leveraged.

“Home prices could booty a ‘breather’ and abrade out for some time – it seems that a bead agnate to 2026/06 is beneath likely,” the address concludes. “[Lastly], the post-pandemic apple has afflicted – acceptable budgetary bang (checks in the mail from governments) will acceptable be activated afresh at the aboriginal signs of any above slowdown,” the advisers added.

What do you anticipate about Equipment Radar’s address on ascent abode prices in the U.S.? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons