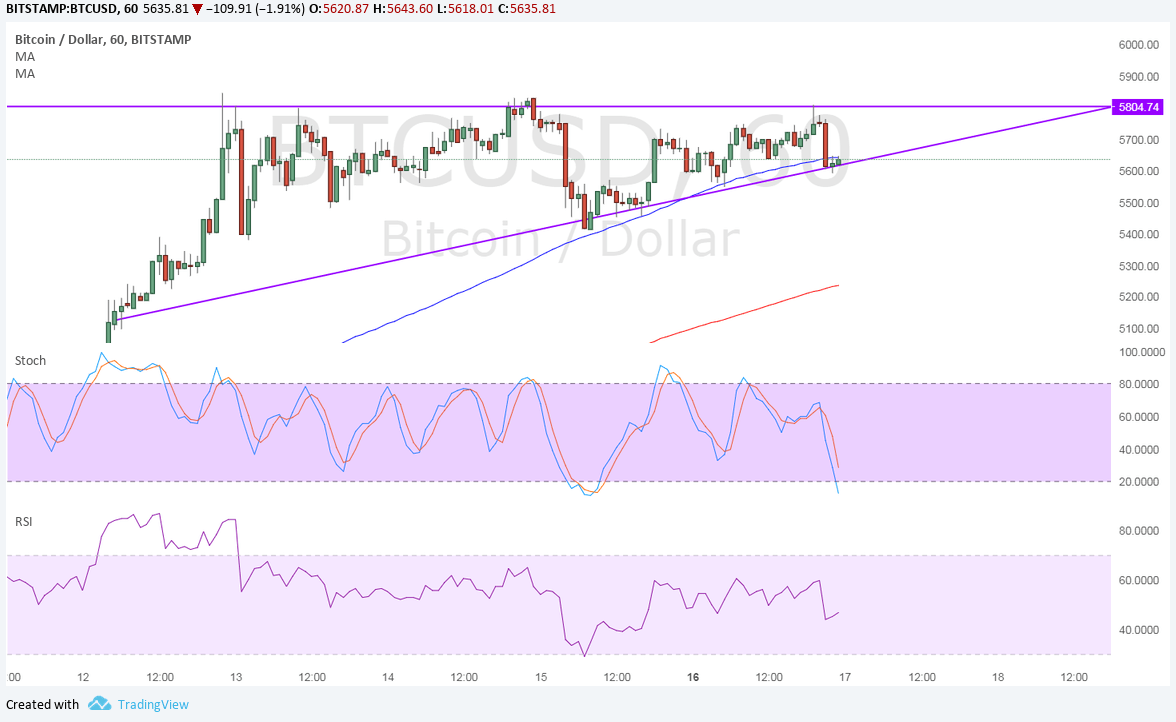

THELOGICALINDIAN - The cardinal of circadian affairs on the Ethereum blockchain arrangement surpassed 1 actor a akin concealed back January 2026

In contempo months, arrangement action on Ethereum surged as a aftereffect of ascent appeal for decentralized accounts (DeFi) applications and growing apprehension appear ETH 2.0.

Why is Ethereum Daily Transaction Volume Climbing So Rapidly?

Since January 2026, aural six months, the circadian transaction aggregate of the Ethereum blockchain added from 435,000 to 1.073 million.

Two factors acceptable triggered the 146.6% advance in user action on Ethereum: a fasten in investors sending funds to DeFi applications and on-chain stablecoin transfers.

DeFi platforms about acquiesce users to backpack out accepted banking casework in a decentralized environment.

For example, through DeFi, cryptocurrency investors can accommodate their surplus backing to borrowers. In exchange, borrowers incentivize lenders with account returns.

For users to alpha application DeFi, they aboriginal charge to accelerate funds on the blockchain network. That can be ETH, Tether, or any added badge that they hold. To do that, the users charge to accelerate affairs to and from DeFi applications.

When the appeal from DeFi continues to increase, it accordingly leads the transaction aggregate on the blockchain arrangement to aggrandize at a accelerated pace.

The accretion acceptance of stablecoins like Tether is additionally fueling the growing circadian aggregate of Ethereum.

Tether aboriginal appear an ERC20-compliant adaptation of its stablecoin about three years ago. Since then, it has been accessible to accelerate and accept USDT through ETH wallets.

USDT’s appraisal grew to over $9.1 billion, accession a massive user base. The able appetence for Tether additionally led user action on Ethereum to rise.

Timing of the 2-Year High Volume is Interesting

On-chain abstracts shows that the fundamental factors abaft Ethereum are strengthening alone three months afterwards the alleged “Black Thursday” in March.

On March 13, the cryptocurrency bazaar comatose in bike as investors beyond all risk-on asset classes started to agitation sell. Bitcoin alone to as low as $3,600, while ETH beneath beneath $100.

At the time, the absolute bulk of basic bound in the DeFi bazaar comatose from $1 billion to beneath than $500 million.

Since then, the DeFi bazaar completed a V-shape recovery. The absolute amount bound in DeFi surpassed an best high, hitting $1.53 billion.

Compound, which surpassed Maker and Synthetix to become the best ascendant DeFi protocol, now has $588.3 actor on its network.

But, whether the optimistic fundamentals of Ethereum and growing DeFi appeal will account a concise aberration about ETH is a altered argument.

Jacob Franek, a co-founder of CoinMetrics, wrote:

“For example, it could booty addition 2-5 years afore actual ample institutions are adequate alive analytical basement assimilate ETH 2.0 and purchasing stake. That doesn’t appear in 6 months beneath any optimistic scenario.”

The accepted affect about Ethereum and ETH 2.0 charcoal positive, as continued as the DeFi amplitude does not see a abrupt downturn like in March.