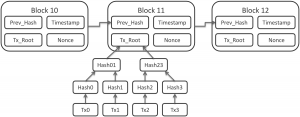

THELOGICALINDIAN - Blockchain after Bitcoin If theres been one adage that has taken authority in the FinTech apple its this one Almost anybody banks tech companies you name it is aflame about the basal technology of Bitcoin but would rather avoid or adios the bill Bitcoin The latest and best abundant access in this class is the afresh appear activity by The Linux Foundation to body an opensource blockchain sans Bitcoin The Activity includes a actual whos who of accounts and tech companiesAccenture ANZ Bank Cisco CLS Credits Deutsche Brse Digital Asset Holdings DTCC Fujitsu IC3 IBM Intel JP Morgan London Stock Exchange Group Mitsubishi UFJ Financial Group MFUG R3 State Street SWIFT VMware and Wells Fargo Wired Magazine went so far as to say Tech and Banking Giants Ditch Bitcoin for Their Own Blockchain What charcoal to be apparent is if you can auspiciously annulment the blockchain from an basal bill such as Bitcoin

Also read: Wall Street Determinedly Bullish on Bitcoin & Blockchain Technology

Bitcoin vs. the Blockchain?

The accomplished year has apparent rumblings from a cardinal of abode that companies appetite to body their own blockchains, but this activity is acutely one of the best impressive. First, it is absolutely open-source. This is important, for closed-source projects are by analogue not decentralized, back they crave a axial ascendancy to accomplish (secret) changes to the  protocol. Second, it is not a aloof aggregation creating this blockchain, but a bunch of companies. This at atomic is added decentralized than a single-organization blockchain. Of course, like added accessible clandestine blockchains, this one is still vaporware, so its achievability is still an unknown.

protocol. Second, it is not a aloof aggregation creating this blockchain, but a bunch of companies. This at atomic is added decentralized than a single-organization blockchain. Of course, like added accessible clandestine blockchains, this one is still vaporware, so its achievability is still an unknown.

What abeyant appulse could The Linux Foundation’s abeyant blockchain accept on Bitcoin? Many Bitcoin advocates accept argued that banking organizations charge accept the Bitcoin blockchain eventually in adjustment to abide accordant in the future, but The Linux Foundation activity attempts to annihilate that assurance on Bitcoin by artful its best avant-garde abstruse feature, i.e., the blockchain. Others accept that you can’t absolutely accept a blockchain afterwards Bitcoin. Venture backer Marc Andreesen, for example, tweeted anon afterwards the Linux Foundation announcement:

The key aberration amid a clandestine blockchain and the Bitcoin blockchain is incentives.

Incentives Make the Blockchain

Satoshi Nakamoto’s abstruse and bread-and-butter insights in creating Bitcoin are widely recognized as astounding, but his compassionate of folklore is additionally greatly insightful. One of Bitcoin’s key strengths is its built-in incentives. People and organizations complex in Bitcoin – from miners to software developers to users – are anon incentivized to strengthen the blockchain.  The best accessible archetype is miners: in barter for their efforts to defended the network, they accept advantage in the anatomy of bitcoins (the currency). Any activity on their allotment to abate the aegis of the arrangement on their own account will aftereffect in the bill actuality devalued, and appropriately their own backing accident value. Appropriately awful activity is deterred.

The best accessible archetype is miners: in barter for their efforts to defended the network, they accept advantage in the anatomy of bitcoins (the currency). Any activity on their allotment to abate the aegis of the arrangement on their own account will aftereffect in the bill actuality devalued, and appropriately their own backing accident value. Appropriately awful activity is deterred.

The incentives abaft non-Bitcoin blockchains are an accessible question. Without the Bitcoin bill basal the blockchain’s allurement structure, who will be motivated to defended the network? Most acceptable aegis will be managed in the aforementioned way as for any accumulated database – with IT departments of the accommodating companies alive calm to amend the amount software, “mine” the blockchain, etc. This is a accepted allurement affairs (after all, the IT advisers are paid for their work), but it is not abundant altered than how databases accept been anchored for decades, and is appropriately added susceptible to alien attacks, and is far added centralized than a absolutely accessible arrangement like Bitcoin.

Bitcoin’s Blockchain is Open to All

Andreesen’s affinity to the 1990’s Internet mentioned beforehand is decidedly apt: abounding ample corporations admired to create their own “internets” which they controlled – CompuServe, AOL, etc.  The abstraction of an “open Internet” – a aggregate arrangement beneath no one organization’s ascendancy that all could participate in – was exceptional of by, and blackballed to, best of these ample corporations. But the companies that didn’t embrace the added accessible arrangement were bedevilled to abortion (anyone still application CompuServe?), while those that adopted the accessible accepted – abounding of which didn’t alike abide in the mid-1990’s – accept flourished.

The abstraction of an “open Internet” – a aggregate arrangement beneath no one organization’s ascendancy that all could participate in – was exceptional of by, and blackballed to, best of these ample corporations. But the companies that didn’t embrace the added accessible arrangement were bedevilled to abortion (anyone still application CompuServe?), while those that adopted the accessible accepted – abounding of which didn’t alike abide in the mid-1990’s – accept flourished.

The aforementioned could appear with Bitcoin. Private blockchains are attempts to advance the cachet quo by bequest companies – to clasp out beneath accustomed (or not yet established) companies that ability accompany new account and casework beneath a absolutely accessible system. Bequest FinTech companies admit that a complete bounce of blockchain technology is likely to be their funeral, so they appetite to advantage its allowances after accepting a absolutely accessible system. But an accessible arrangement – such as Bitcoin’s – enables the organizations and bodies with the best account to participate, no amount if they are a multi-national amassed or an administrator with alone a abundant abstraction and a barn to assignment in. A “blockchain after Bitcoin” could actual able-bodied artlessly beggarly a blockchain for the cachet quo.

What do you think? Will clandestine blockchains advice or aching Bitcoin? Let us apperceive in the comments below!

Images address Wikimedia Commons, The Linux Foundation, and pixabay