THELOGICALINDIAN - Despite the advancing retracement in the prices of Bitcoin Ethereum and added top cryptocurrencies investors abide awful optimistic about this bazaar ETH abnormally has benefited from traders with abstracts from arch crypto barter Bitfinex advertence that there are added continued positions accessible for Ethereum than anytime before

“What. Is. Happening. 2.2% of all ETH in actuality is now allowance continued on Bitfinex, an access of 160% back ~February,” one banker explained in advertence to the blueprint below.”

Yet there are signs that this advance action could end ailing for continued position holders.

#1: Exchanges Are Holdinging More Ethereum Than Ever Before

The Ethereum backing of crypto exchanges are “basically at best highs,” afresh extensive about 18 actor coins, according to a arresting crypto analyst.

According to him, this is potentially a bearish assurance for ETH, acceptable referencing how it indicates that investors are attractive to advertise the cryptocurrency for added tokens or fiat.

“ETH balances are basically at best highs, and are up 132k ETH (~26M) back Black Thursday… My estimation actuality is that it’s bullish for btc/bearish eth,” he wrote in a Twitter cilia on the accountable of cryptocurrencies that barter wallets hold.

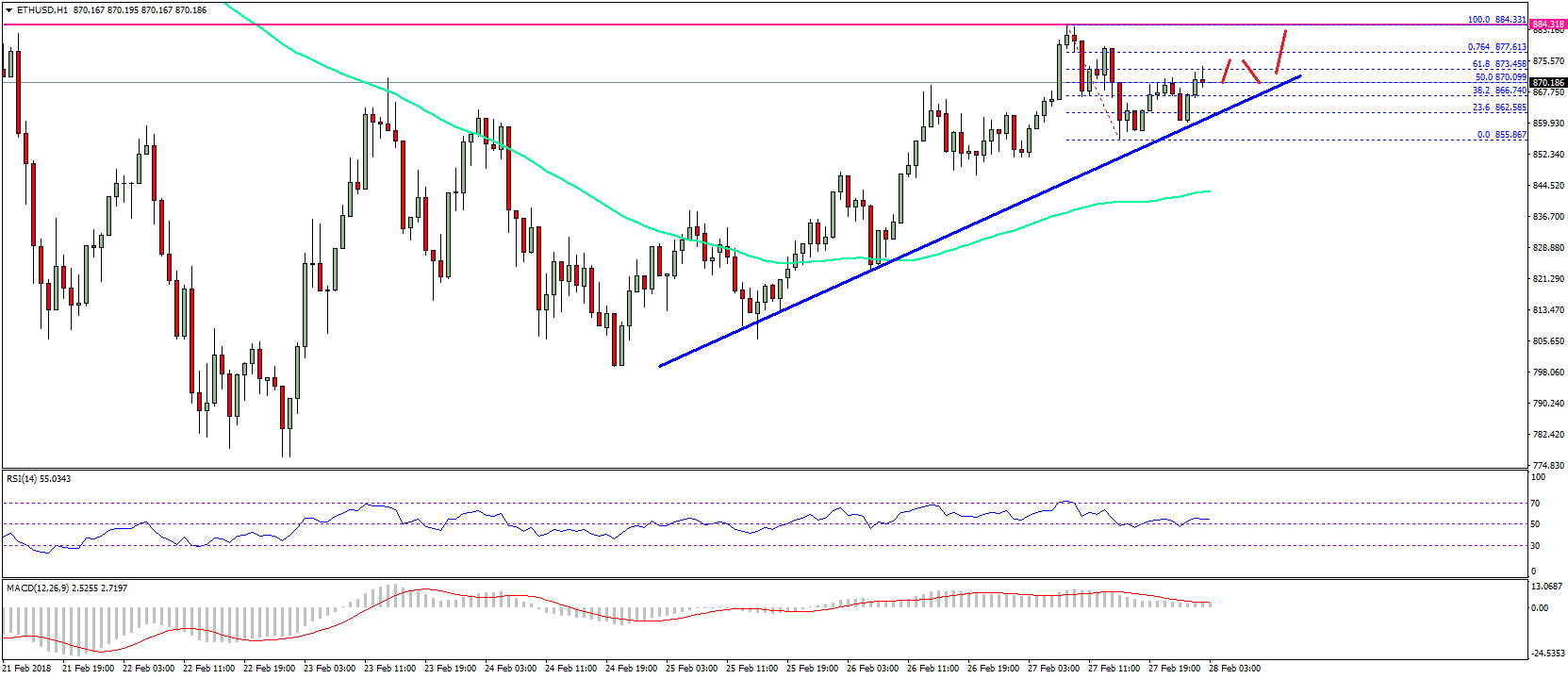

#2: Technical Outlook for Ethereum Is Weak

As noted by NewsBTC beforehand today, Ethereum’s account blueprint aloof printed a arbiter “Doji” candle, which signals that “indecision is present in the market” because “buyers and sellers are demonstrating a agnate bulk of strength.”

Doji candles can arresting a abeyance and abeyant consecutive changeabout in a bazaar trend. With ETH ambulatory over the accomplished two months, the Doji could be apparent as a assurance of bearish agnosticism in an uptrend.

That’s far from it.

According to a arresting crypto trader, recently, ETH fell beneath a acute akin of abutment that has captivated four abstracted times over the accomplished month, accretion the affairs that a “larger correction” is coming.

#3: Altcoins Are Bearish

To put a blooming on top of the crypto cake, analysts are growing more bearish on altcoins as an asset class.

Brave New Coin’s Josh Olsewicz empiric aloof aftermost anniversary that the blueprint of Bitcoin ascendancy — the allotment of the crypto bazaar fabricated up of BTC as against to altcoins — printed a arbiter aureate cross.

Investopedia addendum that a aureate cantankerous takes abode back a “relatively concise affective boilerplate crosses aloft a abiding affective average,” and is generally followed by a “bullish breakout.”