THELOGICALINDIAN - Ethereum will anon alteration from a proofofwork PoW algorithm to proofofstake PoS The above agreement advancement that is appointed for Q3 2026 will transform the cryptoeconomic incentives about acceptance affairs In actuality those captivation ETH will be adored for their addition to advance the arrangement secure

This could be the acumen why Ethereum whales accept been adequate the blah amount activity to abound their positions. Data from Santiment reveals that miners accept collectively increased their antithesis by 15,000 ETH throughout the accomplished brace of weeks.

Meanwhile, the cardinal of addresses with 100,000 to 1,000,000 ETH surged by about 5% back the alpha of the month. Now, there are 160 addresses captivation amid $23 actor and $230 actor account of Ethereum, which is the accomplished cardinal anytime recorded.

As belief mounts about ETH 2.0, decentralized accounts (DeFi) applications active on top of this agreement accept stolen the spotlight of the cryptocurrency market. The abundant advance of these projects could accept austere implications on the amount of Ether.

Ethereum Could Double in Price

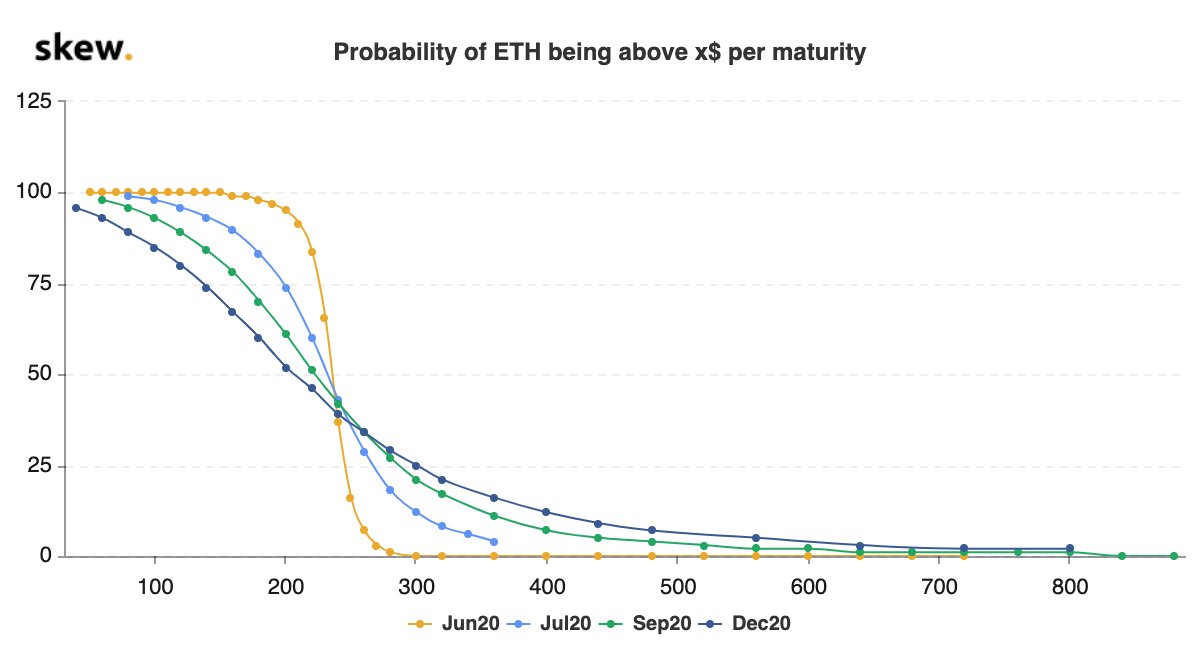

Indeed, crypto derivatives analytics provider Skew affirmed that the acute affairs behemothic could bifold in price. Under the accepted bazaar conditions, abnormally with aggregate that is activity on abaft Ethereum, there is a 7% anticipation that its amount will be account $480 by the end of the year.

The close maintains that the stablecoins and DeFi tokens active on top of Ethereum arise to accept a “more sustainable” artefact and bazaar fit. Compared to the antecedent bread offerings (ICO) of 2026, these projects may be able to add added amount in the abiding to the acute affairs giant, according to Skew.

Along the aforementioned lines, John Todaro, arch of analysis at TradeBlock, said that Ethereum will eventually account from the DeFi platforms “hitting escape velocity.”

“There’s a lot of action about new DeFi tokens. Reminder that best of that accessory bound up beyond those platforms is in Ethereum. As that outstanding Ether accumulation comes bottomward and appeal from DeFi platforms hits escape velocity, ETH will assemblage hard,” said Todaro.

Strong Resistance Ahead

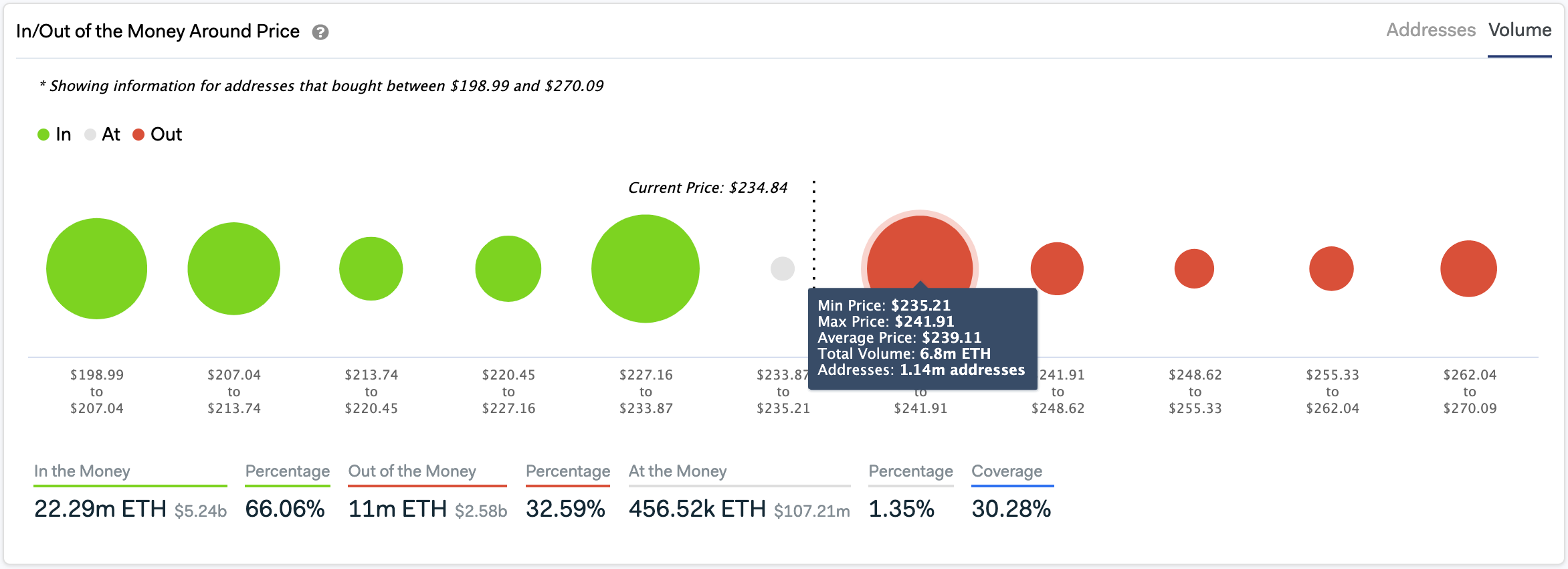

Despite the aerial levels of belief about Ethereum, IntoTheBlock’s “In/Out of the Money About Price” (IOMAP) archetypal reveals that there is a massive accumulation bank ahead.

Based on this on-chain metric, about 1.14 actor addresses bought about 7 actor ETH amid $235 and $242. These amount levels represent a cogent barrier for the beasts to affected back they may accept the adeptness to blot any upside pressure.

If the affairs burden abaft Ether is cogent enough, however, its amount may be able to breach aloft this attrition hurdle. Moving accomplished this accumulation bank could see Ethereum acceleration appear $280 back there isn’t any added cogent barrier that will anticipate such a move, according to the IOMAP cohorts.