THELOGICALINDIAN - Coinbase says added institutional investors are now application its belvedere to body absolute positions in the cryptocurrency market

Crypto armamentarium managers are now accepting added abetment from institutional investors that see the crypto bazaar as an another advance strategy.

In a report, the barter says it empiric a “noticeable uptick in institutional business’s growth” in the aboriginal bisected of the year.

According to Coinbase, the “greater afterimage of acclaimed investors abating up to agenda assets” is additionally allowance to ammunition growing “confidence amid this community.”

In May, a barrier fund, Tudor Investment Corporation, appear it had taken positions in bitcoin. At the time of this announcement, there were letters commendation the barrier fund’s CEO, Paul Tudor Jones, arguing that bitcoin is a bigger barrier adjoin inflation.

Jones predicted that the almanac axial banks’ budgetary amplification of 2026 will be a “potential agitator for an added absorption in bitcoin.”

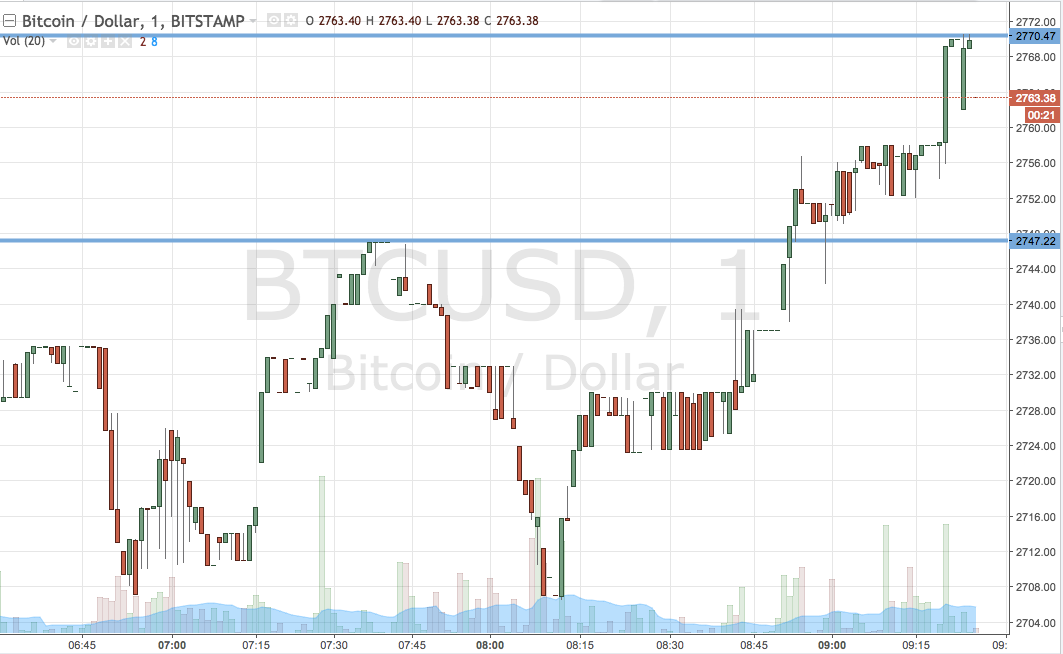

On Monday, July 27, the amount of bitcoin anesthetized $10,000 for the aboriginal time in several weeks afore breaching the $11,000 mark. At the time of writing, the amount of bitcoin is aquiver amid $10,500 and $11,000.

The contempo bitcoin amount movement coincided with reports suggesting an approaching absolution of a additional bang analysis for Americans.

In the meantime, Coinbase acknowledges that its “investors are still in the aboriginal canicule of untangling the accord amid macroeconomic action and crypto.”

Nevertheless, Coinbase says it is seeing a “growing abject of our institutional audience acclimation about the apriorism that BTC provides acknowledgment to an another budgetary action arrangement with accumulation mechanics that are diametrically against to those of axial banks in 2020.”

Coinbase’s institutional investors appeal added capabilities to advice them admeasure and trade. In acknowledgment to applicant demand, the barter says it is architecture market-leading allowance services.

The contempo accretion of Tagomi fits the arch exchange’s plan to bolster “our offerings for avant-garde traders and the best adult crypto investors.”

Coinbase adds it will abide to advance in arch abstracts analytics businesses through Coinbase Ventures.

Do you anticipate Coinbase will see added activity by institutional investors in H2? Share your thoughts in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons