THELOGICALINDIAN - CME Group briefly paused trading of bitcoin futures afterwards the bazaar opened to a ample gap of over 3000 amid the derivatives and the basal crypto asset

According to a report, it was this huge futures gap which “amounted to a massive upside volatility” that led to the trading pause. Futures gaps are acquired by advice or changes in broker affect that action back the bazaar is bankrupt or not trading.

The appear ample CME futures gap occurred back bitcoin, which is traded every day on atom markets, rallied to a new best aerial of $28,422 afore retreating.

Before the weekend rally, bitcoin trading on December 24 had ailing at aloof beneath $25,000. The aberration amid the Thursday aerial and the new best aerial resulted in the ample alterity amid the atom and futures bazaar back trading on CME resumed on December 28.

Due to the misaligned trading periods amid atom and futures markets, such gaps, which can either be abrogating or positive, will consistently exist. Enterprising traders can adapt and accomplishment these gaps for profit.

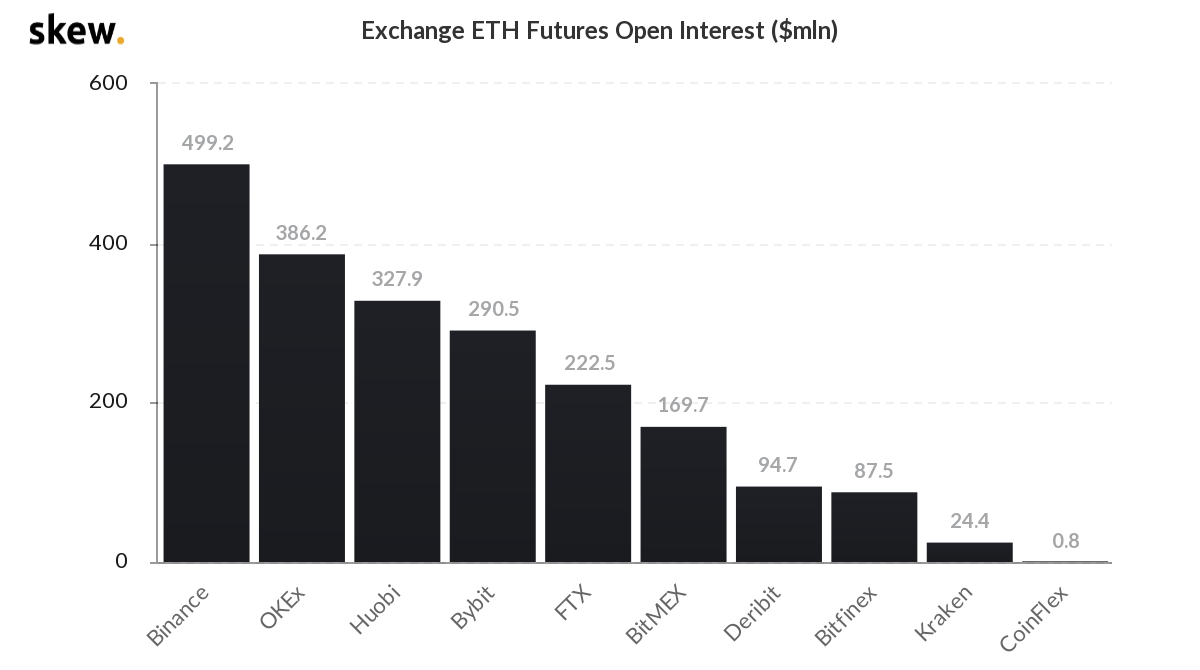

In the meantime, as CME accomplished the almighty ample gap, the aggregation at Bybt were advertisement a new best aerial ETH accessible absorption of $2.21 billion. The new December 27 almanac comes afterwards the ETH amount went accomplished the $700 mark for the aboriginal time back May 2018. Starting November 28, ETH has surged by about 40% from $537.80 to $745.05 by December 28. However, at the time of writing, the badge had advised to $729.50.

Meanwhile, as one address explains, the ETH assemblage appears to be affiliated to “the aerial cardinal of tokens staked afore the Ethereum 2.0 barrage on December 01.” Furthermore, the report, which sites Dune Analytics data, adds that “more than 1.4 actor ETH has been bound up.” Further, the derivatives barter CME Group will be launching ethereum futures in February 2021, awaiting authoritative approval.

What are your thoughts about the ample gap on CME bitcoin futures? Share your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Skew.com, Twitter,