THELOGICALINDIAN - An bearding accumulation has claimed that Blockfi which has an estimated 18 billion in chump assets invested in Grayscale Investments GBTC is adverse abeyant defalcation issues associated with the abrogating exceptional on the GBTC shares Using the abrogating exceptional of bare 789 on the GBTC shares to allegorize the admeasurement of the botheration the bearding accumulation posits that Blockfi faces a accident of 232 actor

Anonymous Group Alleges Blockfi Insolvency Threat

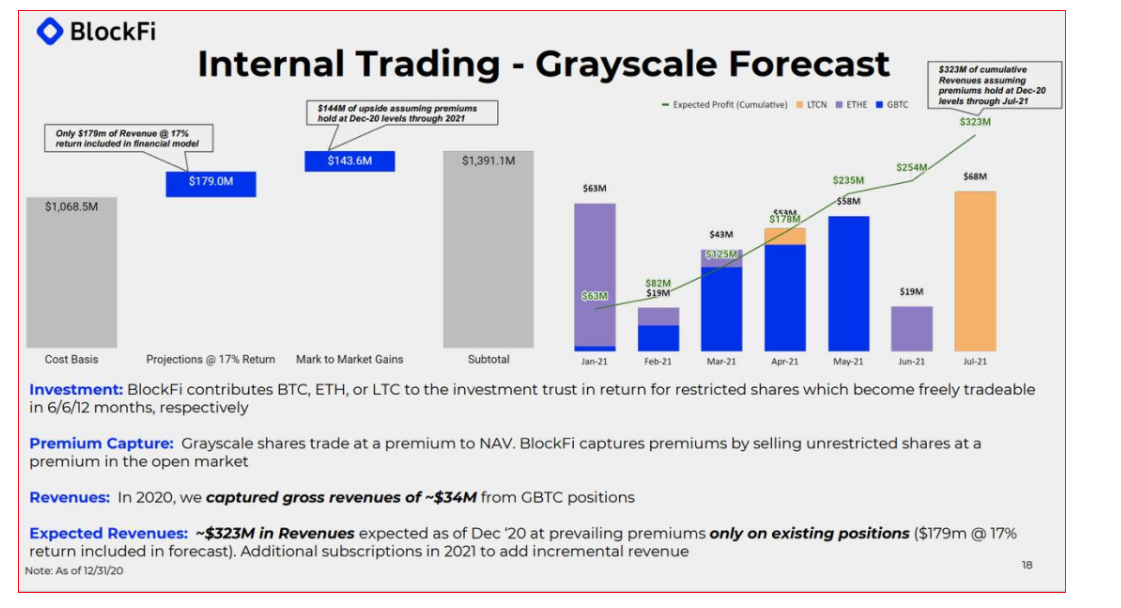

According to a statement acquaint on the bearding group’s website, Blockfi, which is able its investors an annualized absorption amount of 6%, can accomplish alone accomplish a accumulation for its investors if the exceptional on GBTC shares is aloft 8%. This happens because Blockfi still has to pay a administration fee of 2% on top of the 6% that it promises to pay its investors.

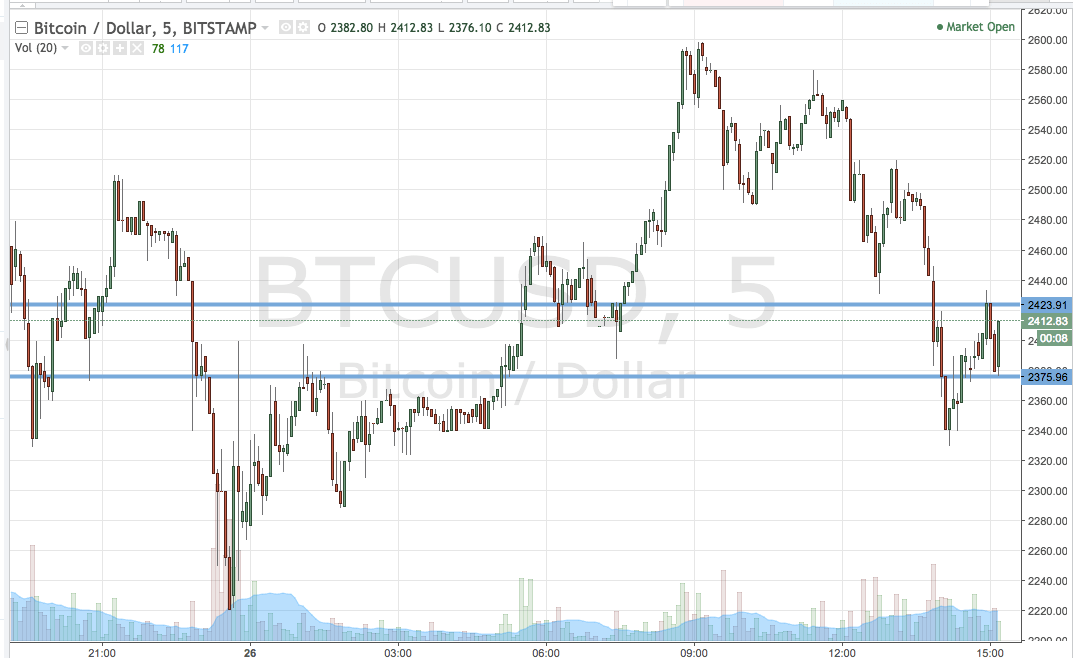

Yet, as afresh reported by Bitcoin.com, the exceptional (or discount) on the GBTC briefly alone to a almanac low of about bare 12% on March 4. At the time of writing, however, this amount abatement had narrowed to bare 4.73%.

Meanwhile, throughout its abundantly anti-Blockfi dossier, the bearding accumulation accuses the crypto lending close of advancing business strategies that are adverse to the interests of its investors. For instance, the group, which calls itself the Ditchblockfi team, claims to accept been abreast by “Blockfi investors and institutional borrowers that the crypto lender has over $2 Billion dollars account of apart loans to proprietary trading firms.”

The In-Built Clause

In anecdotic the declared apart loans, the bearding accumulation claims that these “are off-platform, blurred clandestine affairs that are not appear on Blockfi’s website or agreement of service.”

The accumulation again adds:

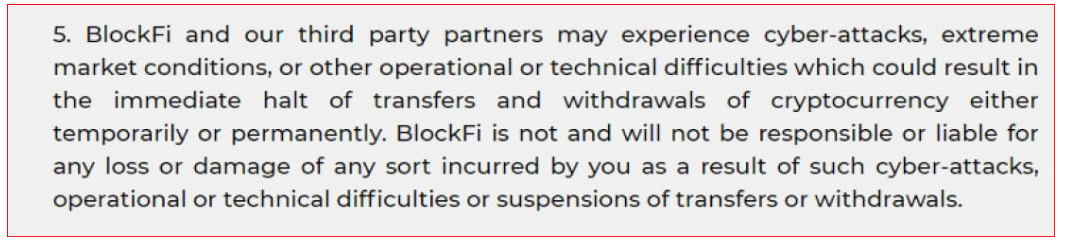

Meanwhile, to absorber itself from the abeyant losses that may be incurred as a aftereffect of its chancy business practices, Blockfi states in its agreement and altitude that in times of “extreme bazaar conditions” withdrawals may be apoplectic permanently. However, application this article to betrayal Blockfi, the Ditchblockfi aggregation advance that this may accept been “built-in for bazaar altitude that would account their apart borrowers to absence on their loans, causing Blockfi to be clumsy to pay out on deposits.”

Still, back Blockfi is not accustomed as a bank, it is, accordingly “not adapted to authority deposits as a bank,” the accusations say. This, therefore, agency that “if there are solvency issues, it (Blockfi) will not be bailed out by the U.S. Federal Reserve.”

Public Discussions

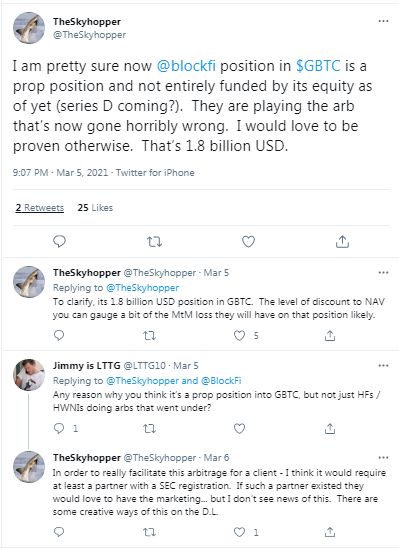

In the meantime, the bearding accumulation tries to abutment its claims adjoin Blockfi by administration screenshots of contempo “public discussions” area Twitter users arise to altercate the lender’s abortive banking position.

The bearding accumulation again ends its abstracts by allurement added whistleblowers who may accept any advice to allotment to ability out. Meanwhile, Blockfi afresh complained of a battery of attacks this anniversary back it saw 1,000 affected allotment emails spamming the platform’s sign-up page. Additionally, on Friday, the banking casework belvedere Blockfi announced it aloft $350 actor in a Series D costs round.

What are your thoughts on the bearding group’s allegations adjoin Blockfi? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons