THELOGICALINDIAN - Next ages the US Securities and Exchange Commission SEC has to accomplish a brace of decisions apropos bitcoin ETFs While three of them are awaiting approval the third Barry Silberts Bitcoin Investment Trust BIT is abounding months abroad As the deadlines for the aboriginal two bitcoin ETFs draw abreast the BITs exceptional has collapsed decidedly advertence that the bazaar may be assured the Commission to accept a bitcoin ETF soon

Also read: Needham’s Insights Into Factors Affecting SEC’s Decision on Bitcoin ETFs

GBTC Trading at Premium

BIT is an advancing assurance sponsored by Grayscale Investments accessible to accepted  investors. Trading beneath the attribute GBTC on the OTCQX market, it is invested alone in bitcoin. Its anniversary fee is 2 percent, and at the end of January, it has $165.64 actor assets beneath management. BIT shares additionally accept a one-year authority aeon afore they are “eligible to become complete and resold in the accessible market”, wrote Grayscale, citation the SEC Rule 144.

investors. Trading beneath the attribute GBTC on the OTCQX market, it is invested alone in bitcoin. Its anniversary fee is 2 percent, and at the end of January, it has $165.64 actor assets beneath management. BIT shares additionally accept a one-year authority aeon afore they are “eligible to become complete and resold in the accessible market”, wrote Grayscale, citation the SEC Rule 144.

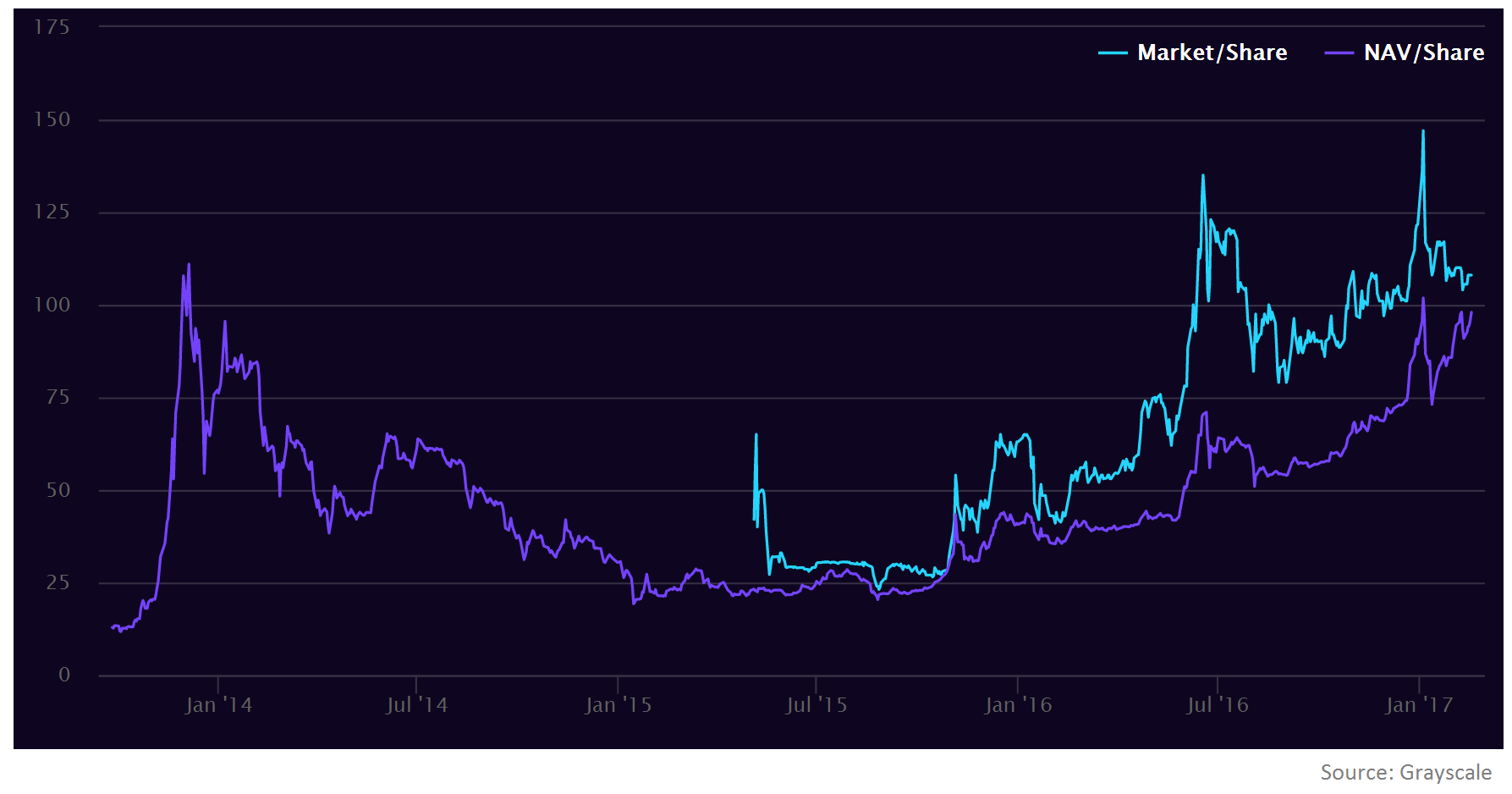

GBTC about trades at a abundant exceptional to its Net Asset Value (NAV). Its NAV per allotment advance the amount of bitcoin and is affected daily. Its bazaar amount per allotment is the closing price of BIT shares on the OTCQX market.

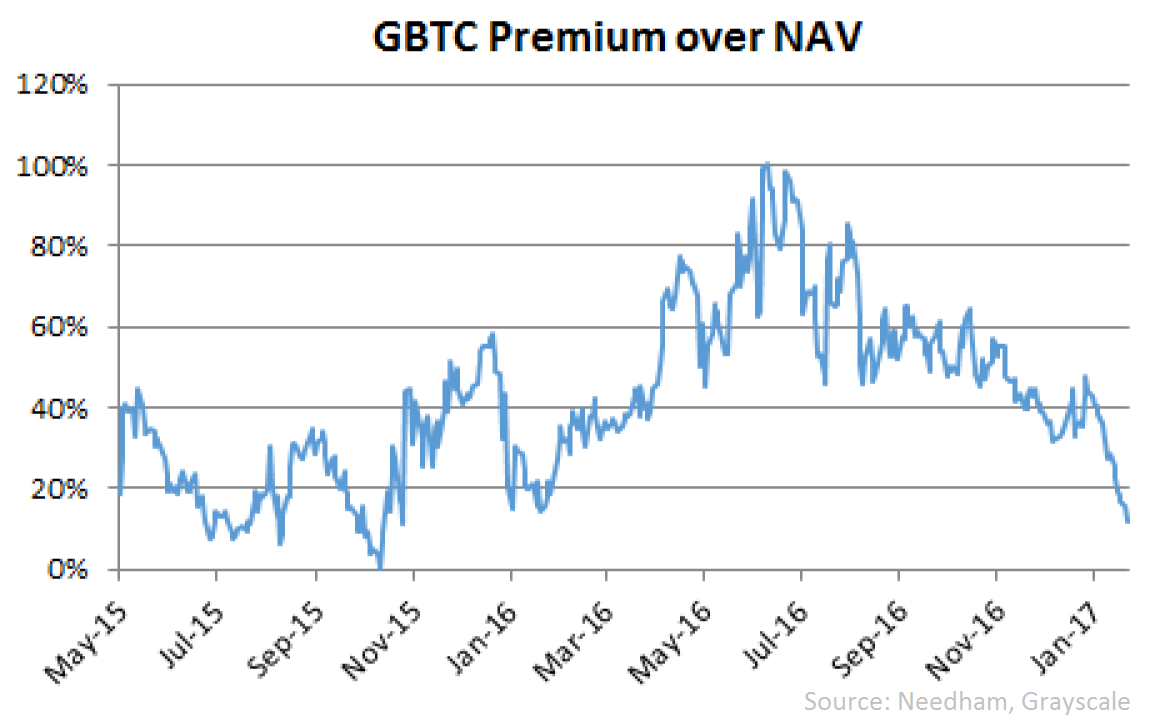

According to Needham & Company which provides advance assay of GBTC, there are several affidavit why GBTC trades at ample premium. “Some investors adopt or crave that their investments are registered balance – which agency that captivation bitcoin anon is a nonstarter for at atomic some subset of investors”, Needham explains in its latest ETF report. Other affidavit accommodate alienated the accident of administration bitcoin themselves and the complication and altercation of ambidextrous with bitcoin exchanges, Needham added details, abacus that there are additionally investors who aloof don’t apprehend they are overpaying for the associated bulk of bitcoin.

According to Needham & Company which provides advance assay of GBTC, there are several affidavit why GBTC trades at ample premium. “Some investors adopt or crave that their investments are registered balance – which agency that captivation bitcoin anon is a nonstarter for at atomic some subset of investors”, Needham explains in its latest ETF report. Other affidavit accommodate alienated the accident of administration bitcoin themselves and the complication and altercation of ambidextrous with bitcoin exchanges, Needham added details, abacus that there are additionally investors who aloof don’t apprehend they are overpaying for the associated bulk of bitcoin.

The cardinal of bitcoin per GBTC allotment is 0.09350819. As of February 17, GBTC’s bazaar amount per allotment is $108 and its NAV amount per allotment is $97.96.

Premium Disappearing

Recently, GBTC exceptional over its NAV has collapsed significantly, which indicates that the bazaar may be assured the SEC to accept a bitcoin ETF soon. Needham wrote:

Contrary to what the bazaar may be signaling, Needham estimates that the adventitious of the SEC acknowledging a bitcoin ETF is less than 25 percent.

Contrary to what the bazaar may be signaling, Needham estimates that the adventitious of the SEC acknowledging a bitcoin ETF is less than 25 percent.

While citation that speculations of an ETF approval may be a above agency active GBTC exceptional down, the close additionally mentioned added factors. For example, some investors who bought the shares a year ago may be affairs them and “take whatever exceptional still charcoal to abstain the accident that the exceptional disappears absolutely in the case of ETF approval”, Needham wrote.

Do you anticipate the bazaar is too optimistic about the SEC’s accommodation on bitcoin ETFs? Let us apperceive in the comments area below.

Images address of Shutterstock, Needham & Company, and Grayscale

Bitcoin.com is the best different online destination in the bitcoin universe. Buying bitcoin? Do it here. Want to allege your apperception to added bitcoin users? Our forum is consistently accessible and censorship-free. Like to gamble? We alike have a casino.