THELOGICALINDIAN - The Japanese Financial Services Bureau FSA has issued a account apropos antecedent bread offerings ICOs In accession to accident warnings the bureau abundant how two absolute laws may administer to badge sales

Also read: Chinese Exchanges Seek Second Chance in Japan and Other More Crypto-Friendly Countries

FSA Warns of ICO Risks

Japan’s FSA published a account on Friday, allegorical its position on ICOs. The bureau aboriginal warned the accessible of two risks applicative to ICO investors.

Japan’s FSA published a account on Friday, allegorical its position on ICOs. The bureau aboriginal warned the accessible of two risks applicative to ICO investors.

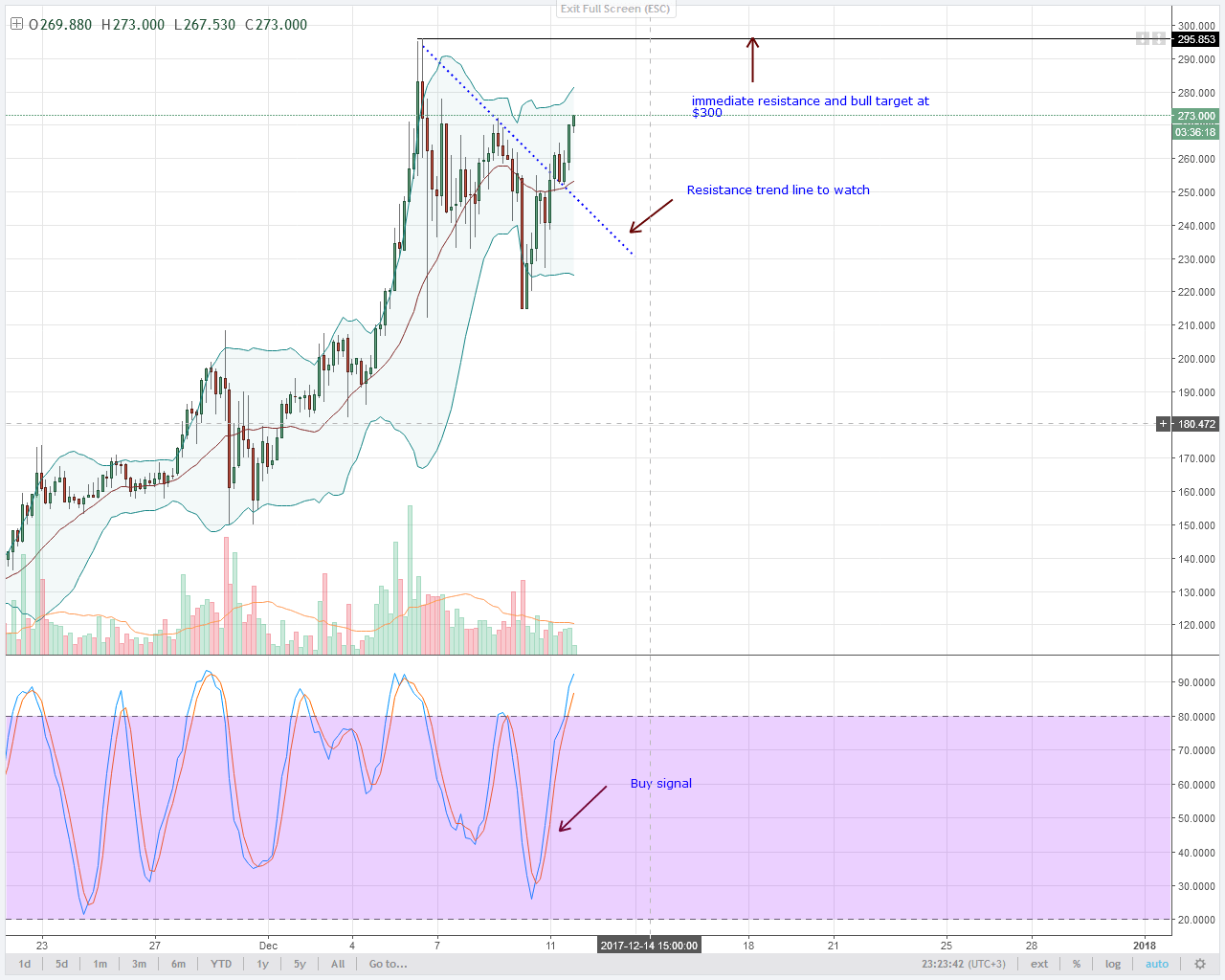

The aboriginal accident apropos amount volatility, which the bureau cautioned, “the amount of a badge may abatement or become abandoned suddenly.” The additional accident is “potential for fraud.” The FSA warned that appurtenances and casework categorical in ICOs’ whitepapers may not be realized, abacus that:

Two Existing Laws May Apply

Although Japan has no specific laws for ICOs, they may be adapted by two absolute laws. For businesses ablution an ICO, the FSA emphasized:

If a badge issued in an ICO avalanche beneath the basic bill accoutrement of the Payment Casework Act, again businesses accouterment agenda bill barter casework consistently “must be registered with anniversary Local Finance Bureau that is the delegated ascendancy to the Prime Minister,” the FSA wrote. So far, eleven cryptocurrency exchanges accept been accustomed by the agency.

If a badge issued in an ICO avalanche beneath the basic bill accoutrement of the Payment Casework Act, again businesses accouterment agenda bill barter casework consistently “must be registered with anniversary Local Finance Bureau that is the delegated ascendancy to the Prime Minister,” the FSA wrote. So far, eleven cryptocurrency exchanges accept been accustomed by the agency.

However, “if an ICO has the characteristics of an investment, and the acquirement of a badge by a basic bill is about accounted agnate to that of acknowledged tender, the ICO becomes accountable to regulations beneath the Financial Instruments and Exchange Act,” the bureau described.

ICOs in Japan

The ICO bazaar in Japan is growing. Small companies, as able-bodied as ample corporations, are application badge sales to accession money. Recently, news.Bitcoin.com reported on the country’s internet giant, GMO, planning to use an ICO to advertise its 7nm bitcoin mining boards. Japanese banking casework aggregation SBI Group is additionally launching two ICO businesses: a costs business and a appraisement advice business through Morningstar Japan.

Tech Bureau, which operates the Japanese bitcoin barter Zaif, launched a belvedere alleged Comsa in August. The aggregation declared Comsa as a “one-stop band-aid that includes a conception of multi-language whitepaper, pre-configured badge auction dashboard, blockchain affiliation casework and PR services, committed for your own ICO.”

Tech Bureau, which operates the Japanese bitcoin barter Zaif, launched a belvedere alleged Comsa in August. The aggregation declared Comsa as a “one-stop band-aid that includes a conception of multi-language whitepaper, pre-configured badge auction dashboard, blockchain affiliation casework and PR services, committed for your own ICO.”

Singaporean bitcoin barter Quoine, which has a able attendance in Japan, announced early this ages the barrage of a all-around ICO accepted as the Qash. Both Quoine and Zaif were amid the eleven bitcoin exchanges accustomed by the FSA in September.

Furthermore, Chinese bitcoin exchanges are reportedly aggravating to move their ICO businesses to Japan. According to theleading Japanese bitcoin barter Coincheck, the aggregation has accustomed “hundreds of requests from Chinese startups and startups about the apple allurement us to account their tokens, afterwards the Chinese government banned ICOs,” the barter revealed.

What do you anticipate of Japan’s position on ICOs? Let us apperceive in the comments area below.

Images address of Shutterstock and Nikkei.

Need to account your bitcoin holdings? Check our tools section.