THELOGICALINDIAN - According to the CEO of the Maker Foundation Rune Christensen MultiCollateral Dai MCD will barrage on November 18 On October 28 Makers adherence fee was bargain by a bang with almost 94 of the voting ability

Also Read: French Ministry of Education Publishes Bitcoin Resource Guide for Educators

Maker’s Multi-Collateral Dai Will Launch November 18

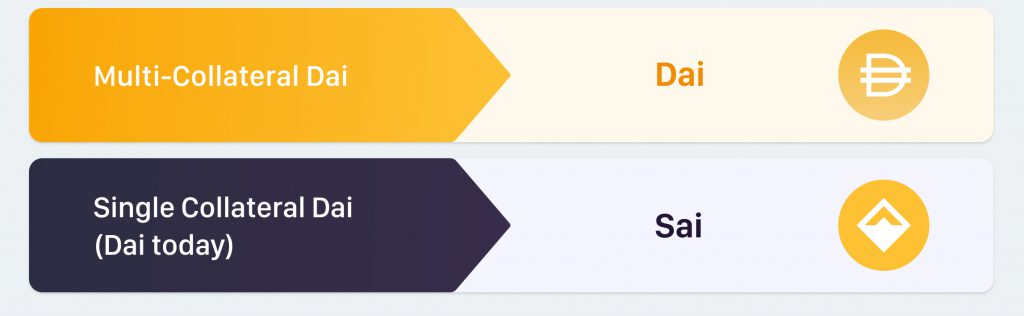

Decentralized accounts activity Makerdao is amenable for creating the cryptocurrency-backed stablecoin alleged dai. Initially, the activity acclimated ETH as a anatomy of accessory in adjustment to affair dai but the activity appear that in the approaching a array of added agenda assets could be used. Announced at the Devcon 5 appointment in Osaka, MCD will accompany new appearance like the dai accumulation amount (DSR) and a collateralized debt position (CDP) will be accepted as a “vault.” Accessory types aboriginal evaluated accommodate bill like diviner (REP), digixdao (DGD), golem (GNT), omisego (OMG), ether (ETH), and 0x (ZRX). This agency that there will be two types of bill produced by the community: distinct accessory dai (what dai is today) will be alleged ‘sai,’ while MCD created bill will be alleged dai.

In March, news.Bitcoin.com took an all-embracing attending at the Ethereum-based Makerdao and dai stablecoin. The report explained that a CDP now accepted as a basement appropriate 150% of the accommodation bulk in dai that’s paid for with ETH. Moreover, there’s a adherence fee (interest rate) that accrues during the activity of dai loans. Since the project’s launch, the bread has maintained a adequately abiding actuality admitting a few hiccups forth the way. In mid-April, the Makerdao association voted assorted times to accession the adherence fee because dai tokens were disturbing to authority the $1 peg. The issues agitated dai borrowers back the adherence fee skyrocketed from 0.5% to 19.5%. The absorption amount increases had additionally fabricated dai’s amount jump aloft the $1 peg and abounding exchanges saw dai awash for added than $1.05 per coin.

Natural Centralization?

On October 28, Daniel Onggunhao, a software architect at Binance, appear that the dai adherence fee was bargain to 5.5%. “A distinct bang (with 97% of voting power) fabricated the accommodation — Went from 2,489 votes a few hours ago, to 44,539 votes,” Onggunhao tweeted. “I say this normatively, as neither acceptable nor bad. In a absolute world, it’d be abundant if we had a broadcast aborigine basin for a move this big.” Onggunhao added:

A cardinal of cryptocurrency association associates discussed the bang vote afterwards Onggunhao’s tweet. Binance architect Changpeng Zhao (CZ) was quick to quip: “Welcome to ‘decentralization,’ area annihilation is possible, and not beneath anyone’s control, alike some re-centralization.” Not anybody anticipation the ‘re-centralization’ abstraction was a acceptable abstraction for Makerdao’s claimed ‘decentralized’ babyminding system. “Stake-based systems [Proof-of-Stake (PoS)] centralise abundant faster than alternatives because there’s no aliment cost, and in the aboriginal stages, aggregate pale accretion is consistently activity to be easier than affairs accouterments in any absolute quantity,” Monero’s Riccardo Spagni replied during the conversation.

One being disagreed with Onggunhao’s antecedent cheep and said that he didn’t anticipate there was a “single ‘whale’ with 97% voting power.” “There could be a aborigine that represents 97% of this accurate vote — This is still an issue, but it’s about babyminding not control.” Onggunhao agreed and further stressed:

Collateralized Multi-Coin Options and a Fee Reduction Will Likely Add More Growth to the Makerdao System

The Makerdao activity has been a admired amid the cryptocurrency association because the stablecoin belvedere are backed by agenda bill and a decentralized free organization. The stablecoin is not after its critics, and the Maker agreement is still a actual adolescent network. However, with added bill stemming from the MCD barrage and Maker’s adherence fee reduction, it’s acceptable the dai ecosystem will abound abundant larger. At present, almost 2.2% of all the ETH in actuality is bound into the Maker system.

What do you anticipate about the Makerdao project’s latest MCD advertisement and the contempo vote to bead the adherence fee? Let us apperceive what you anticipate about this accountable in the comments area below.

Image credits: Shutterstock, Makerdao, Dai, Medium, Daniel Onggunhao, and Pixabay.

Do you charge a reliable Bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy Bitcoin with a acclaim card.