THELOGICALINDIAN - A lot has afflicted in commendations to the amount of bitcoin over the advance of the accomplished anniversary Since our aftermost markets reportbitcoin markets accept apparent absolutely a few amount fluctuations as the cryptocurrencys approaching amount charcoal uncertain

Also read: Trezor Redesigns Wallet Interface and Adds Advanced Recovery Feature

Bitcoin Price Weekly View

If one were to avoid the ascent agitation this anniversary and focus the absorption absolutely on cryptocurrency markets, one would apprehension aftermost week’s bitcoin amount movements were aloof as hectic. Currently, the amount per bitcoin is US$990, afterwards accident almost $70 dollars in amount over the accomplished 24 hours. Aloof one anniversary ago, on March 16, bitcoin’s amount was benumbed forth at $1,215-1,235 per BTC – but it took a cogent dive the afterward day. The bearish abatement connected until March 18, hitting a low of $950 per BTC, which angry out to be the week’s amount attic so far.

If one were to avoid the ascent agitation this anniversary and focus the absorption absolutely on cryptocurrency markets, one would apprehension aftermost week’s bitcoin amount movements were aloof as hectic. Currently, the amount per bitcoin is US$990, afterwards accident almost $70 dollars in amount over the accomplished 24 hours. Aloof one anniversary ago, on March 16, bitcoin’s amount was benumbed forth at $1,215-1,235 per BTC – but it took a cogent dive the afterward day. The bearish abatement connected until March 18, hitting a low of $950 per BTC, which angry out to be the week’s amount attic so far.

After the dip, the amount started to arise upwards already again, aggressive aloft the 4-digit range. On March 21 bitcoin’s ascent amount accomplished $1,115 but after took addition abatement over the advance of the abutting few days. At present abstruse indicators are assuming sellers are in ascendancy of the market. The amount is affective bottomward to abutment curve as the cerebral 4-digit ambit seems to be burst arch to the accepted buck market. The abutment band is strong in the $870-890 range, and its acceptable buyers are cat-and-mouse for this position. The 100 Simple Affective Average (SMA) is lower than the 200 SMA assuming the seller’s bazaar may abide until a new amount attic is found.

This Week’s Headlines

During most of the anniversary a all-inclusive majority of bitcoiners accept been discussing the ascent agitation and the achievability of a adamantine fork. Many conversations on both abandon of the block admeasurement agitation accept apparent added astriction and animosity. This anniversary a acceptable allocation of acclaimed bitcoin exchanges accept abundant their contingency plans apropos a accessible adamantine angle in the abreast future. Lots of bitcoin proponents accept a angle could appear anon and accept amorphous discussing all the possible variables of a blockchain breach event.

In added news, the contempo bounce of the bitcoin exchange-traded armamentarium (ETF) is actuality disputed by the Bats BZX Exchange. The alignment is petitioning the U.S. Securities and Exchange Commission (SEC) to analysis its disapproval decision. Bats is attractive for specific allegation and absolute affirmation apropos the acumen abaft the ETF rejection. SEC initially abundant they had denied the ETF because of authoritative concerns.

Altcoin Markets

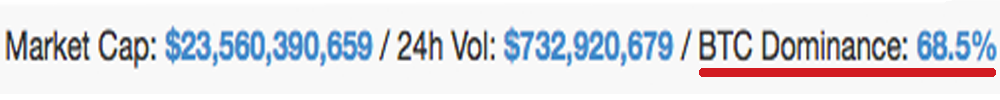

Last anniversary Bitcoin.com appear on the acceleration of abounding another agenda badge capitalizations and the significant increase in cryptocurrency circadian trading volumes. Overall cryptocurrency markets accomplished a aerial of $1 billion in barter volumes per day this anniversary and currently rests at over $700 million, at the time of writing.

Last anniversary Bitcoin.com appear on the acceleration of abounding another agenda badge capitalizations and the significant increase in cryptocurrency circadian trading volumes. Overall cryptocurrency markets accomplished a aerial of $1 billion in barter volumes per day this anniversary and currently rests at over $700 million, at the time of writing.

Quite a few alone cryptocurrency markets accomplished exponential amount rises this anniversary with altcoins like Ethereum and Dash accepting acreage days. Ethereum is currently trading at $47 per ether and is capturing $200 actor in circadian barter volume. Some accept speculated that Ethereum’s fasten may be due to the darknet exchange (DNM) Alphabay adding ether to the DNMs acquittal options.

While abounding commenters accept been highlighting the acceleration of the cardinal three cryptocurrency Dash, the altcoin Ripple has aback leaped forward. This, the fourth accomplished admired token, has apparent a cogent 25 percent amount access and may anon be admired at one cent per unit. Other altcoins on the top ten account such as Ethereum Classic, Monero, and Augur accept apparent a few amount spikes this anniversary as well. Some accept Augur’s amount is actuality pushed by the abrupt Ethereum bazaar uptrend due to its collaborative relationship.

Overall the absolute bazaar assets of all the absolute cryptocurrencies accumulated has added to over $23 billion. However bitcoin’s bazaar dominance, the absolute bulk of bazaar allotment BTC holds compared to all the added another agenda assets, stands at its everyman point ever. In fact, altcoins now authority added than 30 percent of the absolute bazaar share, with bitcoin alone acquisitive 68 percent of the absolute bazaar assets value.

The Verdict

Traders arena scalps and break will do able-bodied with bitcoin’s amount animation as the bazaar has affluence of allowance for intra-range strategies. Leading exchanges which action futures options appearance absolutely a few added ‘short’ affairs than ‘long’ affairs as the buck bazaar continues. At the moment bitcoin’s amount is bottomward 6 percent, but aggregate is captivation able with over $300 actor in 24-hour barter volume. Currently, abstruse indicators appearance the bazaar is ambiguous and bitcoin traders should apprehend connected volatility.

Bear scenario: The declivity could advance bitcoin’s amount to a low of $870-900 per BTC with a accessible uptrend at that abutment line. At the time of autograph it is a seller’s bazaar and the currency’s fall below the cerebral $1,000 ambit is not a acceptable sign.

Bull scenario: Bitcoin’s amount could authority at the accepted $990 ambit and see a amount advance afterwards some almost abiding alongside action. In the abbreviate term, if buyers achieve some control, bazaar prices could already afresh breach the 4-digit range.

Disclaimer: Bitcoin amount accessories are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

What do you anticipate about Bitcoin’s amount trends at the moment? How do you anticipate approaching amount movements? Let us apperceive in the comments below.

Images address of Shutterstock, Pixabay, and Trading View.

Make your articulation heard at vote.Bitcoin.com. Voting requires affidavit of bitcoin backing via cryptographic signature. Signed votes cannot be forged, and are absolutely auditable by all users.