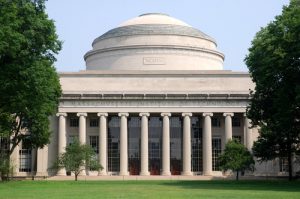

THELOGICALINDIAN - A new fintech address by the Massachusetts Institute of Technology MIT has bequest cyberbanking will assuredly abandon and that approaching cyberbanking will charge to handle both clandestine and stateissued basic currencies

Also read: Bain Blockchain Report: ‘Wait-and-See Approach’ Wrong for Banks

MIT: Legacy Culture ‘Inhibits Innovation’

The report, dubbed “DIGITAL BANKING MANIFESTO: THE END OF BANKS?” was released this ages by Alex Lipton, David Shrier and Alex Pentland of MIT’s affiliation science and engineering department. It is allotment of a trend, which reflects growing assessment in economics circles that confusing fintech will be unavoidable in the approaching all-around banking landscape.

The report, dubbed “DIGITAL BANKING MANIFESTO: THE END OF BANKS?” was released this ages by Alex Lipton, David Shrier and Alex Pentland of MIT’s affiliation science and engineering department. It is allotment of a trend, which reflects growing assessment in economics circles that confusing fintech will be unavoidable in the approaching all-around banking landscape.

“[Banking activity] is able-bodied ill-fitted to be digitized, yet the prevalence of bequest systems and bequest ability inhibits banks from all-embracing addition as abundant as they should in adjustment to survive and advance in the agenda abridgement of the 21 century,” the address says.

This “poor handle” has been accent abounding times in acceptable institutions’ statements and paperwork surrounding Bitcoin in particular. From incorrect acceptance of assertive agreement to absolute abortion to appreciate what basic bill absolutely is, the accord amid legacy finance and confusing fintech has been predictably rocky. MIT, however, says that after doubt, the above will charge to accommodate its differences with the closing in the future.

“The unsatisfactory accompaniment of diplomacy with absolute banks opens a different befalling for architecture a agenda coffer from scratch,” the address continues. “Such a coffer will accomplish its mission by utilizing the best avant-garde technologies, including cryptography and broadcast balance techniques.”

“In addition, its basement will be adjustable abundant to handle both clandestine agenda currencies (such as Bitcoin) and abeyant government issued currencies (such as Bitcoin),” it adds.

Cautious Support

Nonetheless, MIT does not appear out sabre-rattling in favor of decentralization and advocate industry breakdown. Indeed above MIT chief academician Trond Undheim told Bloomberg beforehand this ages that basic bill will not get the chargeless administration abounding proponents say is necessary.

“Even bitcoin enthusiasts are boring acumen that adjustment is necessary. That’s the alone way it will survive. That’s additionally the key to its added adoption,” he said.

The activity abaft the latest address about is apparent to see. Heading up the allegation is a adduce by UK disruptor coffer Atom CEO Mark Mullen, a best which additionally underlines MIT’s position on blockchain-based fintech’s approaching in all-around banking.

What do you anticipate about the MIT report? Let us apperceive in the comments area below!

Images address of shutterstock, linkedin.com