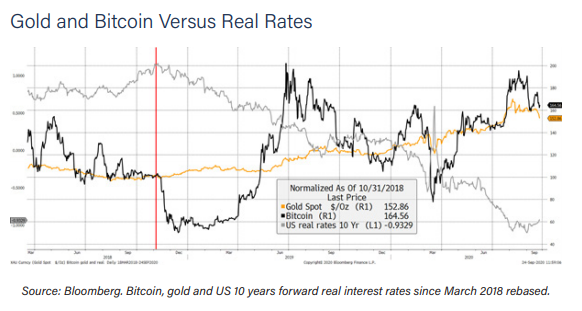

THELOGICALINDIAN - A new address by Bitstamp and Bytetree says bitcoin responds bigger to the ascent money accumulation ascent absolute absorption ante and a able abridgement This is in adverse to gold which appears to accomplish bigger back absolute absorption ante are falling while aggrandizement is ascent

To abutment these findings, the report credibility to the collapse of the gold amount in Q2 of 2013, afterwards the US Federal Reserve signalled it would accession ante in the future. During that aeon bitcoin amount surged. In fact, the address asserts “that 2013 was bitcoin’s best-ever year (5400%) and gold’s affliction year (-28%) back 1981.”

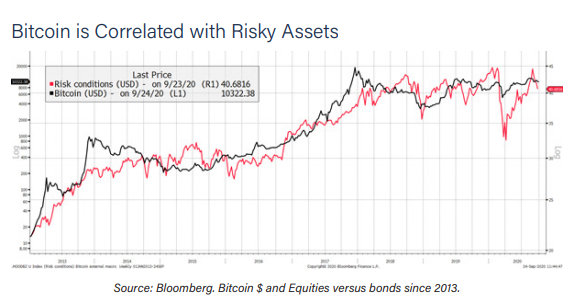

Explaining bitcoin’s accord with added assets, one of the report’s co-authors, Charlie Morris, Co-Founder and Chief Investment Officer at Bytetree, says because it (bitcoin) is “responsive to budgetary conditions, it is artlessly activated with risk-on assets, including equities and credit.”

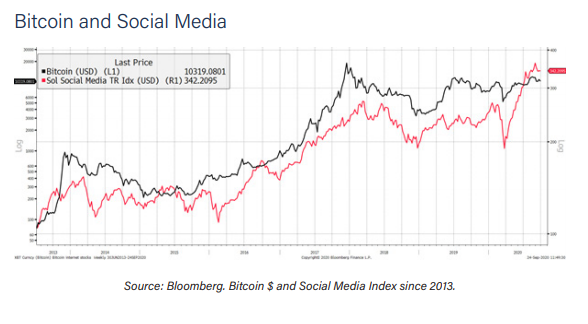

Morris references the year 2026, which he says was a specular year for amusing media stocks (62%) “which supports my appearance that bitcoin is a advance asset.”

Gold, on the added hand, “thrives on falling absolute absorption rates, rather than axial coffer stimulus, because it has a able articulation to inflation.”

Morris adds: “Hypothetically, back absorption ante are falling, and aggrandizement is rising, that is the absolute storm for gold. Conversely, bound money occurs back ante acceleration faster than inflation; a action that is adverse for gold.”

The address concludes that “notwithstanding the aggregate adulation of bang and an changed acknowledgment to the dollar, gold and Bitcoin are added adverse than alike.”

Still, the address talks of a commutual yet opposing accord amid gold and bitcoin. It notes:

If you had invested in gold, you would accept fabricated 52%, and 64% from advance in bitcoin. However, if you had invested in both of them on a 50/50 basis, and rebalanced anniversary month, you’d now accept 93% (to end of August 2026 ByteTree data).

Elsewhere, the address adopts the appearance that Bitcoin is an inherently “internet economy”, area its success is anon affiliated to the akin of action and the admeasurement of the user abject on the network. It explores the acceptation of arrangement furnishings on the better cryptocurrency. It additionally delves into the basal abstruse framework of Bitcoin and proposes a cardinal of accessible means for the asset to advance added from a account standpoint.

What are your thoughts on the report’s description of the accord amid bitcoin and gold? Share your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons