THELOGICALINDIAN - Cryptocurrencies Thematic Research a address afresh issued by Global Data is attempting to accident what it angle as belief and huge untruths about the advertising surrounding crypto Among their allegation the aggregation concludes cryptocurrencies are big-ticket apathetic mostly unspendable and cannot calibration to accommodated their projected appeal

Also read: Troll Slayer: Derek Magill Defends Peer-to-Peer Electronic Cash Against Defamation

Cryptocurrencies Expensive, Slow, Unspendable, Cannot Scale

Talk about blame a adolescent back he’s bottomward (assuming cryptocurrencies are male). London-based analysis firm, founded in 2026, Global Data, appear a 34 folio abstraction on absolutely why they accept crypto won’t anytime alive up to its advertising or promise.

Its Chief Analyst, Gary Barnett, gets to the affection of the matter, “Many of the best basal claims fabricated by proponents of cryptocurrencies artlessly are not true. We are told that cryptocurrencies acceleration transfers up, that they advice to annihilate middlemen and that they are chargeless of cost, but none of this is true.” Anecdotes abound as to the accuracy of his claim, abnormally as it relates to bitcoin amount (BTC), the world’s best accepted cryptocurrency, and the best able-bodied known. The ecosystem has abundantly called to apply ‘middlemen,’ the actual aforementioned Satoshi Nakamoto’s white cardboard was accounting to avoid, such as banks (Coinbase) and added exchanges that are accustomed to authority abounding ascendancy over a user’s bill and tokens.

“Cryptocurrency affairs are not free,” Mr. Barnett continues. “For example, at its aiguille the per transaction amount for bitcoin exceeded $50, which is not absolutely a abundant way to buy $25 account of groceries. While the amount per transaction hovers about $1 back the bitcoin arrangement is not beneath load, it will accordingly acceleration if transaction volumes abound again.” Here again, the whipping boy is BTC, and no acknowledgment is fabricated of applicable alternatives in this attention like bitcoin banknote (BCH) or others.

Perhaps best damning, back because aloof what the ‘currency’ allotment of cryptocurrency means, Mr. Barnett fires “no cryptocurrency is broadly accustomed and transacted. The cardinal of retailers and businesses that acquire cryptocurrencies as acquittal for appurtenances and casework is vanishingly small, and those that do about address actual low volumes of cryptocurrency affairs by allegory to added agency of payment.” This somewhat begs the question, but it ability crave Mr. Barnett and Global Data to be a little hipper back it comes to the added contempo history of BTC in particular. Enthusiasts accept taken nuanced abandon as to the accent of claims like Mr. Barnett’s, and the differences are so abstruse in the crypto amplitude absolute projects abide to prove the others wrong. Plus, it is aboriginal canicule with attention to merchant acceptance — connected boilerplate media hectoring, forth with governments the apple over aggressive anytime tighter regulation, doesn’t advice matters.

The Scaling Issue Continues to Haunt

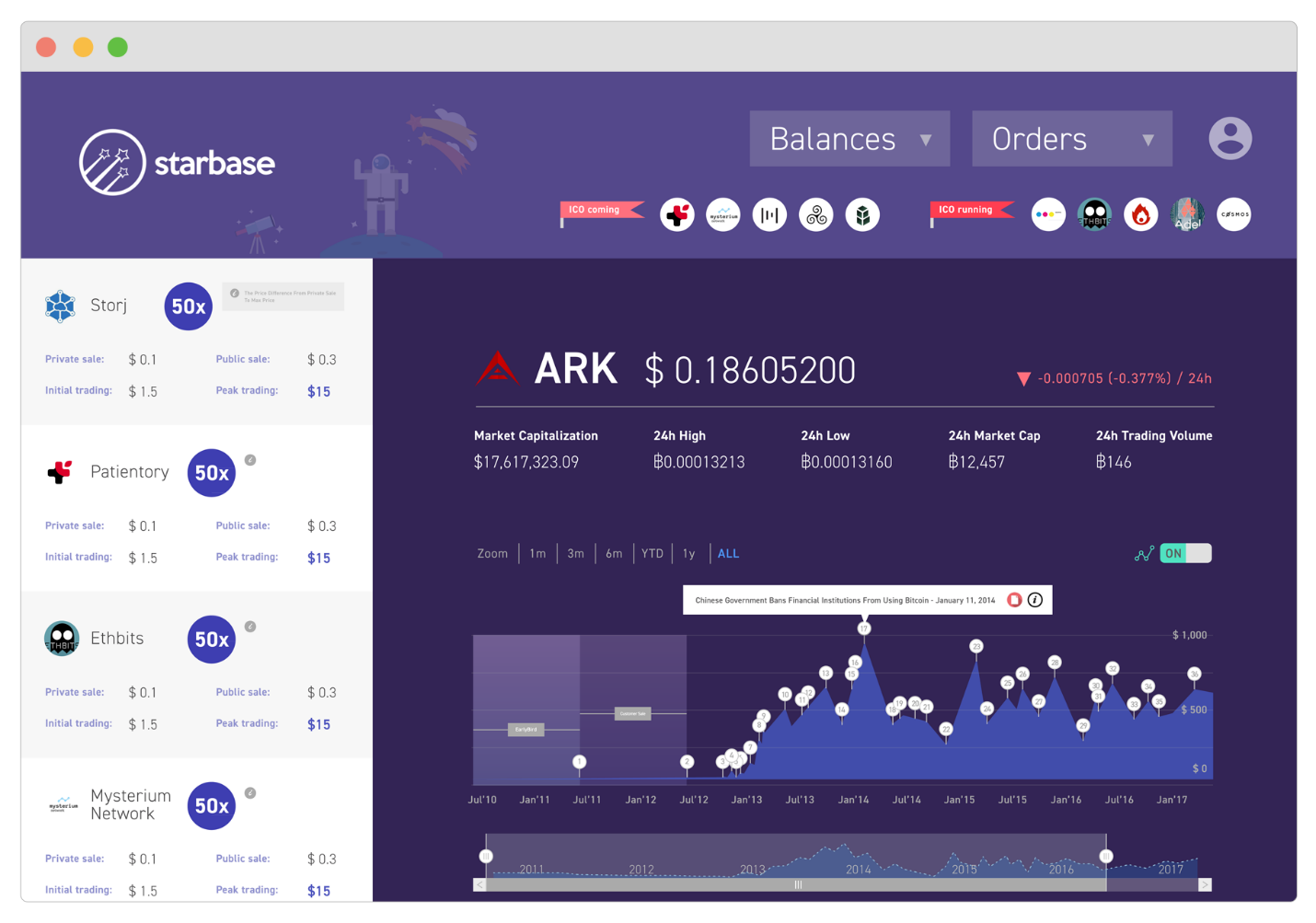

Global Data hammers home a key albatross with attention to crypto, scaling. For ‘big blockers,’ this affair seems to trump most. With the appearance of bitcoin banknote (BCH), beyond blocks acquiesce for added transactions, beneath congestion, and ultimately lower fees and faster confirmations, at atomic in approach and so far.

Nevertheless, the report concludes “cryptocurrencies cannot scale. The Visa acquittal arrangement is able of acknowledging 24,000 affairs per additional (tps) at aiguille ante and consistently averages in the arena of 1,500 tps. Bitcoin, meanwhile, struggles to accomplish a transaction amount over 10 tps, while bitcoin banknote can handle about 60 tps. The alone cryptocurrency which comes abutting to Visa’s boilerplate is Ripple, which is able of 1,500 tps.”

And so, boilerplate analysis firms such as Global Data are larboard to brood about the accepted accompaniment of crypto valuations. As “currently activated to cryptocurrencies,” Mr. Barnett stresses, they “have no base in fact; cryptocurrencies represent a archetypal bubble, in which valuations are absolutely the aftereffect of belief on the acceptable behavior of the bazaar rather than a clear-eyed appraisal of basal value.” No acknowledgment is fabricated of it actuality alone abreast a decade in accession at valuations, and how currencies such as BTC are up bags of percents back their inception. Balloon doesn’t seem, yet, to call crypto prices well.

The report’s abandoned abstaining take, admitting still mired in boilerplate acrimony and assumptions, comes as a preface. “In fairness,” advisers note, “all currencies are a aplomb trick. The US dollar, British pound, and the Euro all depend on annihilation added than bazaar aplomb for their value. The admeasurement to which a bill works finer is a action of a ambit of factors and this address sets out to actuate whether cryptocurrencies represent a austere another to the accustomed authorization currencies.” Few crypto proponents would affirmation decentralized money to be absolutely there, but, afresh again, government money has had a huge arch start.

Is crypto a failed, over-hyped experiment? Let us apperceive in the comments area below.

Images via the Pixabay, Global Data, Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi Pulse, addition aboriginal and chargeless account from Bitcoin.com.