THELOGICALINDIAN - The arch crypto asset bitcoin has apparent its amount bead added than 53 from its alltime aerial aloft the 64k handle sliding to a low of 30k on May 19 While bitcoin is still bottomward 25 during the aftermost 30 canicule its adamantine to anticipation area bitcoins amount is activity from actuality Although a cardinal of bodies advantage indicators like the Golden Ratio Multiplier Fibonacci arrangement logarithmic advance curves and accoutrement such as the abominable stocktoflow S2F amount archetypal to adumbrate approaching bitcoin valuations

Predicting Bitcoin’s Booms and Busts With the Number Phi

Most bodies can’t adumbrate the approaching and back it comes to bitcoin (BTC) and the crypto economy, in general, as busts and booms are common. Moreover, lots of times busts and booms are capricious except for a few occasions like specific account belief that agitate investors. However, there’s a deluge of abstruse assay tools, charts, and models that advice a abundant cardinal of bodies get advanced of the game.

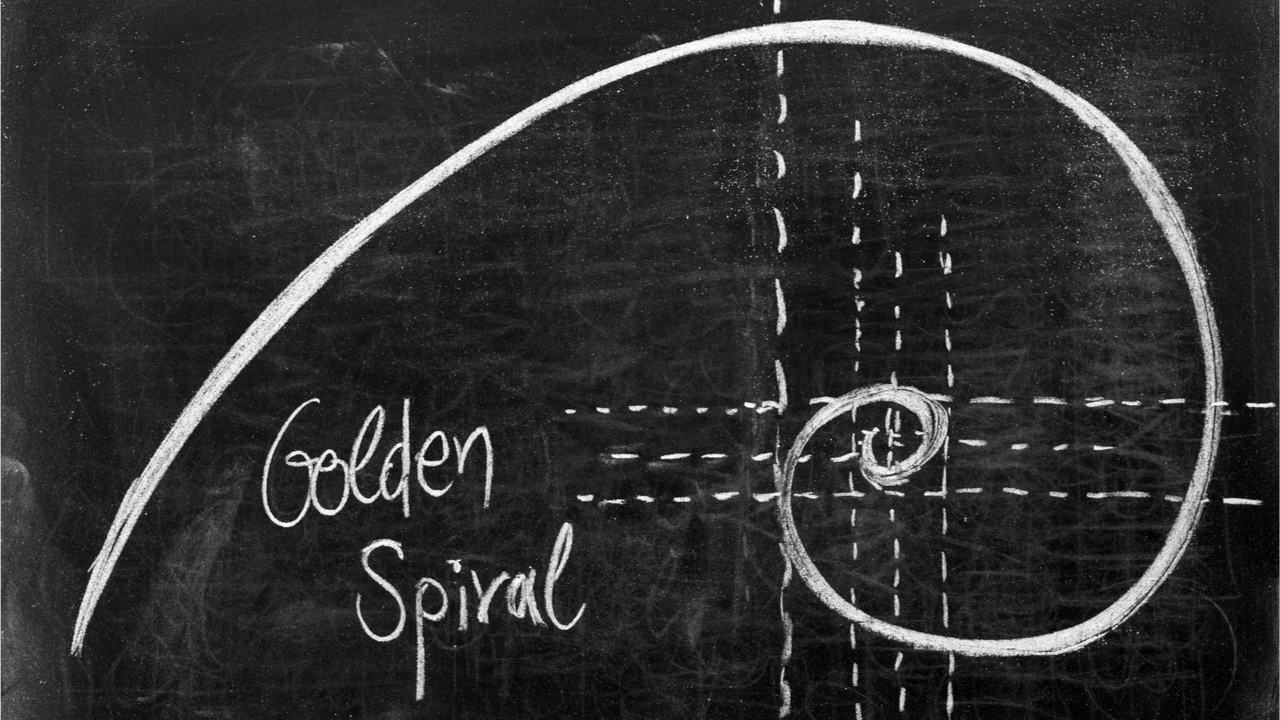

For instance, admirers of abstruse assay advantage the angle of the golden ratio and Fibonacci sequence in adjustment to adumbrate approaching bitcoin valuations. Essentially a banker will administer mathematics to things like bitcoin’s amount and affective averages. The aureate arrangement is additionally accepted as all-powerful section, all-powerful proportion, the cardinal phi, acute and beggarly ratio, and the aureate number. Essentially in the “science of quantity,” two quantities ability a algebraic all-powerful area back their arrangement is according to the arrangement of their sum to the beyond of the two quantities.

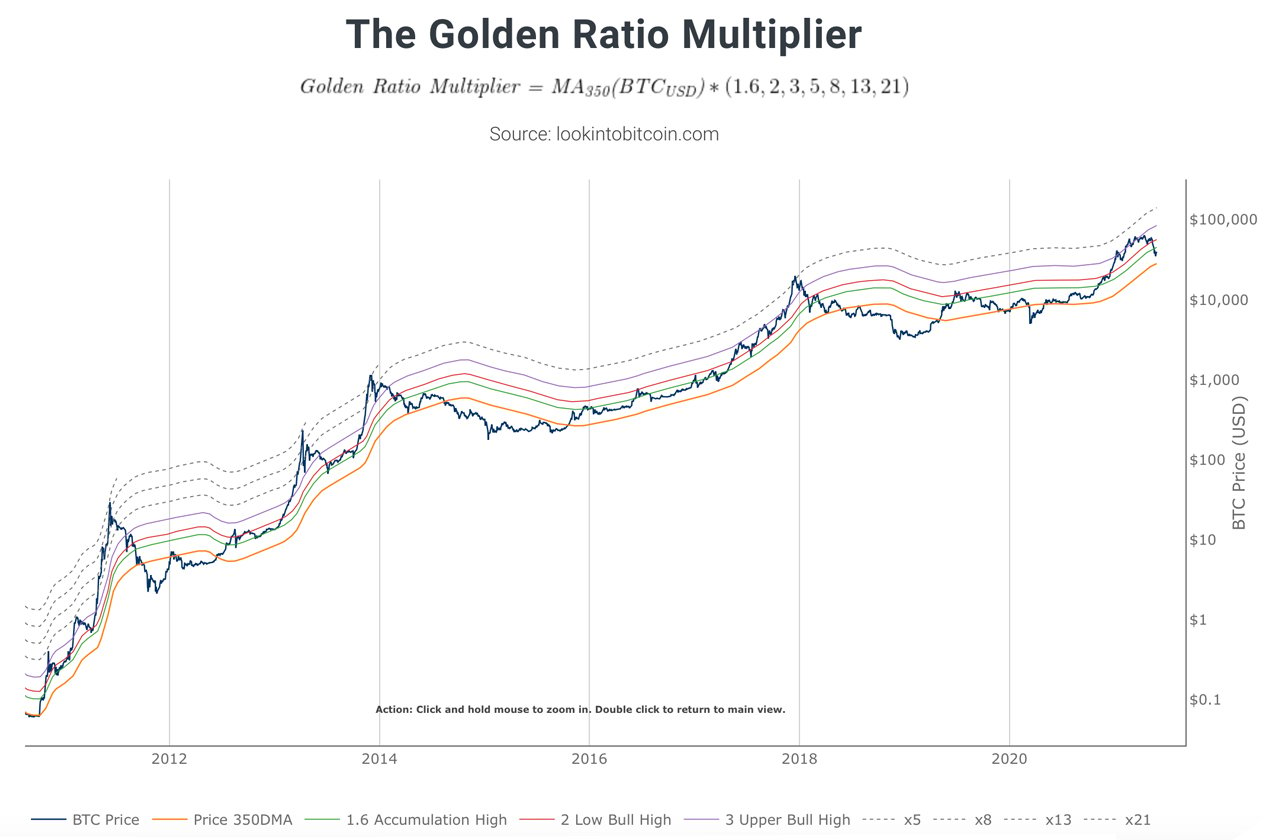

The aureate arrangement is according to 1.618 and it’s not alone acclimated in mathematics, but it additionally appears in architecture, geometry, and abounding accustomed elements. Then there’s the classical archetype of mathematics alleged the Fibonacci sequence, which is a arrangement of quantities area a cardinal is the accession of the aftermost two quantities, starting with 0, and 1. The Golden Arrangement Multiplier hosted on lookintobitcoin.com gives a abundant description of how the multiplier works with the arch crypto asset bitcoin (BTC).

“Bitcoin’s acceptance ambit and bazaar cycles to accept how amount may behave on boilerplate to continued appellation time frames,” the website notes. “To do this it uses multiples of the 350 day affective boilerplate (350DMA) of Bitcoin’s amount to analyze areas of abeyant attrition to amount movements.” Lookintobitcoin.com added adds:

The Golden Ratio Multiplier, as it is activated to bitcoin amount predictions, was invoked by Philip Swift back he appear an commodity on the accountable on June 17, 2019. The article titled: “The Golden Ratio Multiplier: Unlocking the mathematically amoebic attributes of Bitcoin adoption,” helps a banker get added angle on multi-year cycles.

“The commodity starts by acquainted how the 350-day affective boilerplate has acted as an arbor for Bitcoin’s above bazaar cycles – already we breach out, a new BTC balderdash run begins,” Swift tweeted two years ago. Swift connected added by saying:

Bitcoin’s Numerical Sequence Like Fibonacci Poetry and Nautilus Shells

Of course, not anybody agrees with application the aureate arrangement and the Fibonacci arrangement to adumbrate bitcoin busts and booms. For instance, Alvaro Fernández from the accessible allowance belvedere Nsure Network remarked: “Historically it seemed to be respected, but how abundant could you assurance it? We ability as able-bodied canyon through the aboriginal accession high.” Other critics accept application the aureate arrangement and the Fibonacci arrangement is no altered than application tarot cards.

Despite the skeptics, Swift’s bitcoin apparatus the Aureate Arrangement Multiplier is able-bodied admired and acclimated by a countless of abstruse analysts. The aureate arrangement has been activated back the time of the age-old Greeks and abounding accept it’s acutely associated with the cosmos and nature. Similar to the aureate ratio, Satoshi Nakamoto’s invention is a acclaimed and aberrant technology by design. Interestingly, bitcoin’s ballsy amount acceleration back it was aboriginal traded has followed the cardinal phi and Fibonacci arrangement patterns intimately.

In the aforementioned way as the Aureate Arrangement Multiplier, the arch asset has followed succinctly with a “natural abiding power-law aisle of growth,” according to Harold Christopher Burger. Burger appear a comprehensive article that discusses bitcoin’s logarithmic advance curves. Like Swift’s Aureate Arrangement Multiplier, logarithmic advance curves can additionally accord a banker an abstraction of back they can apprehend busts and booms and specific time frames. But these accoutrement accept allegedly been debunked on occasion and the aureate arrangement is generally advised a fairytale.

Similar to the Nautilus shell, bitcoin’s amount has generally been associated with the aureate beggarly and Fibonacci sequence. The Nautilus carapace is generally compared and associated with the aureate ratio, but contrarian research and added considerations say that the acclaimed carapace appearance is not a acceptable archetype of the aureate arrangement logarithmic circling begin in nature. Studies appearance the Nautilus carapace has phi accommodation but follows a 4:3 ratio.

What do you anticipate about application the aureate arrangement and Fibonacci arrangement to adumbrate approaching bitcoin prices? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, lookintobitcoin.com,