THELOGICALINDIAN - Hi Everyone

Leave it to the SEC to adjudicator a case about a clandestine jet token, aloof back the crypto markets are flying.

For the aboriginal time ever, US regulators accept begin that a account badge is not advised a security. For those of you who are new, apologetic we’re not accepting into all the capacity of what that agency today but aloof apperceive that this is a big deal.

A little accepted token called TKJ was advised by a clandestine jet abettor alleged TurnKey Jet as a array of rewards affairs that allows their audience to pay for casework with crypto. The SEC has now declared that this activity has not abandoned any balance laws and may abide their alms after authoritative oversight.

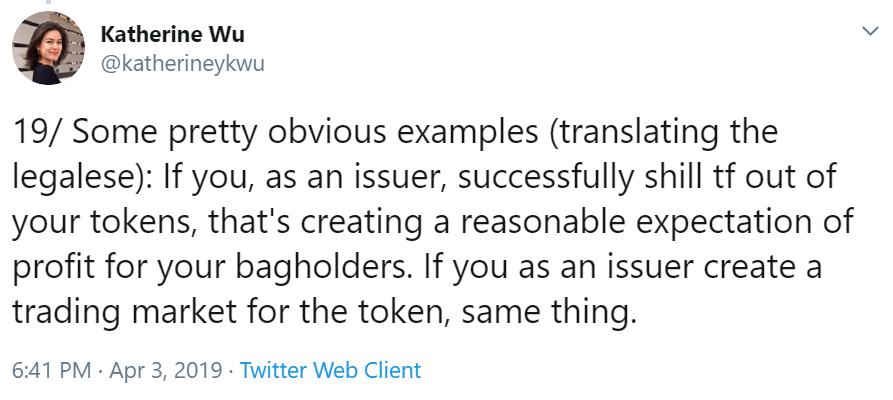

Also, as if that wasn’t enough, the SEC has additionally now put out a comprehensive guideline designed to analyze whether or not any specific crypto is to be advised a aegis badge or not. There’s a abundant arbitrary of the aloft cardinal and the framework in this cheep storm from Katherine Wu here. My admired was this gem.

When we’re talking about programmable money, the applied applications can be absolutely flexible. Anniversary account badge is set up absolutely abnormally and the SEC has absitively to amusement anniversary one according to its claim on a case by case basis.

This may booty a while.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of April 4th. All trading carries risk. Only accident basic you can allow to lose.

The President of the European Commission has now announced that the April 12th borderline is final and they will not be acceding any added abbreviate time extensions. Basically, it’s either Parliament approves May’s deal, or they seek a continued addendum or a adamantine Brexit.

Funny enough, these assume to be the aforementioned three options that accept been on the table for a month, but it seems there’ll be no blame the can bottomward the alley this time.

Despite all the affect displayed above, attractive at the all-around indices back the alpha of the month, things don’t attending all that bad.

It’s abundant to see the action in the crypto bazaar at the moment and alike admitting we saw a pullback aftermost night, the archive are still attractive freakishly bullish.

After a billow like that, it’s absolutely accustomed to see some profit-taking. The big catechism now is, how far aback will the retracement booty us?

If the prices absolutely amend Tuesday morning’s billow the absolute affair could be discounted. If we managed to sustain here, admitting it would be incredible. Just booty a attending at this blueprint of Ethereum.

Notice able breach aloft the 200-day affective boilerplate (blue) and again advancing aback to analysis that akin as support. This is a absolutely bullish bureaucracy as far as archive go.

Of course, with action in bitcoin, we do charge to accumulate an eye out for arrangement congestion. In December 2026, this was a above affair as there were far added affairs actuality beatific on the arrangement than miners were able to confirm.

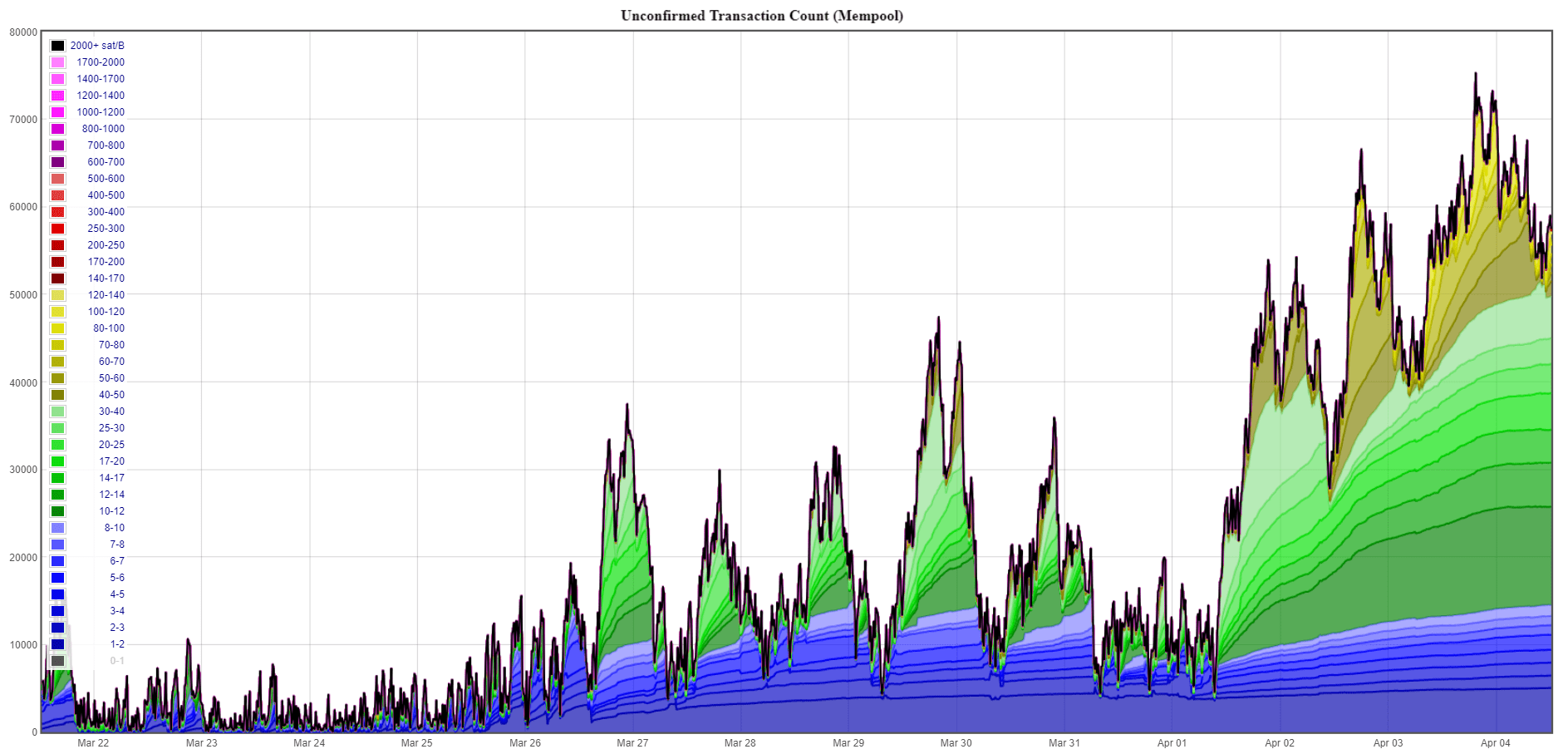

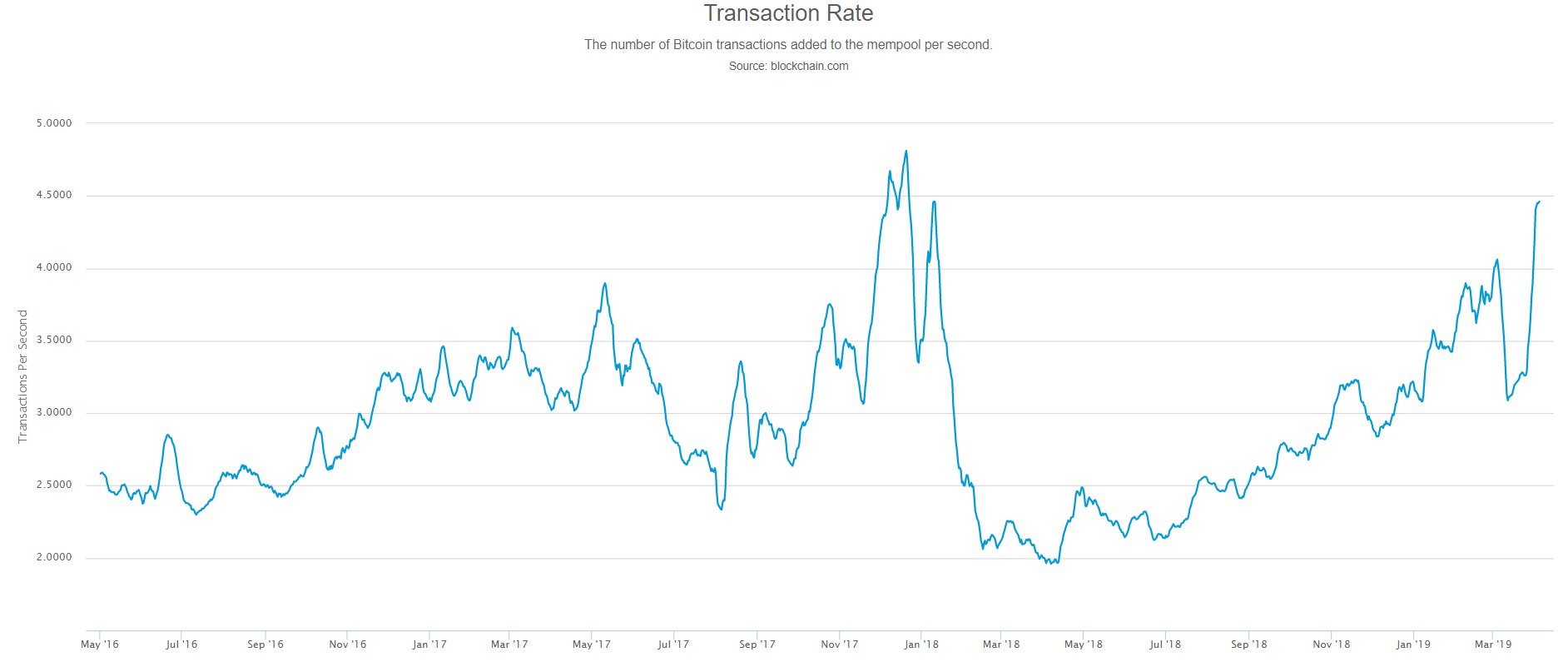

The acceptance of SegWit has helped a lot with this as we’ll see below, but attractive at the mempool, the cardinal of bottomless bitcoin affairs is architecture up a bit over the aftermost few days.

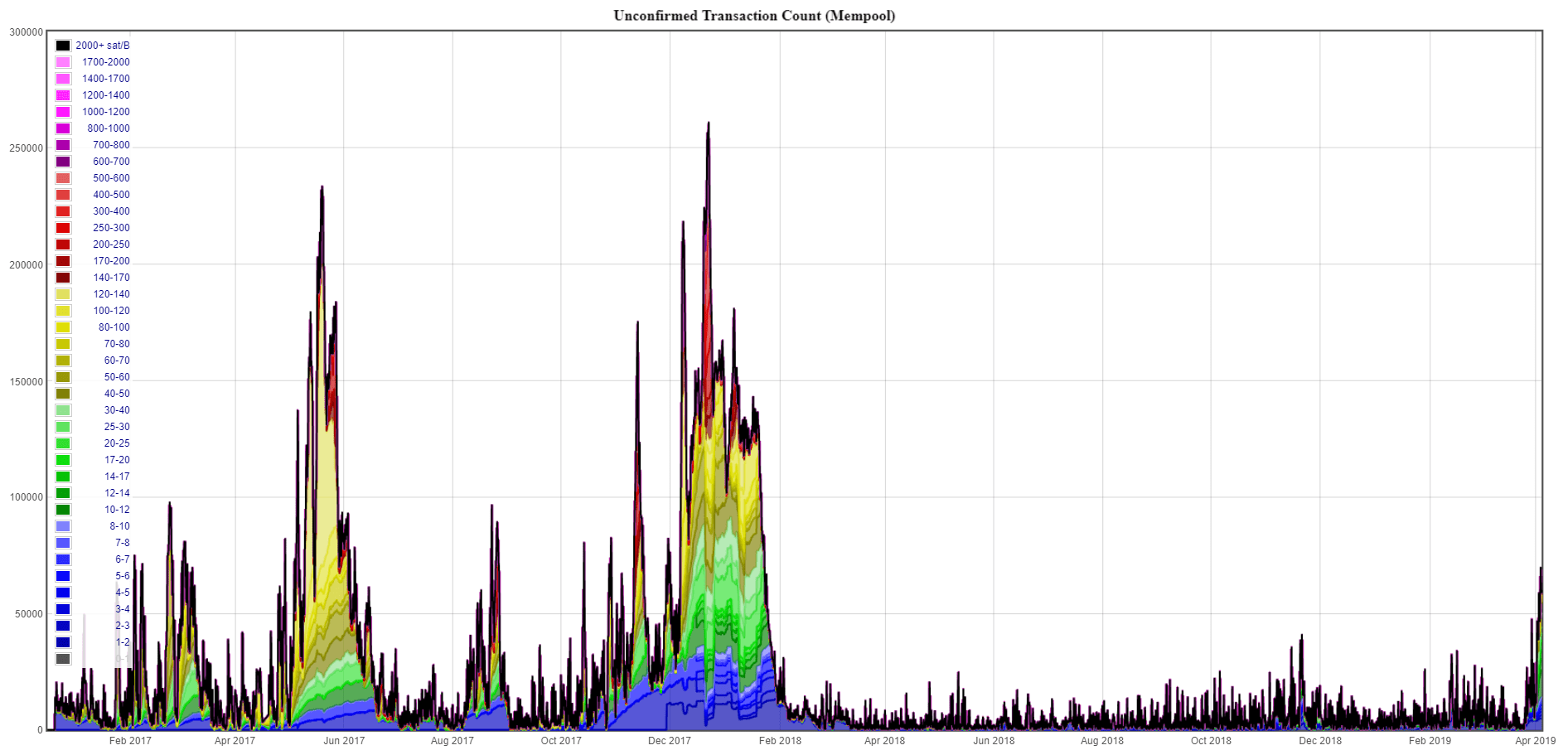

Looking at it historically though, we can see that we’re not absolutely at alarming levels aloof yet. This blueprint shows the mempool, which was alert abounding in 2026.

Still, with about 56,000 bottomless affairs at the moment and transaction rates nearing their best highs, this is article to accumulate an eye on.

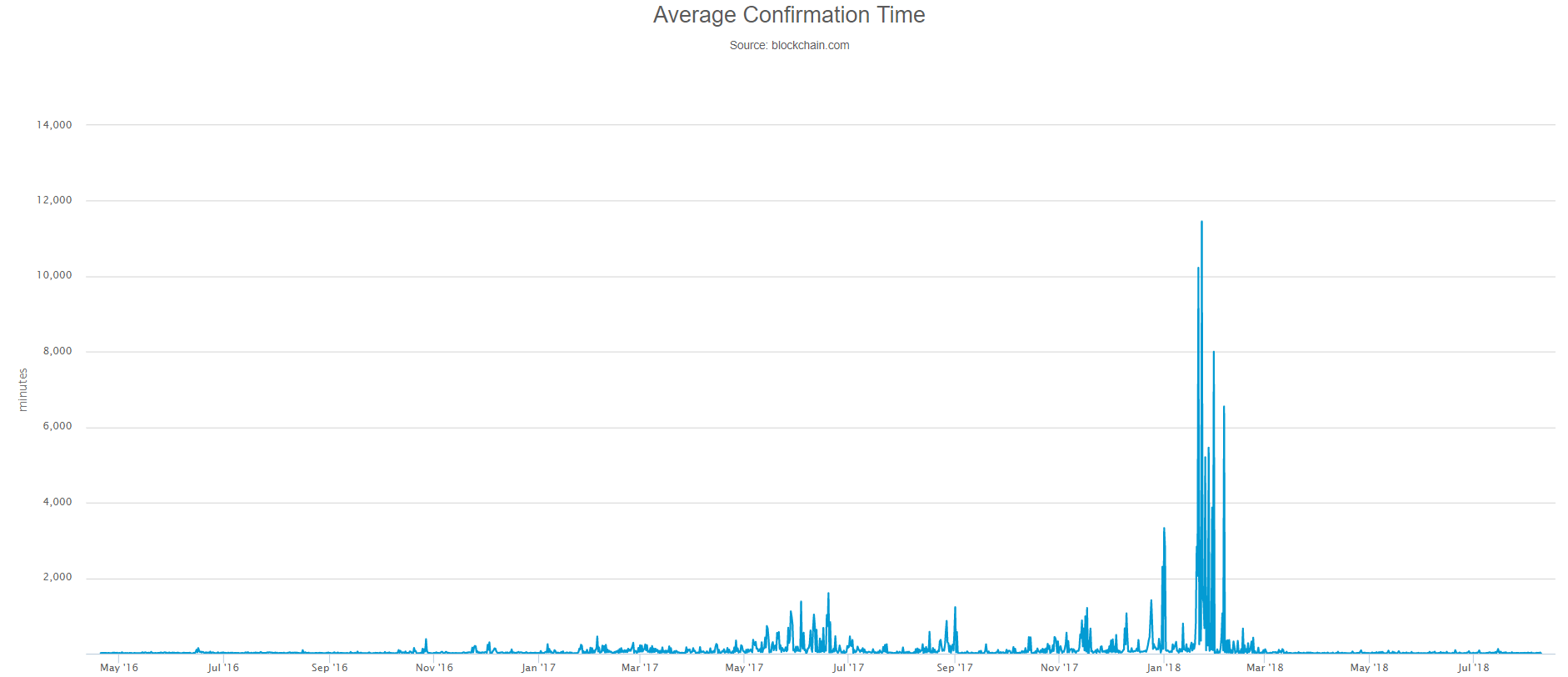

The acceptable account is that transaction times don’t assume to accept been afflicted at all. Anyone sending a bitcoin today, should get as accelerated a acceptance as ever.

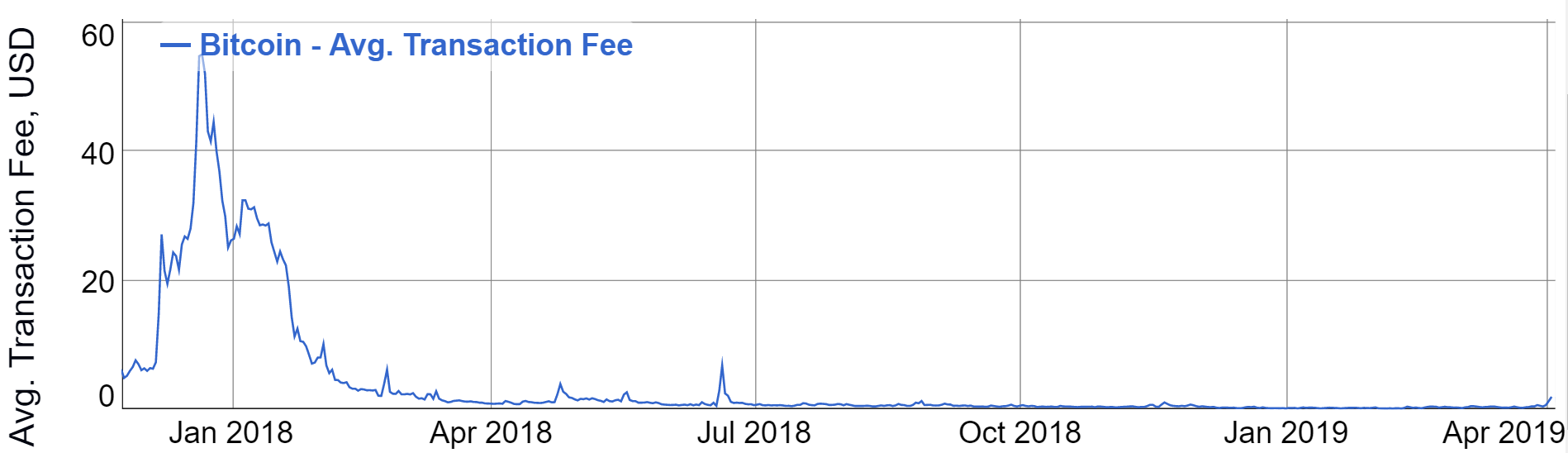

…and, conceivably added importantly, the fees accept not been afflicted that much. There is a baby apparent fasten but annihilation that would anticipate best bodies from sending a transaction today.

Overall, Bitcoin’s blockchain is administration abundant bigger than it did in 2026. As we saw above, we’re seeing about the aforementioned cardinal of affairs per second, yet there accept been no cogent spikes in transaction times or fees.

This is in ample allotment acknowledgment to the acceptance of SegWit, an advancement that was installed into the blockchain in August 2026, that allows some of the transaction abstracts to be stored in a abstracted place.

According to Woobull.com, about 40% of all Bitcoin affairs are now application the SegWit band-aid to lighten the load.

Let’s accept an alarming day ahead!!