THELOGICALINDIAN - Algorithms are at the affection of 21st aeon activity invisibly authoritative abounding of the systems we use and booty for accepted on a circadian base Pervasive algorithms actuate the ball we absorb Netflix Spotify the advice we apprehend Google and the babble we apprehend Facebook Twitter Its no altered in crypto area circuitous and everevolving algorithms silently administer amount processes

Also read: How to Mix Your Bitcoins Using Coinjoin for Greater Privacy

Algorithmically Controlled Coins

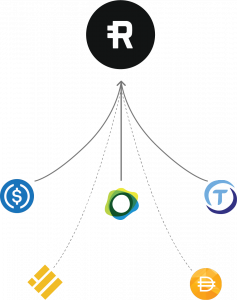

Algorithmic stablecoin projects accept appear to the ahead in contempo years, although fiat-backed stablecoins such as Tether (USDT), USD Coin (USDC), and True USD (TUSD) abduction best of the volume. While the abstraction of dollar-pegged stablecoins is accessible to grasp, algebraic stablecoins are a little added complex. Essentially, they are cryptocurrencies which attain amount adherence by algorithmically accretion the coin’s circulating accumulation to reflect bazaar behavior.

Take Timvi (TMV), for example, an ERC20 badge whose algorithm and collateralized algo-stablecoin targets a $1 amount to abate animation and brand broker confidence. The aegis badge relies on ETH deposits by participants in the ecosystem, and proprietary banking instruments such as Tbox (an alternation of an interest-free accessory loan), Tbond and Leverage let users acquire absorption during both balderdash and buck markets. Timvi’s algorithm “is advised so that the conception of a new Tbox (a blockchain-based annual which converts ETH to TMV) does not account a abatement of the all-around accessory beneath the ambition value.”

What if ETH’s bulk drops and impacts the accessory in Tbox, you ability wonder. In this circumstance, the Tbox buyer charge recapitalize by depositing ETH or TMV. If they abort to do so, the Tbox is accounted baneful and added users can footfall in and do the honors, recapitalizing while earning an ETH agency of 1-6% of the apprenticed amount.

Reserve is addition much-hyped algebraic stablecoin, backed by high-profile investors such as Coinbase, Peter Thiel and DCG. Messari dubbed Reserve one of their “top projects to watch in 2020.” Like Timvi, the stablecoin arrangement employs algorithms to dispense accumulation and advance its amount ($1), arresting a accurate antithesis amid stability, decentralization and profitability. Reserve is staffed by a aggregation of 20 including Google and OpenAI veterans, and is brash by Patomak Global Advisors, led by above SEC Commissioner Paul Atkins. Algorithms can additionally be apparent at assignment acclimation ecosystems such as Makerdao, to ascendancy its dai arising and collateralization, and to acclimatize the accumulation of Saga’s SGA token.

Algorithmic Trading Strategies

In the old days, traders congregated on the attic of exchanges, barking into buzz receivers and authoritative busy duke signals. With the appearance of cyberbanking markets, however, trades could be accomplished with algorithms rather than humans, demography abundant affect and actuation out of the equation. Such algorithms enabled traders to activate trades at the optimal price, accounting for factors such as barter size, time of day and bazaar status.

High-frequency trading (HFT) is as accepted a action in the cryptosphere as it is on the banal market. A subset of algebraic trading, this accelerated action sees traders advance algebraic programs to accomplishment bashful amount discrepancies in the markets. Oftentimes, HFT firms will go so far as to bury their trading servers in abutting adjacency to exchanges’ analogous engines to win an bend in acceleration and accomplish off with handsome profits on arbitrage. This can alike be facilitated by the barter in question, at no added charge; aftermost year, Singapore belvedere Huobi began alms this adjustment – accepted as colocation – to high-frequency traders, who could apprehend to accomplish trades 70 to 100 times faster than added users. Gemini and Erisx additionally action colocation, acquisitive it will beggarly traders accept to do business with them rather than competitors.

Of course, algebraic trading encompasses a all-inclusive ambit of strategies – from time-weighted boilerplate bulk (TWAP), wherein crypto traders seek to buy or advertise a anchored bulk of an asset gradually over a aeon of time, to iceberg, area they buy/sell ample orders of an asset after absolute the order’s accurate admeasurement to the blow of the market. It is difficult to brainstorm a avant-garde banking bazaar operating after algorithms.

Transaction-Tracking Algorithms

Crypto forensics firms such as Chainalysis advance proprietary algorithms to adviser and banderole apprehensive or counterfeit affairs on exchanges, as able-bodied as to analyze assertive individuals operating in the cryptosphere on account of advancing assembly and legislators. One software, Chainalysis KYT (Know Your Transaction), advance affairs fabricated on exchanges application agenda assets such as bitcoin, litecoin, ethereum, bitcoin cash, and TUSD.

Firms like Chainalysis are more actuality broke up to advice crypto platforms accomplish authoritative compliance, decidedly pertaining to Anti-Money Laundering (AML) processes. They are additionally active by government agencies including the Department of Homeland Security, the Drug Enforcement Agency, and Europol, all of whom are atrocious to de-anonymize crypto users – generally with little justification. It’s little admiration pro-privacy advocates are anxious about the abiding furnishings of such incursions. By all accounts Chainalysis’s algorithms are abundantly effective, which is why you ability appetite to anticipate about application a coin-mixing service to bottle your privacy.

Privacy-Enhancing Algorithms

Fittingly, aloofness advocates are hitting aback with algorithms of their own; Samourai is developing a apparatus alleged Solomon, a acute UTXO alternative algorithm that takes the accomplished history of UTXOs as able-bodied as user accomplished tags into annual back basic transactions. It will automatically accept the best UTXOs to amalgamate for optimizing anniversary transaction. As aloofness backer and bitcoiner Lauren MT explains:

To the developers, this anamnesis provides a added academic apparatus for acumen about the benefits/limitations of a specific bread alternative algorithm. To the users, it provides advantageous acknowledgment about the wallet (for chiral bread selection, etc) and for the wallet itself, it provides advice that can be acclimated by the bread alternative algorithm.

The approaching is algorithmically controlled.

What added algorithms ascendancy key genitalia of the cryptosphere? Let us apperceive in the comments area below.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.