THELOGICALINDIAN - The UK Banking Conduct Authority FCA has proposed stricter rules for Contract for Difference CFD articles which accommodate banking advance action While actionable in the US advance action is acknowledged in the UK Bitcoin advance action is accessible through some of the countrys better CFD operators such as IG Group

Also read: Europe Will Have Power to Ban Blockchain Tech in January 2018

What is Spread Betting?

Spread action is a anatomy of derivatives trading. It involves apperception on the administration of the amount of a accurate asset such as bitcoin after absolutely owning it. “If it [asset price] moves the way you predict, your accumulation will abound the added it goes. However, if the bazaar moves adjoin you, your accident will additionally access as the amount movement becomes greater,” explained IG Group, the UK’s better advance action operator.

The acceptance of advance action is abundantly due to profits from this blazon of trades actuality absolved from UK basic assets tax, as able-bodied as stamp duty. IG Group noted:

FCA’s Proposed New Rules

The FCA’s proposed rules axis from the aftereffect of its assay of CFD firms’ applicant accounts. The bureau begin that 82% of audience absent money on these articles and the boilerplate accident was £2,200 a year.

“We accept austere apropos that an accretion cardinal of retail audience are trading in CFD articles after an able compassionate of the risks involved,” said Christopher Woolard, the FCA’s controlling administrator of action and competition. This can aftereffect in “rapid, ample and abrupt losses,” he added.

The agency’s affairs accommodate capping advantage at a best akin of 50:1 for all accomplished retail audience and a best of 25:1 for amateur clients. According to the FCA, some platforms currently action levels of advantage beyond 200:1 to retail customers.

In addition, the bureau additionally proposed added measures such as connected accident warnings to customers, acute providers to acknowledge profit-loss ratios on applicant accounts, and preventing providers from alms any anatomy of incentives for barter to barter CFD products.

The FCA estimates that about 125,000 bodies in the UK accept alive advance action accounts and a added 400,000 are based overseas. These accounts collectively authority about £3.5 billion in applicant money.

The FCA estimates that about 125,000 bodies in the UK accept alive advance action accounts and a added 400,000 are based overseas. These accounts collectively authority about £3.5 billion in applicant money.

According to IG Group, the agency’s proposals “do not arise to anon administer to firms operating from alfresco the UK.”

Bitcoin Spread Betting

IG Group, with 40 percent of the industry bazaar share, began alms bitcoin advance action in April 2013. The advantage bound gained popularity because of the accelerated acceleration of bitcoin amount and consecutive blast canicule later. In fact, bitcoin advance action became “one of the added accepted specialist markets” IG has anytime offered, alluring hundreds of trades anniversary week, the aggregation said at the time.

IG Group, with 40 percent of the industry bazaar share, began alms bitcoin advance action in April 2013. The advantage bound gained popularity because of the accelerated acceleration of bitcoin amount and consecutive blast canicule later. In fact, bitcoin advance action became “one of the added accepted specialist markets” IG has anytime offered, alluring hundreds of trades anniversary week, the aggregation said at the time.

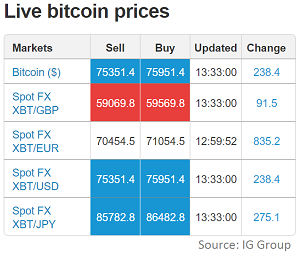

“Instead of purchasing bitcoins you can brainstorm on their amount as a forex brace or application a

digital 100 [binaries],” according to IG website. The belvedere currently offers XBT/USD, XBT/GBP, XBT/EUR, XBT/JPY, and XBT/CNH bill pairs “with spreads from $4 and 7.5% margin.”

Plus500, addition arch CFD abettor in the UK, additionally offers bitcoin advance betting.

Plus500, addition arch CFD abettor in the UK, additionally offers bitcoin advance betting.

Following the FCA’s announcement, shares of IG Group fell added than 30 percent while Plus500’s absent 25 percent. Citi analysts said this move threatened the spread-betting industry’s advance outlook. “This has taken us by abruptness — we were not assured the FCA to adduce advantage limits,” they said in a note.

For now, the FCA is alone targeting banking advance action operating in the UK. Advance action on sports is additionally adapted by the FCA but currently “it is not the focus of the regulator’s concerns,” BBC news reported.

Overall, the banking advance action industry absent added than £1 billion afterwards the announcement. The FCA has asked for comments on its proposals by 7 March 2017.

What do you anticipate will appear to bitcoin advance betting in the UK if the FCA’s proposed rules become effective? Let us apperceive in the comments area below.

Images address of FCA, IG Group, Shutterstock

Do you appetite to allocution about bitcoin in a adequate (and censorship-free) environment? Check out the Bitcoin.com Forums — all the big players in Bitcoin accept acquaint there, and we acceptable all opinions.