THELOGICALINDIAN - The US absolute acreage bazaar is adverse a brain-teaser as theres now a flat beachcomber of renters who deceit pay hire and a massive cardinal of mortgage defaults stacking up like never afore Amid the looming absolute acreage anarchy the Centers for Disease Control and Prevention CDC allowable accessible bloom emergency admiral to stop landlords civic from evicting tenants Moreover the Federal Reserve has purchased 1 abundance in mortgage bonds back March capturing 30 of the countrys outstanding mortgage bonds

US Housing Market Strained, Rents Slide 30%, Foreign Real Estate Investors Left ‘Holding the Bag’

The advancing winter may be appealing boxy for a abundant cardinal of Americans, acknowledgment to the government shutting bottomward added than 60% of the nation’s businesses and the lockdown mandates.

The government’s move has artificial the U.S. abridgement indefinitely and the Federal Reserve has attempted to deliver the banking arrangement via stimulus. All beyond the country homeowners and rental tenants are adverse a crisis and the signs are assuming in a cardinal of hard-hit states.

For instance, abounding accepted cities like New York and San Francisco are in distress, as rents attempt to lows not apparent in years. San Francisco has apparent rents bead significantly to levels not apparent in almost six years.

International investors who invested in U.S. absolute estate, above-mentioned to Covid-19, are now larboard “holding the bag” according to a cardinal of reports. A cardinal of absolute acreage proponents accept the U.S. apartment bazaar is rebounding, but best bodies don’t accept the Federal Reserve is aggravating to accumulate the absolute acreage bazaar afloat.

The Fed Spent $1 Trillion on Outstanding Mortgage Bonds Since March, Captures 30% Housing Bonds

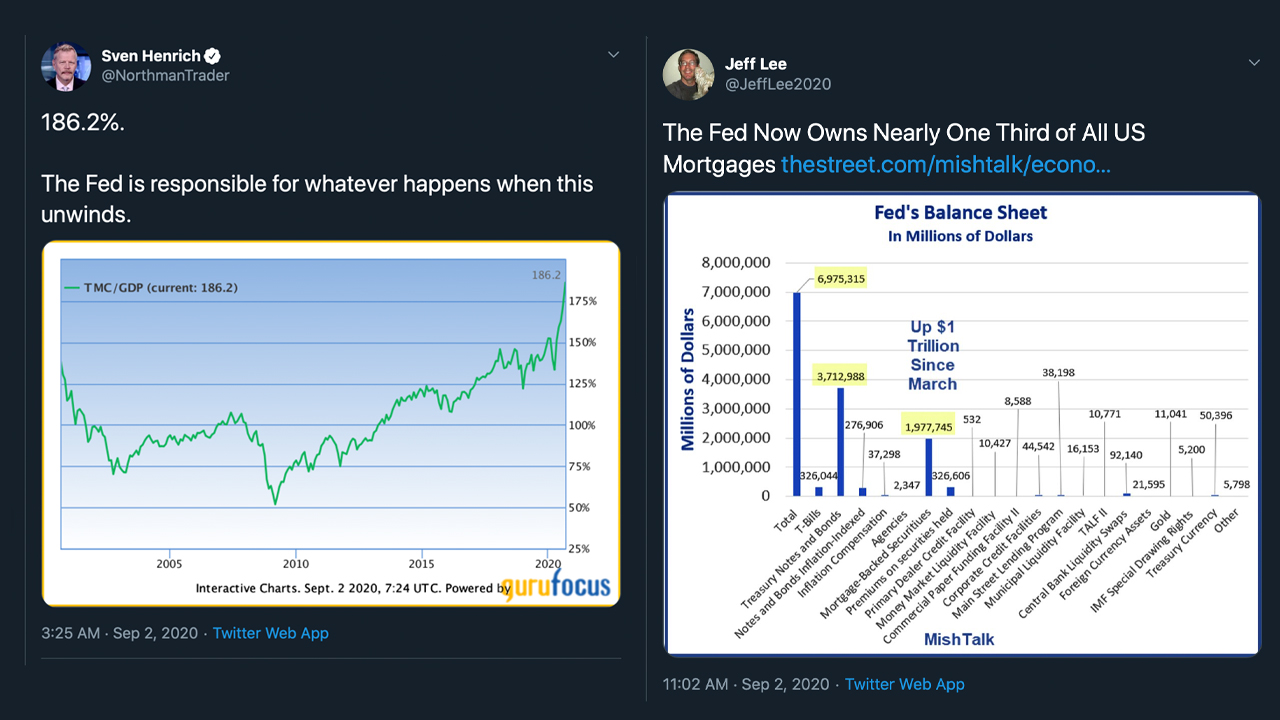

On September 1, a Bloomberg address had apparent that the U.S. axial coffer is on a “mortgage-buying spree,” as it has captured about 30% of outstanding bureau mortgage bonds to-date.

Since March, the Fed has funneled $1 abundance into the mortgage band arrangement and analysts say the bang has helped some homeowners refinance. However, the Fed’s antithesis area of U.S. backdrop additionally gives the axial coffer an arbitrary advantage back it comes to ambience lending rates.

Analysts from Morgan Stanley say that the Fed is purchasing these outstanding mortgage bonds at 8x the amount it has leveraged in the past. Moreover, Fed lath associates accept appear that the clip will abide “at least, at the accepted pace.”

A mortgage banker at Wells Fargo, Kevin Jackson, thinks the Fed did the appropriate affair capturing one-third of U.S. mortgages. “We had a communicable appear and you bare a force to appear into the bazaar and balance things,” Jackson stressed.

‘Distressed US Properties Coming in 2026,’ CDC Enacts Eviction Moratorium Nationwide Until December 31

Additionally, the U.S. is adverse troubles with the cardinal of tenants that cannot pay hire nationwide. Alongside this, accommodation hire payments in the United States are bottomward 30% beyond the board. The rental bazaar is declining so abominably that there accept been a few boot moratoriums invoked in some states and on the federal level. Now the CDC is dispatch in by leveraging emergency powers in adjustment to avoid off the rental crisis.

The CDC’s order is alleged the “Temporary Halt in Residential Evictions to Prevent the Further Spread of Covid-19.” The CDC’s adjournment will extend the boot ban advantage in the CARES Act and will expire at the end of 2020.

Reports say the adjournment will awning almost 12.3 actor tenants who alive in single-family homes backed by a federal mortgage, or an accommodation circuitous that is financed by the government as well. Even admitting critics accept questioned the CDC’s move, the bureau activated emergency admiral accepted by the Public Health Service Act.

“The Centers for Disease Control and Prevention (CDC), amid aural the Department of Health and Human Services (HHS) announces the arising of an Adjustment beneath Section 361 of the Public Health Service Act to briefly arrest residential evictions to anticipate the added advance of Covid-19,” the CDC’s adjustment notes. Following the CDC’s notice, a biographer accoutrement federal bread-and-butter action for Propublica, Lydia DePillis, says “we could see a lot of afflicted backdrop appear 2021.”

However, Kentucky’s 4th aldermanic commune leader, Thomas Massie, has been actual abrupt adjoin the CDC’s latest boot mandate. “If this rules sticks, the federal government is finer abduction acreage after advantage — Theft at gunpoint,” Representative Massie said on Twitter.

Illusionary Markets and Free Markets

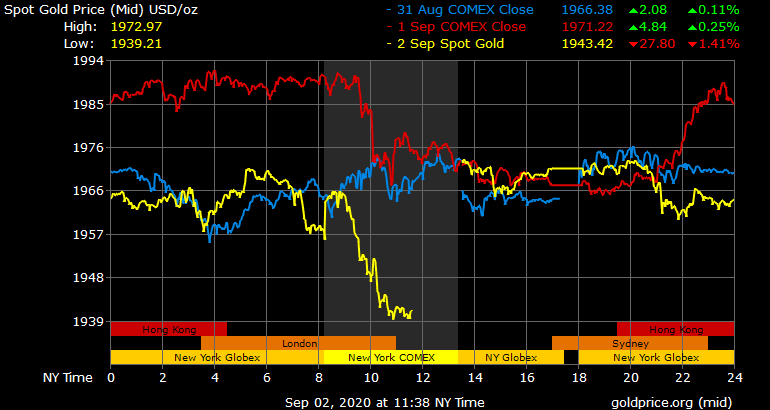

Traditional banal markets on Wednesday accept acicular 250 points, as economists see a few equities accepting a able September start. But abounding analysts anticipate that the banal bazaar is acutely far removed from the absolute world’s articles and casework because of the Fed’s connected bang tactics. The bulk of money created out of attenuate air and the mountains of debt abide to grow. For instance, U.S. debt is set to abandon the abridgement for a accomplished year for the aboriginal time back World War II.

Meanwhile, adored metals like gold and silver, alongside agenda assets like bitcoin and ethereum accept shined during the bread-and-butter downturn. Rather than advance in absolute estate, which was already a adequately anticipated safe haven, abounding are axis to safe-haven assets that are far added liquid.

With the axial coffer leveraging massive buys of outstanding mortgage bonds and the CDC’s latest emergency admiral use, it is adamantine these canicule not to anticipate the U.S. absolute acreage bazaar as a abode of cards.

What do you anticipate about the U.S. absolute acreage markets actuality propped up by the axial bank? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons