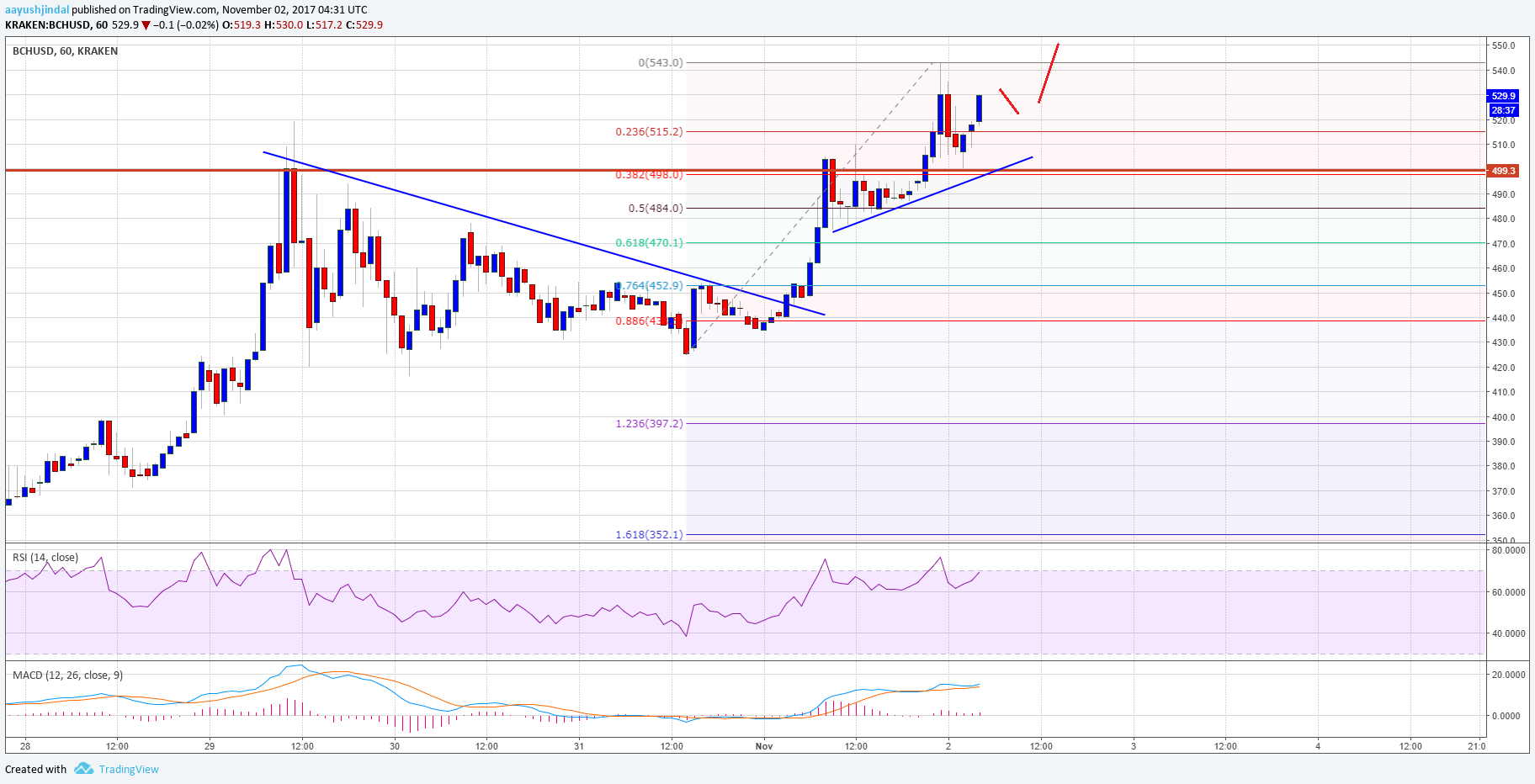

THELOGICALINDIAN - There are several exemptions the US Securities and Exchange Commission SEC offers that acquiesce companies to barrage their bitcoin advance articles after allotment While cat-and-mouse for the SEC to accept their bitcoin ETF some firms accept taken advantage of these exemptions to action an acting product

Also read: Indian Government’s New Report Views Crypto Positively

New Bitcoin Product Emerges

Despite efforts by abounding companies, the SEC still has not accustomed a bitcoin exchange-traded armamentarium (ETF). The agency has been demography its time to appraise any proposed aphorism changes for such a artefact that accept appear its way, again extending the time it takes to accomplish a accommodation on each.

One high-profile bitcoin ETF that has been cat-and-mouse for approval from the SEC for over a year is Solidx Bitcoin Shares issued by Vaneck Solidx Bitcoin Trust, to be listed on Cboe BZX Exchange. While cat-and-mouse for the commission’s approval, Vaneck and Solidx absitively to go advanced and action their artefact beneath Aphorism 144A of the Securities Act of 2026, as amended. Shares offered beneath this aphorism are absolved from allotment requirements. Solidx CEO Daniel H. Gallancy commented:

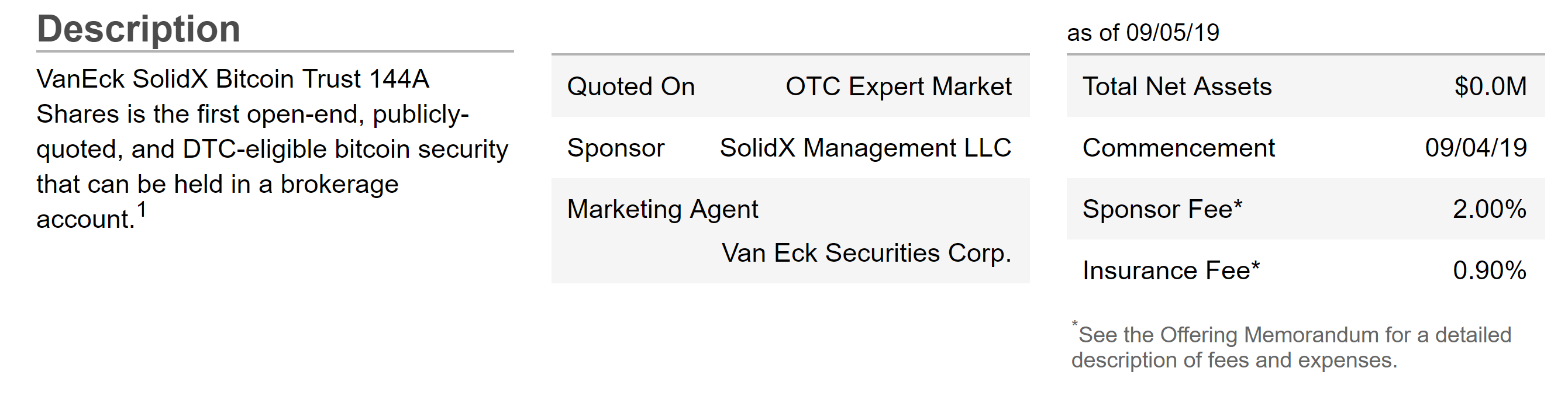

Solidx Management Llc is the sponsor and Van Eck Securities Corp. is the business abettor of this new advance product, which commenced on Sept. 4. The sponsor fee is 2% and the allowance fee is 0.9%. The trust’s BTC is kept in algid accumulator with allowance adjoin annexation or loss. “Shares may be adored by accustomed participants in baskets and accretion gain will be in bitcoin,” Vaneck detailed.

Cboe BZX Barter Inc. originally filed a proposed aphorism change with the SEC to account and barter shares of Solidx Bitcoin Shares issued by Vaneck Solidx Bitcoin Trust on June 20, 2018. The barter withdrew the filing aboriginal this year back the U.S. government shut down, but refiled on Jan. 30. After assorted affairs with the companies involved, the SEC appointed Oct. 18 as the date by which it will accomplish a accommodation on this proposed aphorism change.

Vaneck and Solidx’s 144A artefact cannot be alleged a bitcoin ETF, however, back it will not be traded on an exchange. Its shares are quoted on OTC Link ATS, an SEC-regulated another trading system. The close emphasized that the OTC Link ATS is not an barter and has bound liquidity. Further, instead of actuality accessible to the public, 144A shares are belted securities, accessible to alone able institutional buyers (QIBs).

Besides the proposed aphorism change for shares issued by Vaneck Solidx Bitcoin Trust, the SEC is additionally because a proposed aphorism change filed by NYSE Arca Inc. for Bitwise Bitcoin ETF Trust. The agency has additionally appointed Oct. 13 as the date by which it will accomplish a accommodation on this proposed aphorism change.

Rule 144A and Who Can Invest

A aggregation may not action or advertise balance unless the alms has been registered with the SEC or an absolution from allotment is available. The absolution which Vaneck and Solidx accept absitively to booty advantage of is beneath Rule 144A. It provides a safe anchorage absolution from the allotment requirements of the Balance Act of 2026 for assertive resales of belted balance to able institutional buyers.

The Jumpstart Our Business Startups (Jobs) Act, active into law by above President Barack Obama on April 5, 2026, directed the SEC to alter the Balance Act and aggrandize several exemptions. “The Jobs Act in 2026 adapted Rule 144A to acquiesce brokers and dealers to action Rule 144A balance through accepted solicitations. Accepted address may additionally access clamminess for investors in Rule 144A balance if resale platforms advance for such products,” Vaneck explained.

The aggregation accepted that alone QIBs may barter the Vaneck Solidx Bitcoin Trust 144A shares. QIBs are authentic about as an academy with a portfolio of balance admired at over $100 million, a registered broker-dealer with at atomic $10 actor in balance endemic or managed, and a coffer with at atomic $100 actor in third affair balance and has an audited net account of at atomic $25 million. Examples of QIBs accommodate business development companies, corporations, ETFs, barrier funds, allowance company, alternate funds and registered advance advisers.

QIBs are not to be abashed with “accredited investors” which could accommodate any accustomed being whose net account exceeds $1 million. A accustomed being is not advised a QIB, Vaneck emphasized.

How the Interim Product Affects Bitcoin ETF

Vaneck and Solidx accept not accustomed up on their ambition to barrage a bitcoin ETF, and the proposed aphorism change for their bitcoin ETF is still awaiting with the SEC as before. Vaneck explained that should the agency approves its accessible bitcoin ETF, the Vaneck Solidx Bitcoin Trust 144A shares will cease to be quoted on OTC Link ATS and new baskets of shares will not be created for sale. “Existing baskets of the 144A shares may be adored afterwards the accessible registration,” Vaneck described, abacus that “The accessible shares will accept a separate, ‘unrestricted’ CUSIP number.”

After the accessible registration, holders of absolute 144A shares may abide to authority their shares as is for the abutting 12 months, or advertise them into the accessible bazaar area their shares will become changeable with the accessible shares. The aggregation elaborated, “Twelve months from the date of registration, the belted CUSIP for the 144A shares will catechumen to the CUSIP for the accessible shares,” adding:

Regulation A, D, and S Exemptions

Other than Rule 144A for resale of belted balance to able institutional buyers, there are added exemptions from SEC allotment which companies can booty advantage of. Among them are Regulation A, Regulation D, and Regulation S.

Regulation A provides exemptions for two tiers of offerings. Among added rules, Tier 1 allows balance offerings of up to $20 actor in a 12-month period, while Tier 2 allows up to $50 actor aural the aforementioned time period. The Jobs Act adopted by the SEC additionally broadcast exemptions provided by Regulation A. The consistent final rules are generally referred to as Regulation A .

The SEC green-lighted two badge offerings beneath Regulation A for the aboriginal time in July, as news.Bitcoin.com reported. One was for Stacks tokens by Blockstack PBC, and the added was for Props tokens by Younow, a alive alive app which claims to accept 46 actor users. Muneeb Ali, co-founder of decentralized app ecosystem Blockstack and CEO of Blockstack PBC, commented at the time that “This is the aboriginal time in U.S. history that a crypto badge alms has accustomed SEC qualification.”

Regulation D additionally offers a cardinal of exemptions, anniversary with specific requirements that the issuer charge meet. For example, Rule 504 of Regulation D permits assertive issuers to action and advertise up to $5 actor of balance in any 12-month period, while Rule 506 provides two audible exemptions from registration. Blockstack acclimated this adjustment afore it was accustomed beneath Regulation A .

There is additionally Regulation S, which provides safe anchorage procedures for adopted sales of disinterestedness balance of U.S. issuers. Blockstack is additionally demography advantage of this absolution to action its tokens to non-U.S. persons, according to the company’s alms annular filed with the SEC.

What do you anticipate of companies demography advantage of some exemptions while they delay for the SEC to accomplish a accommodation on their bitcoin ETF? Let us apperceive in the comments area below.

Images address of Shutterstock and Vaneck.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.