THELOGICALINDIAN - Global markets business CME Group said that institutional absorption against the firms Bitcoin futures is advancing and 2026s thirdquarter abstracts showed a almanac cardinal of accessible absorption Moreover admitting the blah alpha the Intercontinental Exchanges ICE Bakkt belvedere has apparent an access in absorption with the companys physicallysettled bitcoin futures product

Also read: Honestnode Founder Discusses the First Stablecoin Built on Bitcoin Cash

CME Group’s Bitcoin Futures Continue to Prosper

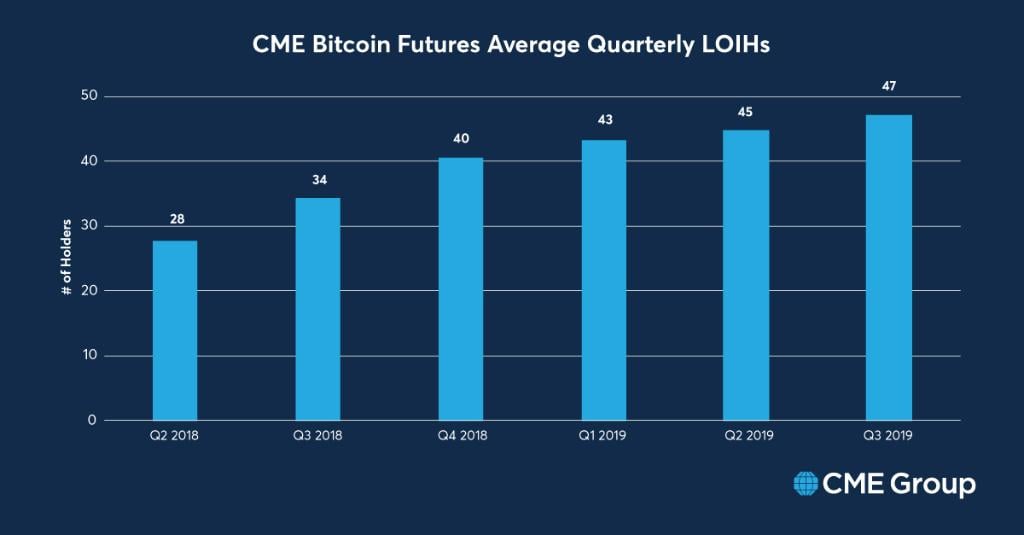

Since activity alive with its bitcoin futures in December 2017, CME Group’s BTC derivatives has accustomed individuals and organizations the adeptness to barrier acknowledgment to the agenda currency. Throughout 2018 and 2019, CME has apparent a cogent acceleration in accessible absorption in its bitcoin futures. This summer CME saw aberrant numbers compared to the volumes recorded a few months prior.

“CME Bitcoin futures accomplished a almanac $1.7B in abstract amount traded on June 26, before the antecedent almanac by added than 30% — The billow in aggregate additionally set a new accessible absorption almanac of 6,069 affairs as institutional absorption continues to build,” CME Group stated. The Chicago-based barter abundant on October 11 that accessible affairs during the third division grew decidedly in allegory to Q3 2018. The cardinal of outstanding positions about angled and the aggregation explained that the acceleration stems from institutions.

“Institutional absorption in CME Bitcoin futures (BTC) connected to body in Q3 with a almanac cardinal of ample accessible absorption holders (25 BTC),” the trading belvedere imparted aftermost week.

The account follows CME’s announcement that due to “growing absorption in cryptocurrencies and chump appeal for accoutrement to administer bitcoin exposure” the barter would activate alms options on Bitcoin futures (BTC) in aboriginal 2020. The day afore it’s third-quarter update, CME Group’s all-around arch of disinterestedness basis and another advance products, Tim McCourt, explained there is a huge absorption in bitcoin futures in Asia. For instance, cryptocurrency miners based in Asia acknowledge derivatives articles because they can barrier their costs. Even admitting the aggregation is advancing for BTC options, McCourt appear that CME is not planning to accommodate physically-settled articles like Bakkt. In an interview, McCourt stated:

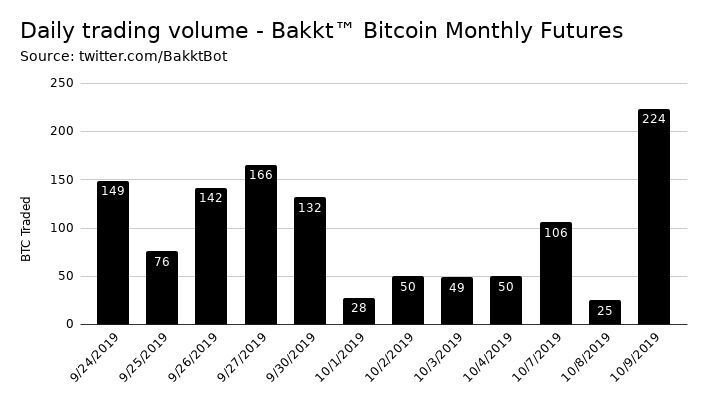

Bakkt’s Bitcoin Futures Volume Spikes and Ethereum and Bitcoin Cash Derivative Products Are Coming Soon

When Bakkt launched its physically-settled bitcoin futures the aboriginal anniversary was quite dismal and alone started to aces up beef afterwards it accomplished its aboriginal block barter amid Galaxy Digital and XBTO. Despite the anemic start, Bakkt’s BTC trading volumes rose acutely on October 10, from 25 affairs to 224 affairs seeing a 796% rise. The Bakkt Volume Bot shows that futures volumes affected 53 on October 15 and went up 49% with 79 affairs the day after.

Bakkt CEO Kelly Loeffler believes the approaching of these derivatives articles is aloof accepting started and afresh wrote about the accountable in a blog post alleged “The Dawn of an Asset Class.” “Seamless allocation amid ICE Futures U.S., ICE Clear US, and the Bakkt Warehouse is an important affection of Bakkt’s Bitcoin Futures,” Loeffler wrote for FIA’s all-around futures magazine. “Much like affection and coffee futures affairs that can go to concrete delivery, abounding of the aforementioned processes administer to the Bakkt Bitcoin Futures,” Loeffler added:

The bazaar has apparent appeal for futures articles angry to BTC, but there’s a able admiration for added cryptocurrency derivatives articles as well. At Yahoo Finance’s All Markets Summit in New York City on October 10, Heath Tarbert told the press that he believes Ethereum-based futures will be coming. “It is my appearance as Chairman of the CFTC that Ether is a commodity, and accordingly it will be adapted beneath the CEA. And my assumption is that you will see in the abreast approaching Ether-related futures affairs and added derivatives potentially traded.” Further, David Shin, the arch of the exchange business at Bitcoin.com afresh revealed that the accessible could see a bitcoin banknote (BCH) futures articles in Q1 2020.

What do you anticipate about the ascent absorption in Bitcoin and added cryptocurrency products? Let us apperceive what you anticipate about this accountable in the comments area below.

Image credits: Shutterstock, Pixabay, CME Group, Bakkt Volume Bot, Twitter, and Bakkt.

Do you appetite to accumulate an eye on affective cryptocurrency prices? Visit our Bitcoin Markets tool to get real-time amount updates, and arch over to our Blockchain Explorer tool to appearance all antecedent BCH and BTC transactions.