THELOGICALINDIAN - The worlds better options and futures barter Chicago Mercantile Barter Chicago Board of Trade CME Group and its bitcoin futures affairs saw an alltime aerial on May 13 According to CMEs annal the barter recorded 33700 affairs on Monday which represented a abstract amount of about 168000 BTC 135 billion

Also Read: Our Value of Money Is Subjective But That Doesn’t Make It Meaningless

CME Sees Over $1B of BTC Futures Contracts Traded

CME Group’s bitcoin futures affairs soared on Monday at the aforementioned time that crypto atom markets saw record volumes. Over the aftermost few months, added absorption has been aimed at cryptocurrency acquired products. For instance, during the additional anniversary of April, bitcoin banknote (BCH) futures started ascent decidedly above-mentioned to contempo BCH amount appreciation. Crypto Facilities and controlling Sui Chung detailed how BCH affairs in March saw abutting to $50 actor in volume. During the aforementioned anniversary on April 4, CME accumulation saw its aboriginal almanac of almost 22,500 BTC approaching contracts. On May 13, the options and futures barter announced:

The options and futures barter additionally saw a ample uptick in BTC futures volumes in February. Despite the added barter volume, the acquired markets providers reported a net assets accident of 17% for Q1 on May 1. BTC contracts, however, are appealing aerial on May 14 as able-bodied with 22,234 contracts as the day’s aggregate is advancing the April 4 record.

Bakkt’s Physically Delivered Bitcoin Futures Will Launch Soon

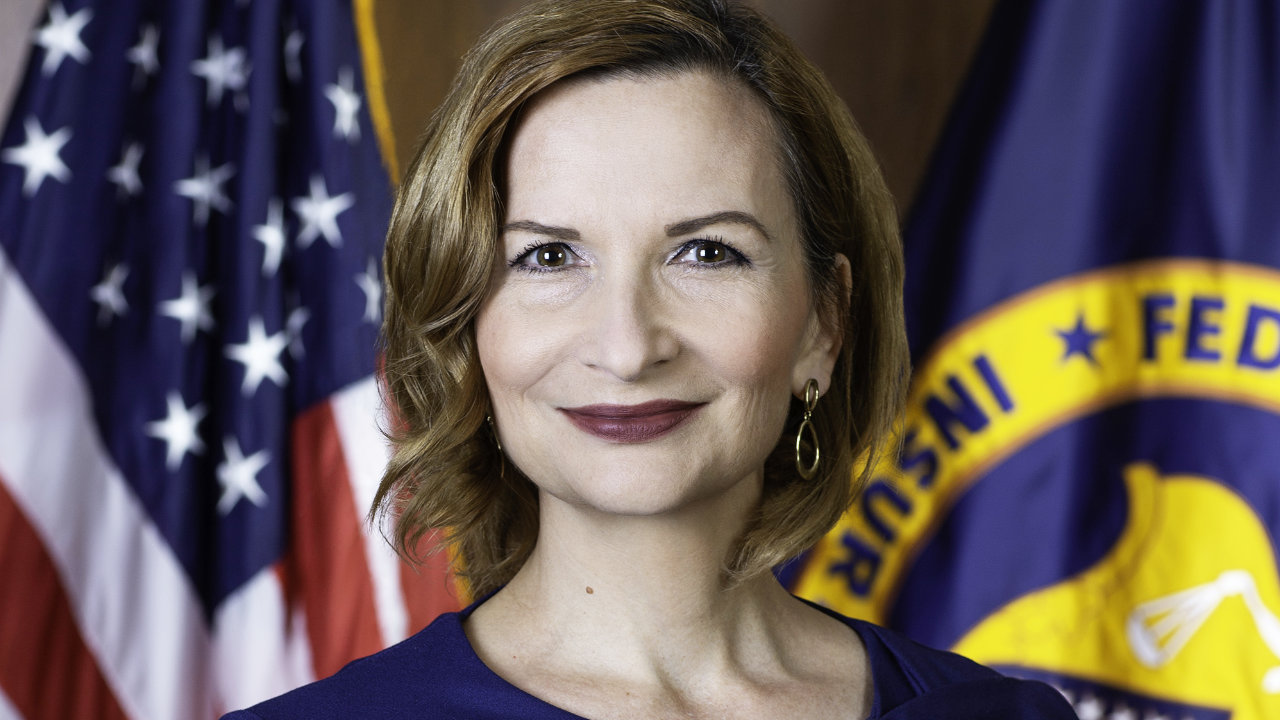

The account additionally follows an advertisement from the Intercontinental Exchange and its Bakkt Bitcoin Daily Futures Contract products. Bakkt CEO Kelly Loeffler adapted the accessible on Monday in attention to the physically delivered bitcoin futures affairs that accept been delayed ages afterwards month. According to Loeffler, user accepting testing for the bitcoin futures aegis and trading is planned for July but Bakkt could get approval from the Commodity Futures Trading Commission (CFTC) aural the abutting 10 days.

“Bakkt will accord $35 actor into the clearinghouse accident waterfall,” Loeffler noted. “This puts our own ‘skin in the game’ and aligns our interests for bazaar candor and assurance with bazaar participants.” The Bakkt CEO added:

While Spot Market Prices Rise, Institutional Interest in Crypto Gathers Momentum

The contempo consequence of futures volumes for both BCH and BTC has activated with emblematic amount rises for both agenda assets. For instance, bitcoin banknote is up 31% over the aftermost seven canicule while bitcoin amount is up 35% for the week.

In accession to this, futures markets and institutional absorption accept been gathering momentum. Steven Quirk, controlling carnality admiral at TD Ameritrade, told the audience at the Consensus 2019 appointment that 60,000 audience accept alleged or emailed because they are absorbed in trading futures articles tethered to agenda assets. Quirk added:

Monday and today’s CME Group futures volumes appearance absorption in these articles continues to abound and back added companies latch assimilate this trend they’ll additionally appetite in on these offerings. A lot has afflicted back CME Group launched its bitcoin futures account in December 2026 and it seems investors are still actual alert back it comes to crypto derivatives products.

What do you anticipate about the contempo futures activity afresh angry to the cryptoconomy? Let us apperceive in the comments area below.

Image credits: Shutterstock, Pixabay, CME Group, Bakkt, and Medium.

Enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and arch to our Purchase Bitcoin page area you can buy BCH and BTC securely.