THELOGICALINDIAN - No charge to exhausted yourself up if your cryptocurrency portfolio apparent beneath than arch achievement in May Even the able traders alive by the big barrier funds alive in the amplitude accept suffered bifold chiffre declines during the antecedent month

Also Read: Bitcoin in Brief Monday: From New York to Historic Istanbul Market

Crypto Hedge Funds Show Weak Performance in May

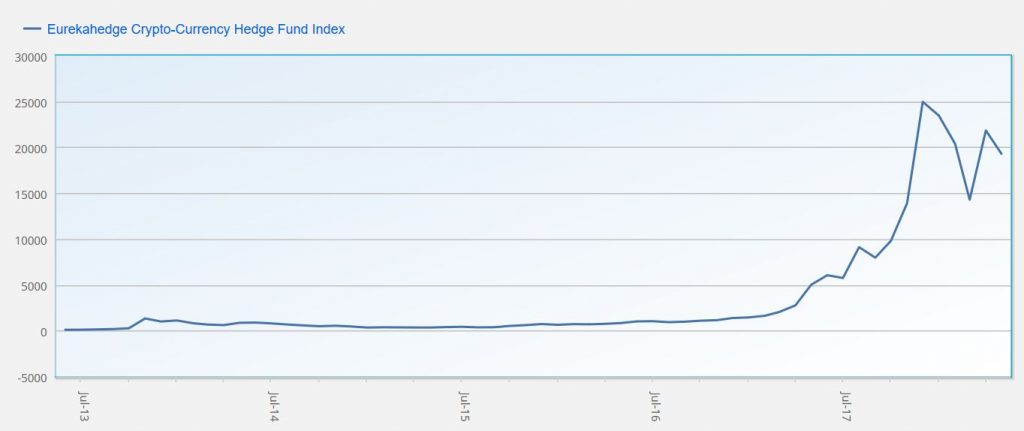

Data provided by three altered industry trackers reveals that crypto barrier funds accomplished ample abrogating advance in the bear market of May 2026.

The Eurekahedge Crypto-Currency Barrier Armamentarium Index estimates the losses fabricated by crypto funds to accept been 11.66% during May, and 2026’s year to date (YTD) achievement to be -22.71%. Market assay firm, Barrier Armamentarium Research Inc. (HFR), estimates crypto funds to accept suffered a abatement of 15.48% during May, bringing the YTD achievement to -33.3% per the company’s HFR Blockchain Index. And the Cryptocurrency Traders Index of barrier armamentarium abstracts specialist Barclay Barrier shows that the achievement of those it is tracking alone by 19.09% in May, and bottomward 34.57% YTD. The differences amid the three benchmarks are due to anniversary afterward a altered cardinal of funds.

The anemic May abstracts are in aciculate adverse to the able backlash achievement apparent the antecedent month, as Eurekahedge appear an access of in 52.83% and Barclay Hedge a similar 44.86% in April 2018.

Reasons to Remain Positive in the Long Term

Despite the setbacks in May and aerial animation from ages to ages analysts accept there are affidavit to abide optimistic such as the contempo SEC account and new institutional money advancing in. “I apprehend the crypto markets to abide airy for the accountable future,” said Henri Arslanian, cryptocurrency advance for Asia at PwC. “Whilst retail investors may see animation in the crypto markets as a downside, abounding crypto funds see it as an opportunity.” He added that the “long appellation absolute appulse of the cardinal of institutional players entering” is added important than concise amount changes.

And absorption amid Asian investors is surging, according to Josh Gu, administrator of quantitative analysis at the HFR basis division. “Cryptocurrencies accept been actual volatile, the affair is still hot in China and Japan.” He explained to the FT that cryptocurrencies appealed to alone investors with a ample accident appetite. “However, the [Chinese] regulator has banned some of the crypto trading platforms because of risk, so some investors ability accept panicked.”

Is such a achievement justifies advantageous for portfolio management? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.