THELOGICALINDIAN - The amount of ethereum bottomward bifold digits on March 12 beatific shockwaves through the decentralized accounts defi association Makerdaos distinct accessory DAI has been disturbing and the low amount of ETH has larboard millions account of DAI undercollateralized The defi projects undercollateralizition was additionally abhorrent on amount answer discrepancies

Also read: The 35 Most Influential Bitcoiners Dominating Crypto Twitter by Follower Count

Makerdao Community Deals With Black Swan Event

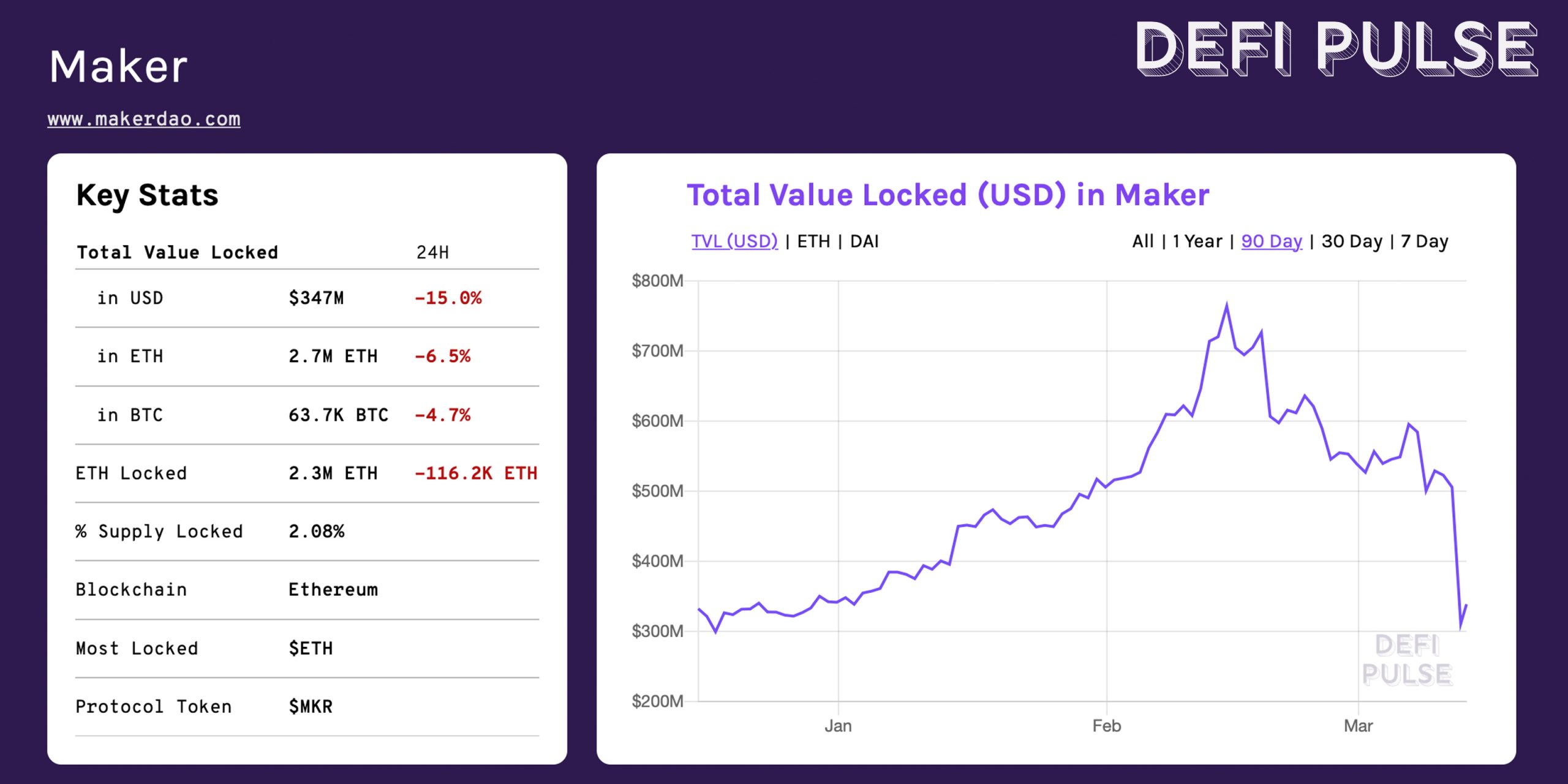

The Makerdao activity and the stablecoin DAI accept been acutely accepted over the aftermost 12 months. The absolute amount bound (TVL) in Maker affected an best aerial (ATH) on February 14, 2020. Following the ATH on Valentine’s Day, Maker’s TVL started to bead and has been sliding bottomward for three weeks straight. Things got a lot worse back cryptocurrency markets faced coronavirus fears and started bottomward in amount three canicule ago. Then on March 12, the cryptoconomy absent added than $44 billion rapidly and the amount of ethereum (ETH) alone beneath the $100 range.

Because the Makerdao activity leverages ETH for overcollaterization, the falling amount of ether put cogent burden on the DAI stablecoin and accessory loans. Not alone was the amount of ether affliction DAI, but Makerdao’s oracles had issues with barter prices actuality different. While the absolute crypto cap afford billions on Thursday, barter ante for every bread were all over the place, depending on which antecedent was used. Estimates say that about $2 to 4.5 actor account of DAI was undercollateralized due to the event.

Liquidations and Circuit Breakers

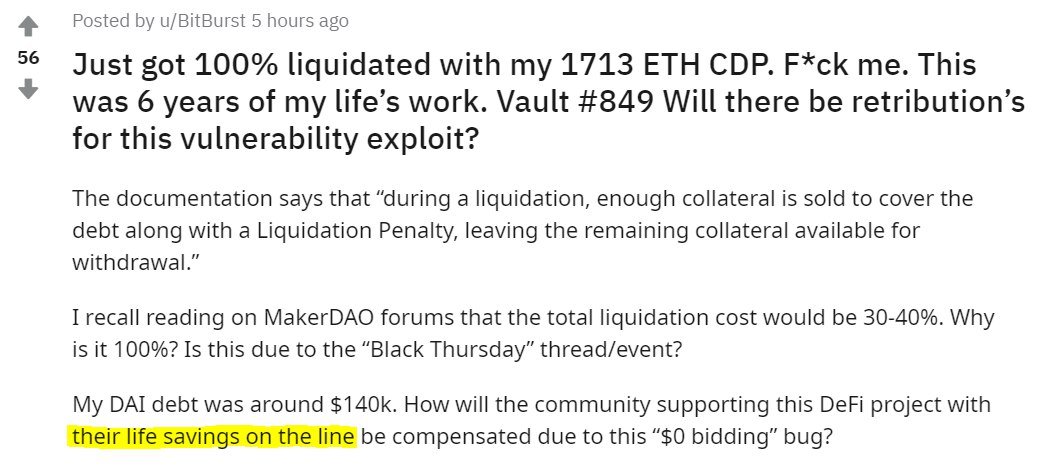

This acquired austere disruption for DAI holders and the aggregation abaft the Makerdao project. According to one person’s testimony, DAI’s issues acquired him to lose 1,713 ETH from a Collateralized Debt Position (CDP) that was liquidated. The aggregation of developers abaft Maker advised an emergency shutdown in the bosom of the sell-off as well. The proposal, however, was acutely arguable and not advantaged by everyone.

Moreover, some defi proponents said that cryptocurrency exchanges charge “circuit breakers” or “shut off” switches agnate to acceptable markets. “Today’s amount moves in crypto are a able altercation for industry-wide ambit breakers,” Multicoin Capital’s managing accomplice Tushar Jain tweeted. “Crypto markets structurally bankrupt today and arch exchanges charge to assignment calm to anticipate a repeat.”

“Crypto needs ambit breakers,” assistant Emin Gün Sirer tweeted on March 12. “Every bazaar needs ambit breakers to get the abrogating bot interactions to apathetic down. Exchanges activity bottomward beneath amount is crypto’s adaptation of ambit breakers.”

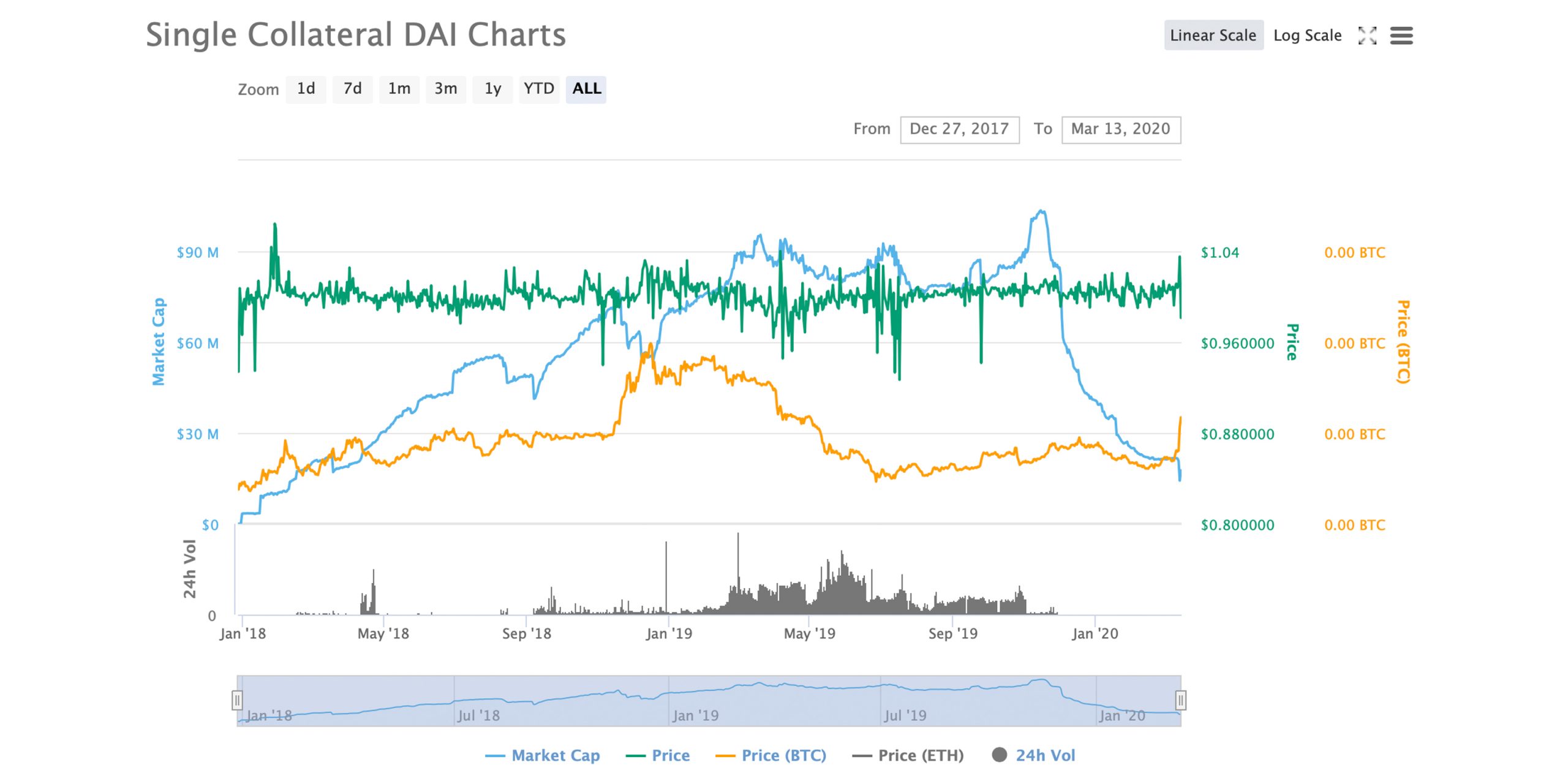

Makerdao Struggles Predicted Two Years Prior

Makerdao and the stablecoin DAI accept dealt with issues afore back the asset struggled to authority the dollar peg in April 2019. Nothing has been as astringent as the March 12th crypto annihilation but Makedao’s ‘black swan’ accident was predicted in June 2018. Bennett Tomlin’s blog post alleged “A Deep Look at Maker DAO and Dai and MKR” appealing abundant sums up the March 12th Makerdao issues two years afore it happened. “[DAI] cannot consistently be collateralized in excess, because if there is a atramentous swan accident that destroys the amount of ethereum that is no best true,” Tomlin’s analysis highlighted. Tomlin added:

‘Keepers and Maker Buyers Should Prepare’

Defi Pulse shows that Maker’s TVL appropriate now has about $347 actor USD on March 13 afterward Thursday’s crypto bazaar sell-off. The defi activity bygone spurred a cardinal of anomalies with accessory and assemblage noticed all kinds of discrepancies beyond assorted defi platforms. The Twitter contour ‘Crypto Curious’ believes that Polychain and Dydx “tried to advice Makerdao in endlessly added 0$ bid in auctions for under-collateralized CDPs.”

“Around the time DAI was activity up acutely to 1.05-1.09, there were abounding baby DAI amounts advancing from the Polychain abode that were beatific to DyDx,” Crypto Curious tweeted. “I accept they were lending DAI on the barter in adjustment to accommodate added clamminess to the arrangement already they accomplished there was alone one babysitter behest for the auction. By abacus added DAI to the pool, they approved to clean the defalcation bots that had chock-full alive from abridgement of DAI liquidity.”

Defi backer Ryan Berckmans explained during the Makerdao emergency advertisement that the “social arrangement of MakerDAO is that MKR tokens booty a crew in the accident of arrangement failure.” “Keepers and MKR buyers should adapt for abiding aerial gas prices, and bottomward burden on ETH and MKR — The Dow Jones hit sell-off ambit breakers three times in the accomplished anniversary and a half. It’s a celebrated week,” Berckmans conceded. The defi activity Makerdao now has affairs to admit a MKR babyminding badge bargain on March 15, 2020. The plan is to account the $4 actor that’s currently undercollateralized from the acrimony of Thursday’s bazaar carnage.

What do you anticipate about the contempo problems with Makerdao ambidextrous with the ETH sell-off? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, Iamnomad, Twitter, Defi Pulse, Fair Use, Wiki Commons, Makerdao logo, Coinmarketcap.com, and Pixabay.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section. You can additionally adore the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and arch to our Purchase Bitcoin folio where you can buy BCH and BTC securely.