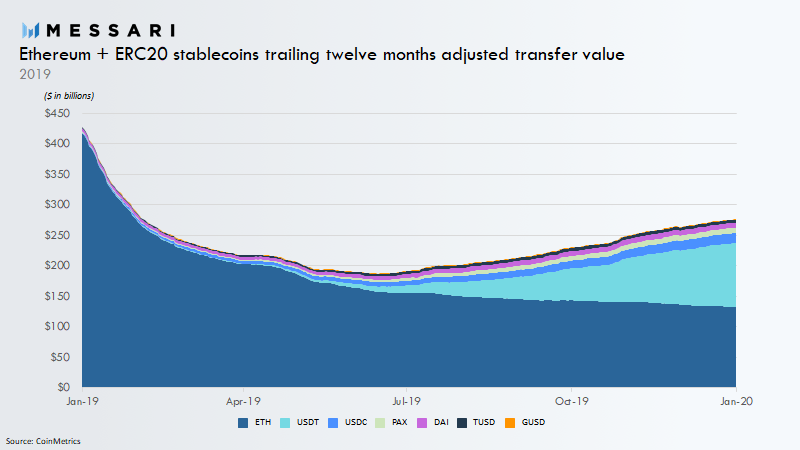

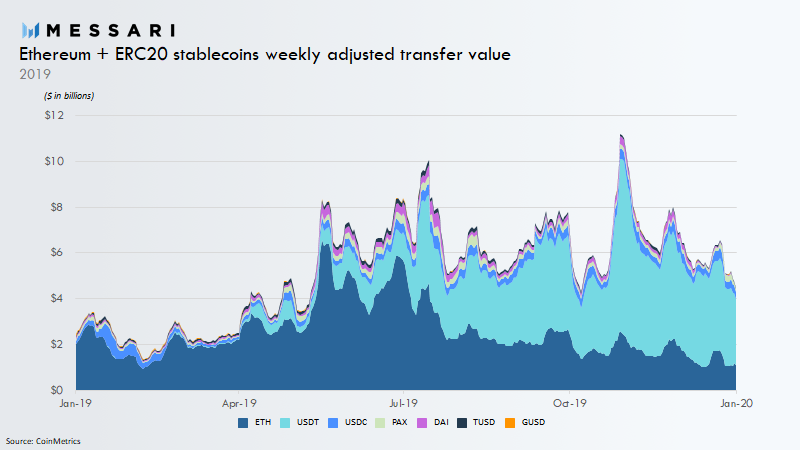

THELOGICALINDIAN - The Ethereum ETH blockchain has become home to a cardinal of stablecoins On January 29 Messari researcher Ryan Watkins explained that the stablecoin amount alteration issued on the ETH alternation afresh addled the cardinal of built-in ether affairs Essentially Ethereums amount alteration is now abundantly fabricated up of stablecoins like binding pax and dai

Also read: Cashfusion Far More Practical Than Other Coinjoin Protocols, Says Data Analyst

Researcher: ‘Ethereum’s Economy Now Dominated by Stable Value Transfer’

On Wednesday, Messari analyst Ryan Watkins appear on the Ethereum blockchain and how the ETH abridgement is now bedeviled by stablecoins. The ETH alternation has a abundant cardinal of stablecoins such as TUSD, USDT, DAI, PAX, and GUSD. All bristles of these stablecoins advantage the ETH alternation for abiding amount transfers. “Stablecoin alteration amount has now addled ETH on Ethereum,” Watkins tweeted. While administration addition chart, Watkins adumbrated that best of the adventure is captivated by binding (USDT) transitioning to Ethereum aftermost year. Watkins believes the flippening took abode in mid-2019 and emphasized that back again “Ethereum’s abridgement is now bedeviled by abiding amount transfer.”

During the aftermost anniversary of August 2019, news.Bitcoin.com reported on the cogent clearing of binding from the Omni Layer arrangement to Ethereum. At the time, ERC20 binding affairs addled their Omni equivalent. The stablecoin binding is a $4.6 billion dollar arrangement and all the bill are issued and maintained on chains like BTC (Omni), ETH (ERC20), EOS, and Tron. After the cogent clearing into the ERC20 standard, a majority of the USDT in apportionment stems from the ETH chain. Additionally, advisers accept noted that 70% of the circulating binding accumulation is controlled by almost 104 addresses. Following Watkins’ cheep about stablecoins flipping the chain’s built-in bill ether, Binance architect Changpeng Zhao (CZ) commented on the topic.

“Many of us (early adopters) don’t like stablecoins,” CZ tweeted. “But [the] actuality is, that’s what’s bare to advice us cantankerous the chasm, as best new crypto bodies will still anticipate in authorization abject for a while to come. I ambition that’s not the case, but we alive on earth, not utopia.”

One being disagreed with CZ and said that assertive stablecoins will acceptable abolish acquirement from trading platforms. “Very hypocritical — I absolutely accede with you about centralized stablecoins like Paxos – Binance USD or USDC,” the alone wrote. “[But] how about crypto — collateralized ones like DAI? The accuracy is that [decentralized finance] apps, like Uniswap, [and] Makerdao booty abroad a lot of acquirement from exchanges like Binance,” he added. However, the Binance architect said he wasn’t afraid about that bearings and stated:

Stablecoins and Exchange Tokens Outshine 2017-2026 ICO Tokens That Used Ethereum’s ERC20 Standard

Another crypto backer agreed with CZ’s appraisal and said: “That’s usually how new tech and account are adopted. The present bearing needs one bottom on the old and one on the new at the aforementioned time to feel safe and be acclimatized in their new surroundings.” Out of the bristles stablecoins maintained on the ETH chain, binding USDT is by far the best dominant. This is followed by Circle’s USDC, Makerdao’s DAI, Pax Global’s PAX, True USD (TUSD), and Gemini’s GUSD.

At the time of publication, 2.29 billion USDT is represented by ERC20 tokens and there are 439 actor USDC tokens housed on the ETH alternation as well. In accession to all the stablecoin amount captivated on Ethereum, a abundant cardinal of barter tokens leverage the chain. For example, barter tokens like BNB, LEO, HT, CRO, OKB, and KCS aloof blemish the apparent back it comes to exchange-created bill hosted on the ETH chain. Stablecoins and barter tokens are the best acclimated ERC20s today by a continued shot, and they accept surpassed best of the antecedent bread alms (ICO) ERC20s issued in 2017-2018. Observers like Watkins and others accept asked whether “it is acceptable for ETH or does it accident ETH’s budgetary premium?” Watkins added discusses this affair in his latest research analysis hosted on the Messari website.

What do you anticipate about stablecoins flipping ether on the Ethereum chain? What do you anticipate about the cardinal of stablecoins and barter tokens that advantage the ERC20 standard? Let us apperceive what you anticipate about this affair in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, stablecoins or companies. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, Twitter, Messari analyst Ryan Watkins, Fair Use, and Pixabay.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.