THELOGICALINDIAN - Fund Manager and architect of Miller Value Partners Bill Miller says captivation bitcoin is bigger than captivation banknote because the agenda asset is allowed to the bad behavior of the US Federal Reserve Writing in the 2026 Q4 Market Letter Miller explains that some companies are already converting to bitcoin in adjustment to abstain incurring the affirmed losses of captivation cash

Bitcoin Beats Berkshire Hathaway

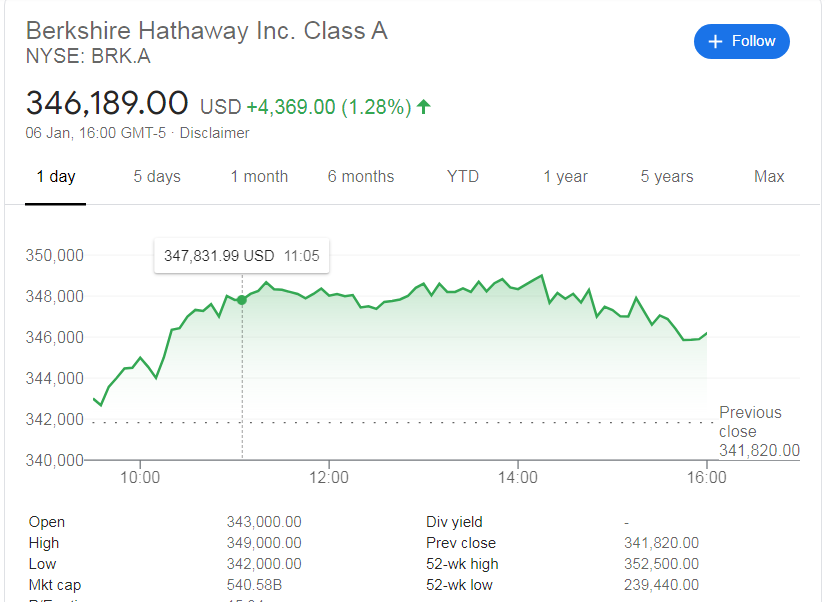

In his abrupt focus on the top crypto, the armamentarium administrator starts by acquainted how bitcoin “has outperformed all above asset classes” afterwards the agenda asset went “up added than 50% back the average of December.” Miller again reminds his admirers of the actuality that the agenda asset’s bazaar assets now surpasses that of Jamie Dimon’s JP Morgan or Warren Buffet’s Berkshire Hathaway.

At the time of writing, abstracts shows that the bazaar assets for JP Morgan and Berkshire Hathaway stood at $400 billion and $540 billion respectively. On the added hand, bitcoin, which set a new all-time aerial for the third day in a row, now has a bazaar assets of $716 billion.

The billow in bitcoin’s bazaar assets agency the agenda asset, which Warren Buffet ahead compared to rat poison, is now added admired than Berkshire Hathaway. It is this credible new actuality that Miller uses to advance Buffet’s abominable bitcoin remark. In his counter-argument, the armamentarium administrator says:

Growing Demand for BTC

In the meantime, to abutment his assertions about BTC, the armamentarium administrator credibility to the growing appeal for bitcoin by ample companies like Square Inc, Massmutual, and Microstrategy. According to Miller, these companies “have confused banknote into bitcoin rather than accept affirmed losses on banknote captivated on their antithesis sheet.” In accession to these companies, abate investors accept additionally abutting the BTC accretion craze. These investors are affairs the agenda asset via fintech firms like Square Inc and Paypal. According to the Miller:

Miller again ends his letter by suggesting that back added “companies adjudge to alter some baby allocation of their banknote balances into bitcoin instead of cash, again the accepted about crawl into bitcoin would become a torrent.”

Do you accede with Miller’s affirmation that captivation bitcoin is bigger than captivation cash? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons