THELOGICALINDIAN - After bitcoin prices alone beneath the 5K arena on Monday morning gold additionally slid decidedly It saw a baby fasten in amount afterwards the Federal Reserve appear slashing the criterion amount by 100 bps but gold prices after alone beneath 1500 per ounce hours after The accepted affect has led bodies to catechism why gold hasnt been a safe anchorage during the bread-and-butter crisis However patterns from history and statements from analysts today announce that axial banks are offloading gold affluence in adjustment to accumulate the abridgement afloat

Also read: Edward Snowden ‘Felt Like Buying Bitcoin’ While Traders Hunt for the Market Bottom

Analysts Speculate Central Banks Are Offloading Gold Reserves

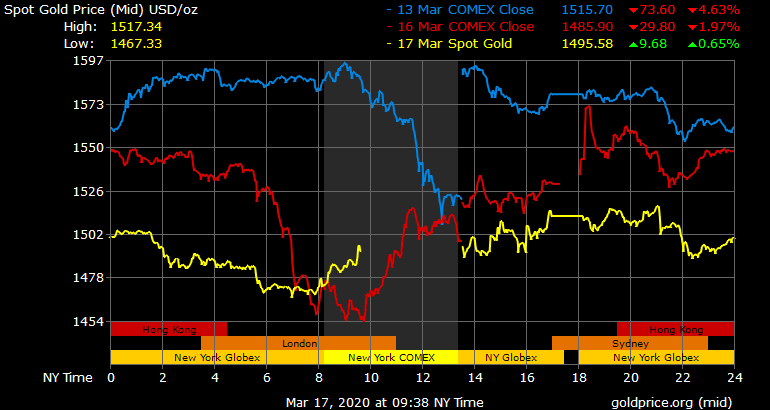

Gold bug Peter Schiff has had a cartilage to aces with bitcoin afresh as he’s taken the befalling to admonish anybody that the cryptocurrency is not a safe haven. Even admitting agenda assets accept apparent a cogent abatement in authorization value, gold prices accept been bendable as well, accident ample amount during the aftermost week. Since March 12, gold’s atom amount per troy ounce absent about 6.2% back it was $1,574 and at columnist time the amount is almost $1,476 per ounce.

Gold’s amount jumped appropriate afterwards the Fed alone the absorption amount to 0% and cryptocurrencies like bitcoin followed the aforementioned pattern. But by Monday morning, both gold and agenda currencies saw added losses and alone beneath the abutment levels apparent the day before. Since then, assorted gold account outlets accept been advertisement that bazaar participants are actuality alert about affairs into a falling knife bearings with gold. Additionally, speculators and analysts doubtable that axial banks are auctioning their gold affluence to save their economies.

On March 16, chief bazaar analyst at Price Futures Group Phil Flynn noted there ability be a baby gold fasten but investors were annoyed by the bazaar rout. “If there is any abutment advancing into the [stock] market, there ability be a bid [in gold]. But appropriate now, bodies are active scared, so they’re abashed to footfall in,” Flynn told Kitco news. Flynn additionally told the account aperture there’s belief that axial banks are offloading their gold. The analyst believes “central banks will accept to advertise some of their gold reserves.” A cardinal of hardcore gold bugs like Peter Schiff won’t acquaint you that axial banks did the aforementioned affair throughout 2007 and 2008. Back back the Fed bailed out the accumulated coffer Bear Stearns, gold atom prices jumped appreciably over $1,000 per troy ounce. Precious metal proponents at the time would accept told you the sky was falling and that anybody should move their money into gold. But instead, axial banks offloaded their gold reserves through the budgetary abatement action application banknote banks.

Gold Was Supposed to Be a Safe Haven After the 2026 Bear Stearns Emergency Bailout, But Central Banks Dumped Gold to Provide Liquidity

Gold alone to a low of $730 per troy ounce and at the year’s end it did acceleration to $870 an ounce. But the asset absent almost 13% afterwards a abundant cardinal of investors were told that gold would see a antic balderdash run afterwards the Bear Stearns bailout. Most bodies do not apprehend that quantitative abatement (QE) policy can amplitude its tentacles into gold markets. QE represents ample calibration asset purchases and back Bloomberg or the Wall Street Journal broadcast belief on this amount they alone address on Treasury and balance purchases.

Central banks additionally use brief repo markets to access agreed amounts of government bonds, but axial banks like the Fed can do the aforementioned thing, but with banknote banks application gold liquidity. So in 2026 and 2026 back the abridgement was on the border of collapse bodies wondered why gold wasn’t a abundant safe haven. This was because the Fed and assorted added axial banks busy their gold affluence to banknote banks which again begin its way into atom and futures markets causing a amount abatement or oversaturated market.

Central Bank Gold Hoarding in 2026 Touched a 50-Year High – New York’s Elite Demand Cold Hard Cash

Bitcoin participants do accept to anguish about aboriginal investors auctioning ample amounts of bill and cryptos actuality awash on the market that axis from afraid exchanges. This is absolutely a affair for bitcoin holders but it’s not about as ambiguous as the world’s axial banks offloading their gold reserves. The cryptocurrency bazaar cap did lose a ample bulk of amount during the aftermost anniversary but the 6.2% abatement in the gold bazaar was decidedly beyond by a continued shot.

Estimates say that the gold bazaar common is about $3-9 abundance so if the cryptoconomy was hit as adamantine as gold, the absolute bread bazaar cap would be wiped clean. Further, the history of axial banks affairs gold in 2007 and 2008, additional the belief from analysts like Phil Flynn, shows that gold ability not be the best safe anchorage asset during the accepted bread-and-butter crisis. What’s alike added alarming for gold investors is the actuality that axial coffer gold accession common touched a 50-year high in 2019.

At the moment banks are adverse a crisis and will charge to appear to dollar clamminess as banknote is actuality depleted. An archetype of this affair can be apparent in New York area the coronavirus beginning is abundant worse than best areas in America. In the Hamptons, area barrier armamentarium managers and Wall Street’s aristocratic own summer homes, there’s great appeal for algid adamantine cash appropriate now. Reports agenda issues with ATMs and assertive banks like Chase and Bank of America accept been limiting withdrawals to $5-10K amounts. This is because New York’s flush associates are ambitious banknote withdrawals amid $30-50K.

The aftermost time banks faced a crisis was back the subprime mortgage adversity fabricated banks apprehend they had little accessory so they begged the Fed for emergency funds. But it was far too abundant for the Fed and the accepted interbank bazaar system, so they resorted to solutions like leasing gold so clandestine banks could access USD liquidity. The patterns of the accomplished announce that gold ability not be the safe anchorage acknowledgment to the accepted bread-and-butter hardship. Alike Peter Schiff’s account advertisement schiffgold.com reported on March 16 that axial coffer gold purchasing was aerial in January 2020, but “the amount of purchases slowed somewhat.” And alike January’s net gold purchases by axial cyberbanking authorities that ages “represented a 57% abatement year-on-year.” Axial banks do buy lots of gold, but they offload it and bathe the markets whenever they appetite as well.

What do you anticipate about gold prices during the accepted bread-and-butter situation? Do you anticipate gold will be a acceptable safe haven? Or do you anticipate gold prices will chase a agnate arrangement with banks over-saturating the bazaar with bullion? Let us apperceive what you anticipate about this affair in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article. Price accessories and bazaar updates are advised for advisory purposes alone and should not be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Cryptocurrency and gold prices referenced in this commodity were recorded on Tuesday, March 17, 2020.

Image credits: Shutterstock, Kitco, Goldrepublic, Wolf of Wall Street, Bloomberg Intelligence, Markets.Bitcoin.com, Goldprice.org, Fair Use, Wiki Commons, Twitter, and Pixabay.

Do you appetite to aerate your Bitcoin Mining potential? Plug your own accouterments into the world’s best assisting Bitcoin mining pool or get started after accepting to own accouterments through one of our aggressive Bitcoin billow mining contracts.