THELOGICALINDIAN - The agenda bill asset administrator Grayscale told investors on Thursday that the close has about filed a Registration Statement on Form 10 with the Securities and Exchange Commission SEC for the companys Ethereum Trust

The contempo filing is autonomous and if the SEC approves the registration, the Ethereum Trust will be the additional crypto asset advance agent to access the cachet of a advertisement aggregation by the SEC.

Established in 2013 by Digital Currency Group, Grayscale Investments has been about for absolutely some time now. The close manages a cardinal of advance cartage that acquiesce investors to accretion acknowledgment to crypto assets like bitcoin, bitcoin cash, ether, horizen, XRP, zcash, ethereum classic, litecoin, and stellar.

In September 2026, Grayscale alien the Bitcoin Investment Assurance which originally was alone accessible to accepted investors. Then the assurance got the Financial Industry Regulatory Authority’s (FINRA) approval and Grayscale was accustomed to action shares publicly.

Then on January 21, 2026, the Bitcoin Assurance had its shares registered with the SEC and it was the aboriginal crypto-based assurance to access a advertisement cachet from the SEC. On Thursday, Grayscale told investors that it was attempting to get the Ethereum Assurance accustomed with the Commission as well.

“If the Registration Statement becomes effective, it would baptize Grayscale Ethereum Trust as the additional agenda bill advance agent to attain the cachet of a advertisement aggregation by the SEC, afterward Grayscale Bitcoin Trust as the first,” Grayscale acclaimed in an investor’s email. Grayscale added:

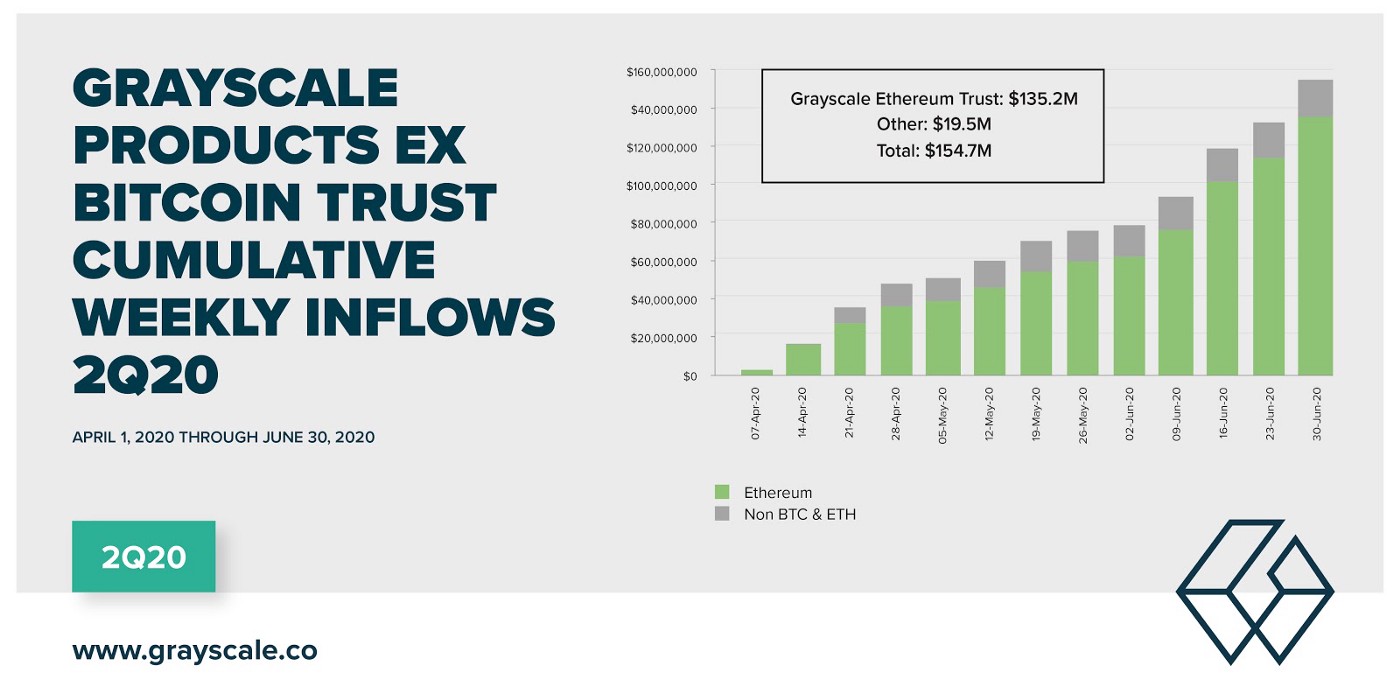

In an announcement post on Medium, Grayscale said that Q2 2020 statistics appearance that advance into the Grayscale Ethereum Trust hit $10.4 million. “In fact, appeal for Grayscale Ethereum Trust accounted for about 15% of absolute inflows into Grayscale articles during our better division yet,” the aggregation said. Grayscale’s filing advertisement continued:

Both the Medium blog column advertisement and the email to investors says that the close charge accent that the filing is absolutely voluntary.

However, Grayscale does not appetite the contempo Ethereum Trust filing to be abashed as an “effort to allocate the Trust as an exchange-traded armamentarium (ETF).”

Grayscale’s Allotment Statement attack follows the recent approval by FINRA for the company’s advance vehicles, the Litecoin Trust and the Bitcoin Cash Trust. After the Ethereum Trust allotment announcement, Digital Currency Group architect Barry Silbert tweeted that the attack is a “milestone.”

What do you anticipate about Grayscale’s Ethereum Trust registering with the SEC? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Grayscale Investments