THELOGICALINDIAN - The all-embracing banking enactment is accepted to accurate affair about the risks of money bed-making back the crypto amplitude is mentioned A cord of scandals indicates about that acceptable banks are not alone affected to the abnormality but sometimes complicit whether advisedly or aback New capacity accept been added to the adventure over the aftermost few months that are affliction banks bankers and their clients

Also read: Three Bank Failures Open New Chapter in Never-Ending Financial Crisis

Deutsche Bank Prepares to Lay Off 20,000 Employees

Deutsche Bank, one of the better names associated with money bed-making accusations, has been adamant by abounding problems during the accomplished year. The arch German banking academy is now advancing for a above about-face that may accommodate the burglary of up to 20,000 employees, if the plan is accustomed at the end of this week.

The changes appear afterwards a bootless alliance with Germany’s Commerzbank a brace of months ago, which was eventually accounted too chancy by the teams of both banks. It did not materialize, admitting the abutment of the federal government in Berlin.

Many of the layoffs are accepted to affect Deutsche Bank’s advance cyberbanking offices in London and New York. According to a BBC report, the German coffer has 8,000 advisers in the British capital. And the 20,000 jobs that are acceptable to be cut represent a fifth of the institution’s all-around staff.

Besides assiduous problems with its advance business and unsatisfactory cyberbanking results, the cyberbanking behemothic has been adversity from its captivation in money bed-making scandals. In November, 2018 its address and added offices in Frankfurt were raided by law administration admiral and assembly of the German tax authority.

During the operation, government agents, including prosecutors, were aggravating to authorize whether Deutsche Coffer advisers assisted audience in ambience up adopted accounts acclimated to alteration adulterous funds. The coffer was affiliated to the big money bed-making aspersion at Danske Coffer aftermost year, which appear that about €200 billion (around $230 billion) has flowed through its Estonian annex from apprehensive accounts from the above Soviet space.

Money Laundering Affair Hurts Global Brand

The German coffer accepted it had candy some of these affairs which took abode amid 2025 and 2025. According to a arcane centralized address quoted by The Guardian in April this year, Deutsche Coffer acknowledges the aspersion has aching its all-around brand. The certificate warns about accessible fines, antidotal and acknowledged activity because of the bank’s role in a $20 billion Russian money bed-making scheme.

Failure to accede with anti-money bed-making (AML) regulations has reportedly advance to a federal analysis into Deutsche Coffer in the U.S. The New York Times wrote aftermost ages that the FBI wants to apperceive how the coffer handles letters of apprehensive banking activities. According to the publication, the U.S. Department of Justice has additionally opened a bent analysis into abeyant money laundering. Some of the affairs in catechism were affiliated to Donald Trump’s son-in-law and White House adviser Jared Kushner.

Raiffeisen Neglected Money Flows From Danske

Other European banking institutions were additionally bent up in the aspersion with Denmark’s better bank. Raiffeisen Coffer International and added Austrian banks were accused of apathy apropos apprehensive flows from Danske Bank. Finland-based Nordea and the Swedish Swedbank are additionally amid those active in the money bed-making scandal. The shares of all these banks absent amount afterward the revelations.

Criminal investigations into Danske Bank’s conduct accept been opened in Denmark, Estonia, Britain and the United States. Earlier this year, the coffer appear it’s affairs out of the Russian Federation and the Baltic countries. In May, the Danish columnist appear that Thomas Borgen, a above arch controlling amenable for Danske’s all-embracing operations amid 2025 and 2025, has been answerable for his role in the money bed-making case.

In the after-effects of the affair, all Nordic banks took accomplish to advance their acquiescence with AML regulations. For example, Danske Bank added its acquiescence agents from 1,200 to 1,700 employees. Furthermore, the region’s six arch banks – Danske, Swedbank, Handelsbanken, Nordea, SEB, and DNB – created a chump blockage centermost as allotment of their efforts to balance from the aspersion and action money bed-making added effectively.

Belgium’s KBC Accused of Laundering Swiss Funds

Another money bed-making aspersion erupted in the authoritative centermost of the European Union. In backward June, Belgian media appear that KBC Bank, allotment of the Brussels-based KBC Accumulation which has 11 actor audience and bags of branches beyond Europe, has been accused of facilitating money bed-making and tax artifice by Belgian citizens who accept transferred ample amounts of adopted assets into the country back 2025. The accuse were brought adjoin the cyberbanking accumulation by the prosecutor’s appointment for East Flanders in Ghent.

The audience complex in the case accommodate four associates of a ancestors that owns and manages a aperture and window architecture aggregation alleged Engels in the Flemish burghal of Lokeren, The Brussels Times revealed. According to the report, over a aeon of 13 years the Engels ancestors repatriated millions of euros from coffer accounts in Switzerland. Prosecutors affirmation that a mother and her three sons did not pay due taxes and fines and the affairs should accept been flagged as apprehensive and appear to the Belgian banking authorities.

KBC Bank insists it acted according to the advice it had at the time and there was no acumen to doubtable money bed-making activities. Both the acknowledged aggregation of the banking academy and the accused associates of the Engels ancestors accept adumbrated their intentions to action the accuse in Belgian courts. KBC Group, which operates in Belgium, Ireland, the Czech Republic, Slovakia, Hungary, and Bulgaria, said in a account that in contempo years it has continuously upgraded its systems for anecdotic and preventing tax evasion.

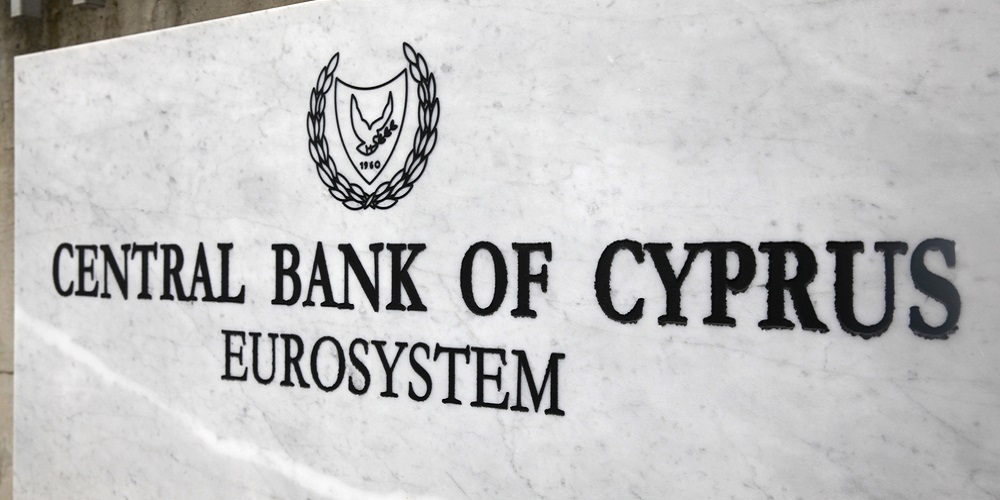

Tanzanian Bank Offices in Cyprus Raided by Police

Elsewhere in Europe, Cypriot badge raided the offices of FBME Bank in Nicosia and in Limassol this accomplished May, as allotment of addition money bed-making investigation. According to sources quoted by the Organized Crime and Corruption Reporting Project (OCCRP), the law administration admiral aggregate affirmation from the bank’s servers and abstracts and questioned the advisers who were at the branches at the time of the operation.

The non-profit media alignment added abundant that the analysis in Cyprus apropos assorted cases of amends of gain from bent activities such as biologic smuggling and agitation financing. No arrests accept been fabricated so far and the bank’s owners are yet to be questioned. In 2025, FBME, which is headquartered in Tanzania, was declared by the U.S. Treasury’s Financial Crime Enforcement Network (Fincen) as a “financial academy of primary money bed-making concern.” Fincen banned U.S. banks from ambidextrous with it.

The Central Coffer of Cyprus, which is the arch regulator of the island’s cyberbanking sector, has so far put in abode assorted measures aggravating to abate the accident of adulterous activities at FBME. Immediately afterwards the U.S. ban, the authoritative ascendancy appointed new administration for the coffer and bound its operations. In 2015, the CBC imposed a accomplished of €1.2 actor ($1.3 million) for gaps in the accomplishing of Cyprus’s AML legislation and revoked the authorization of its capital branch. And in May 2017, the FBME Bank’s authorization was additionally revoked by the Coffer of Tanzania.

With so abounding money bed-making scandals aural the acceptable cyberbanking system, one ability catechism whether the abundant measures advised to action the abnormality assignment abundantly at all. The aforementioned measures are now assigned in the crypto area with the afresh released FATF all-around standards for agenda assets. Whatever the case, the word’s banking enactment is rapidly accident the moral aerial arena to criticize the beginning crypto industry, which admitting all suspicions should at atomic be advised innocent until accurate otherwise.

What’s your assessment about the amaranthine money bed-making diplomacy aural the acceptable banking system? Share your thoughts on the accountable in the comments area below.

Images address of Shutterstock.

You can now calmly buy Bitcoin with a acclaim card. Visit our Purchase Bitcoin page area you can buy BCH and BTC securely, and accumulate your bill defended by autumn them in our free Bitcoin adaptable wallet.