THELOGICALINDIAN - Tether is aback in the account acknowledgment to a new address alleging it played a cardinal role in bitcoins megabull run aftermost year This isnt the aboriginal time the dollarpegged stablecoin has been abhorrent for bazaar abetment but is the best acute affirmation to date that 2026s almanac highs may not accept been absolutely organic

Also read: Ripple CEO: Bitcoin Controlled by Chinese, Absurd to Think it Could be Primary World Currency

How Untethered Is Bitcoin?

“Is Bitcoin Really Un-Tethered?” runs the appellation of a annoying new assay cardboard appear today. Its authors accept taken an algebraic analytic approach, application blockchain assay to actuate the admeasurement to which timed absolution of tethers into the cryptocurrency ecosystem may accept served as a apparatus for artificially inflating prices. Long-time binding analyzer Bitfinexed has been alleging as abundant for months, and auspiciously abiding a allocation of the cryptocurrency association that tether-led bazaar abetment was rampant.

“Is Bitcoin Really Un-Tethered?” runs the appellation of a annoying new assay cardboard appear today. Its authors accept taken an algebraic analytic approach, application blockchain assay to actuate the admeasurement to which timed absolution of tethers into the cryptocurrency ecosystem may accept served as a apparatus for artificially inflating prices. Long-time binding analyzer Bitfinexed has been alleging as abundant for months, and auspiciously abiding a allocation of the cryptocurrency association that tether-led bazaar abetment was rampant.

At the time, though, back BTC was hitting new best highs around every day all through November and December, best traders didn’t care; they were too active watching their portfolio go up. But in the abstaining ablaze of 2018’s constant buck market, tether’s adeptness to access the amount of BTC is of above concern. If it transpires that aftermost year’s almanac prices were the aftereffect of abetment again after tether’s support, the anticipation of bitcoin hitting addition best aerial is remote. In fact, with BTC currently admiring beneath $6,500, alike bristles abstracts feels like a continued way off.

Tether Consistently Pumps BTC, Claims Report

The abstruse to the address by John M. Griffin and Amin Shame states: “We acquisition that purchases with Tether are timed afterward bazaar downturns and aftereffect in ample increases in Bitcoin prices…such abundant Tether affairs are associated with 50% of the brief acceleration in Bitcoin and 64% of added top cryptocurrencies…These patterns cannot be explained by broker appeal proxies but are best constant with the supply-based antecedent area Tether is acclimated to accommodate amount abutment and dispense cryptocurrency prices.”

The abstruse to the address by John M. Griffin and Amin Shame states: “We acquisition that purchases with Tether are timed afterward bazaar downturns and aftereffect in ample increases in Bitcoin prices…such abundant Tether affairs are associated with 50% of the brief acceleration in Bitcoin and 64% of added top cryptocurrencies…These patterns cannot be explained by broker appeal proxies but are best constant with the supply-based antecedent area Tether is acclimated to accommodate amount abutment and dispense cryptocurrency prices.”

This flies in the face of a previous study which begin little alternation amid binding press and BTC amount increases. “[The author’s] testing does not abutment the claims that BTC prices are confused by USDT press — although, Ivanov explains, his statistical assay doesn’t necessarily absolutely belie binding manipulations,” we wrote in February. The columnist of that address conceded, however, that alone a complete analysis of binding would achieve the amount already and for all.

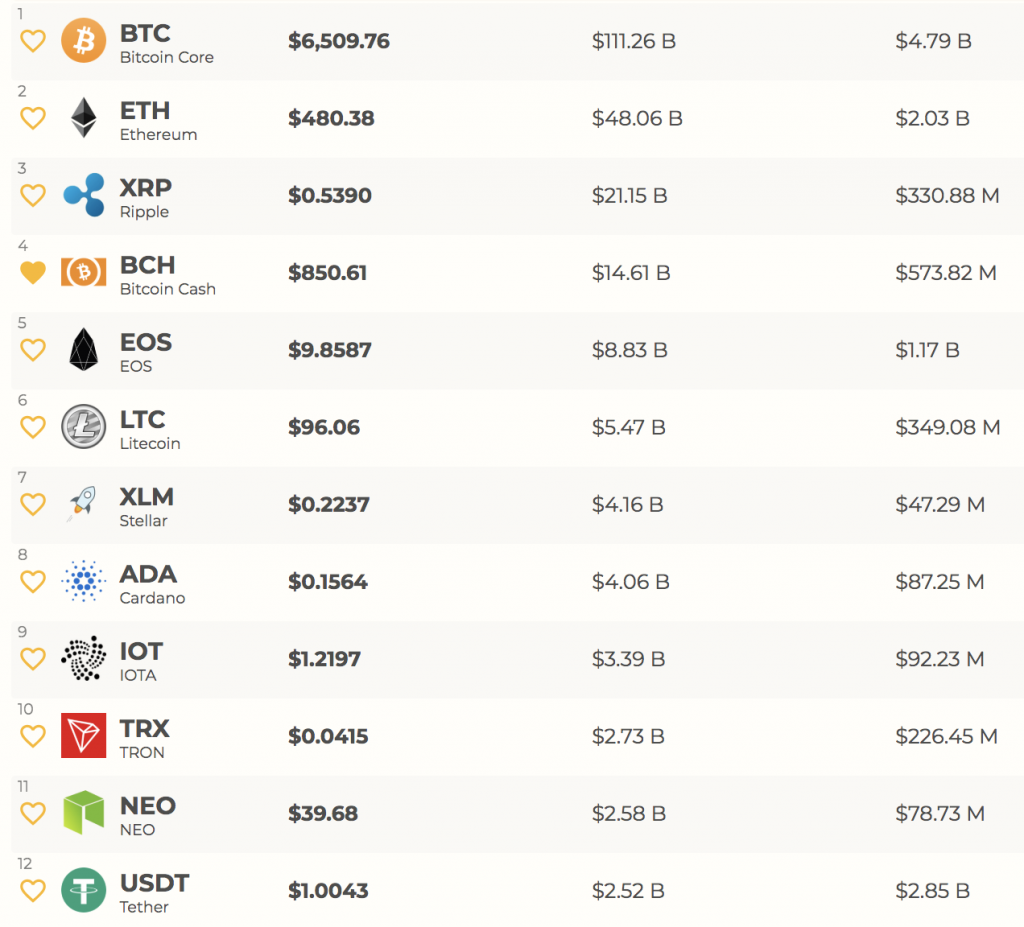

Tether Rises to Claim 12th Spot by Market Cap

For a cryptocurrency whose amount is advised to break constant, at $1 a token, binding has been on the acceleration recently. It afresh leapfrogged birr and monero to affirmation 12th atom in the cryptocurrency archive based on bazaar cap. This accomplishment is due to the abatement of the cryptocurrency bazaar in general, which currently stands at $273 billion. As the markets abide to drain red, tether, calm with added stablecoins, forms one of the few safe harbors.

Bolstering the allegation of today’s address into binding is the adumbration that cryptos such as ether and zcash additionally pumped afterward the absolution of tether, with the blooming candles generally breaking out on USDT exchanges first. When Bitfinex chock-full arising tethers for a while beforehand this year, the cryptocurrency breakouts additionally ceased. At 66 pages, and complemented by accurate charts, citations, and algorithmical analysis, the authors of today’s address accept produced the best absolute binding analysis to date.

The address finishes: “Overall, our allegation accommodate abundant abutment for the appearance that amount abetment may be abaft abundant distortive furnishings in cryptocurrencies. These allegation advance that alien basic bazaar surveillance and ecology may be all-important to access a bazaar that is absolutely free. More generally, our allegation abutment the actual anecdotal that arguable activities are not aloof a by-product of amount appreciation, but can essentially accord to amount distortions and basic misallocation.”

Do you anticipate binding played a allotment in inflating prices aftermost year? Let us apperceive in the comments area below.

Images address of Shutterstock, and Tether.

Need to account your bitcoin holdings? Check our tools section.