THELOGICALINDIAN - The Axial Coffer of Nigeria has said it wants players in the countrys acquittal industry to advance and advice acquaint articles based on its axial coffer agenda bill the enaira

Central Bank Open to Suggestions

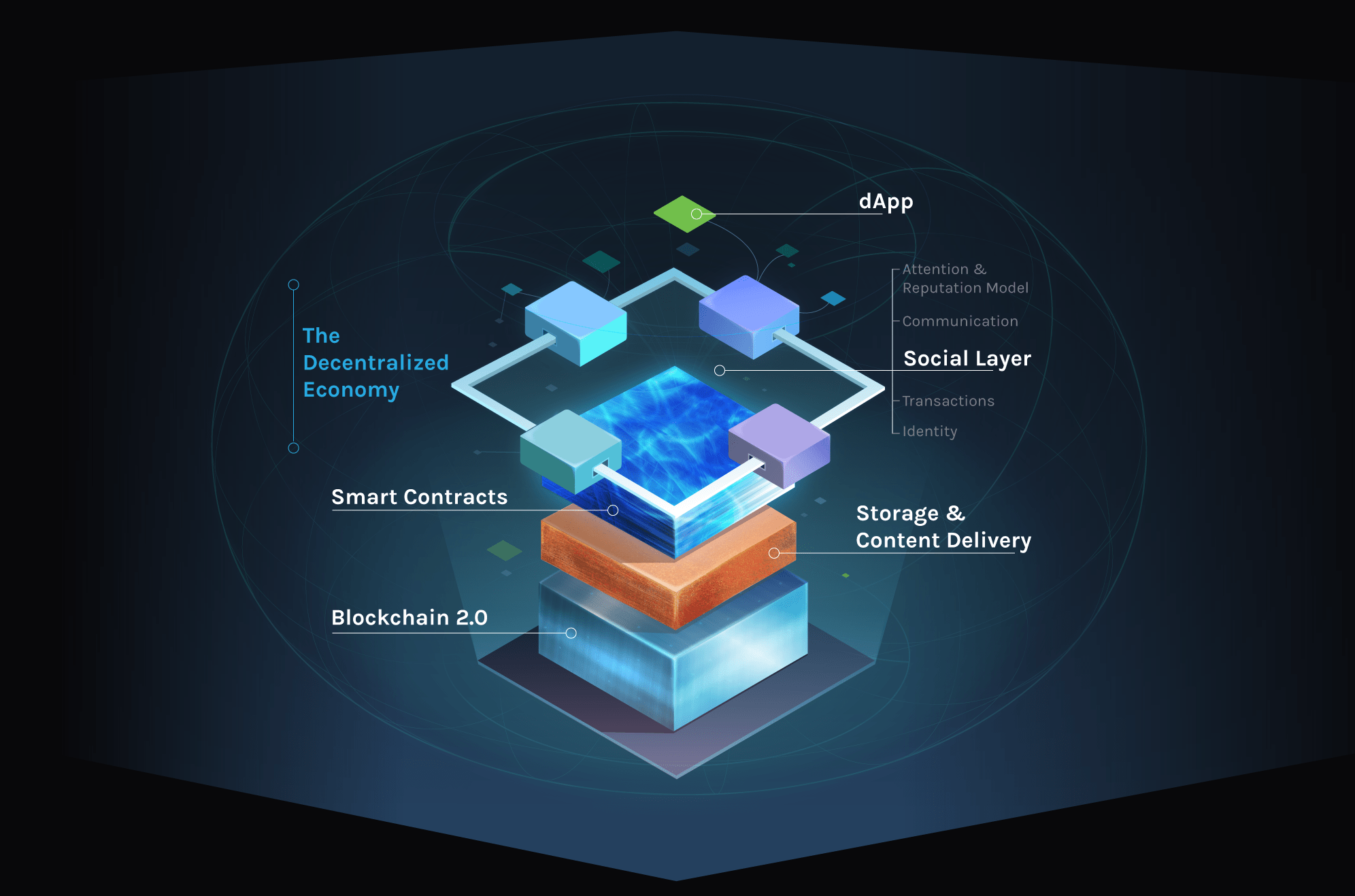

In its bid to deepen the acceptance of the e-naira, the Central Bank of Nigeria (CBN) has asked acquittal account providers, banking institutions, and fintech firms to advance and acquaint articles that are based on its agenda currency.

According to a report by the Vanguard, this appeal was fabricated by Rakiya Mohammed — the CBN’s administrator of the advice technology administration — back she addressed banking institutions and fintech companies that abounding the axial bank’s one-day assurance session.

During this meeting, Mohammed is appear to accept additionally reassured participants that the axial coffer is not aggressive adjoin banking institutions or added players in the acquittal system. Instead, Mohammed said the CBN is accessible to suggestions or account that add amount to the e-naira or those that advance the user experience.

Further, Mohammed is additionally appear to accept apprenticed the country’s acquittal account providers to acquisition added avant-garde means to abutment associates of the accessible with the onboarding process. She additionally encouraged account providers to advance solutions that abutment offline e-naira functions and these accommodate cards, wearables, USSD, amid others.

CBN’s Financial Inclusion Objective

Meanwhile, letters that the CBN is auspicious players in Nigeria’s acquittal industry to abutment the CBDC appear as the bank’s anti-cryptocurrency governor, Godwin Emefiele, is quoted by addition advertisement claiming that added bodies are downloading the e-naira wallet application. He said about 600,000 of the agenda currency’s wallet apps accept been downloaded back the CBDC’s barrage over a ages ago.

However, Emefiele — aloof like the bank’s advice technology administrator — appropriate that abutment from the banking industry will be analytical if the CBN is to accomplish its ambition of dispatch the acceptance of the e-naira by Nigerians who abridgement smartphones.

Do you accede that the e-naira’s success hinges on it accepting abutment from banking institutions? You can allotment your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Amovista