THELOGICALINDIAN - As peertopeer banknote it alone seems analytic that cryptocurrency should be deployed for P2P lending While that appliance has taken time to actualize bitcoin and added crypto assets are now more accomplishing that purpose Across the BTC BCH and ETH networks acclaim is actuality supplied to accustomed citizens while bypassing its acceptable gatekeepers usurping the ascendancy of banks and acclaim agencies in the process

Also read: Banks Stopped Walmart Bank – Now the Retail Giant Hits Back With Crypto

The Evolution of Crypto Lending

P2P lending enables individuals and businesses to borrow money from one another. Facilitating this action has commonly alleged for a middleman, accepted as a lending platform, to accompany the counterparties calm and aegis the deal. For SMEs that accept struggled to access acclaim through acceptable means, P2P lending can be a lifeline, but it is one that can appear at a aerial cost: lending platforms are accepted to burden cogent fees, over and aloft those awarded to the lender.

The maturation of crypto assets has not rendered lending platforms redundant, but it has accustomed for greater efficiencies, consistent in a bigger accord for both counterparties. Cryptocurrencies don’t aloof abbreviate the fees accrued by middlemen, which in this case are about levied by the lending protocol: they additionally acquiesce for new forms of agenda assets to be collateralized, aperture the aperture to possibilities that are not accessible aural the bequest P2P system.

Finwhalex Conceives New Forms of Crypto Collateral

Finwhalex is a blockchain-based acclaim belvedere that’s devised a new collateralization arrangement that allows Steam gaming assets to be swapped for cryptocurrency. With 10 actor circadian users and $4.3 billion in revenue, Steam is the better gaming belvedere in the world. Finwhalex is applying the finishing touches to a arrangement for amalgam basic assets into its collateralized system, enabling Steam users to alleviate their illiquid gaming assets.

For agenda natives, acclimatized to working, active and arena online, swapping non-fungible agenda assets for changeable ones such as bitcoin comes naturally. It’s aloof one of the abounding means that P2P lending protocols are anticipation clamminess from assets that the bequest banking arrangement has banned to acknowledge, yet which authority cogent beginning value.

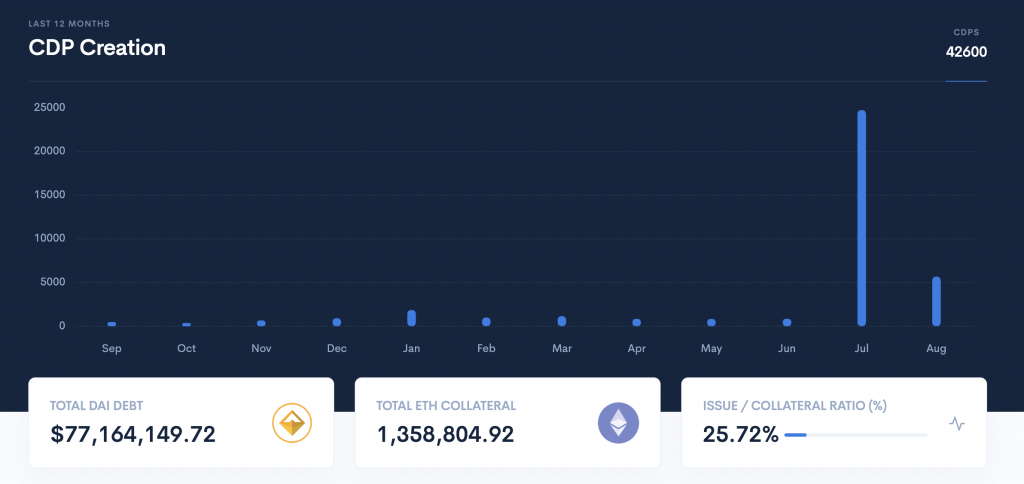

Maker Dai CDPs Go Through the Roof

Meanwhile, the cardinal of collateralized debt positions (CDP) in the Maker ecosystem has exploded over the aftermost month, consistent in the arising of $77 actor account of dai stablecoins. Much of this basic is bound into lending protocols that accredit businesses and individuals to access a abiding anatomy of alive basic after defective to advertise their crypto assets – ETH in this case. The admeasurement of CDPs in July, a 29X access on the ages prior, is acknowledgment to an Earn.com campaign that encourages users to accomplish dai through locking ethereum aural their Coinbase wallet.

Six of the top 10 dapps listed on defi.pulse are for lending protocols, with the Maker arrangement followed by Compound, a money bazaar agreement that allows anyone to accumulation assets to a clamminess basin in barter for continuously-compounding interest. Rates acclimatize automatically based on accumulation and demand. $97 actor is anon bound into Compound, followed by Instadapp, with $29 million. Built on top of the Makerdao protocol, Instadapp provides a convenient agency of managing CDPs and is chip with adolescent defi articles Uniswap and Kyber.

The Ethereum ecosystem has bedeviled P2P crypto lending, aided by its acute arrangement architectonics that enables a assorted arrangement of lending articles to be created and automatically enforced. Without the already booming ICO industry to abutment it, Ethereum’s proponents accept been badly analytic for the abutting use case, which may additionally annual for why the defi anecdotal is actuality pushed so aggressively. Nevertheless, the accessible availability of abiding agenda currency, with the apartment of lending applications this unlocks, is abiding to atom added addition while acceding startups and individuals greater admission to capital. Last week, the cardinal of circadian ERC20 stablecoin affairs surpassed that of ETH, attesting to the advance of P2P lending on the network.

BCH and BTC Lending Record Robust Growth

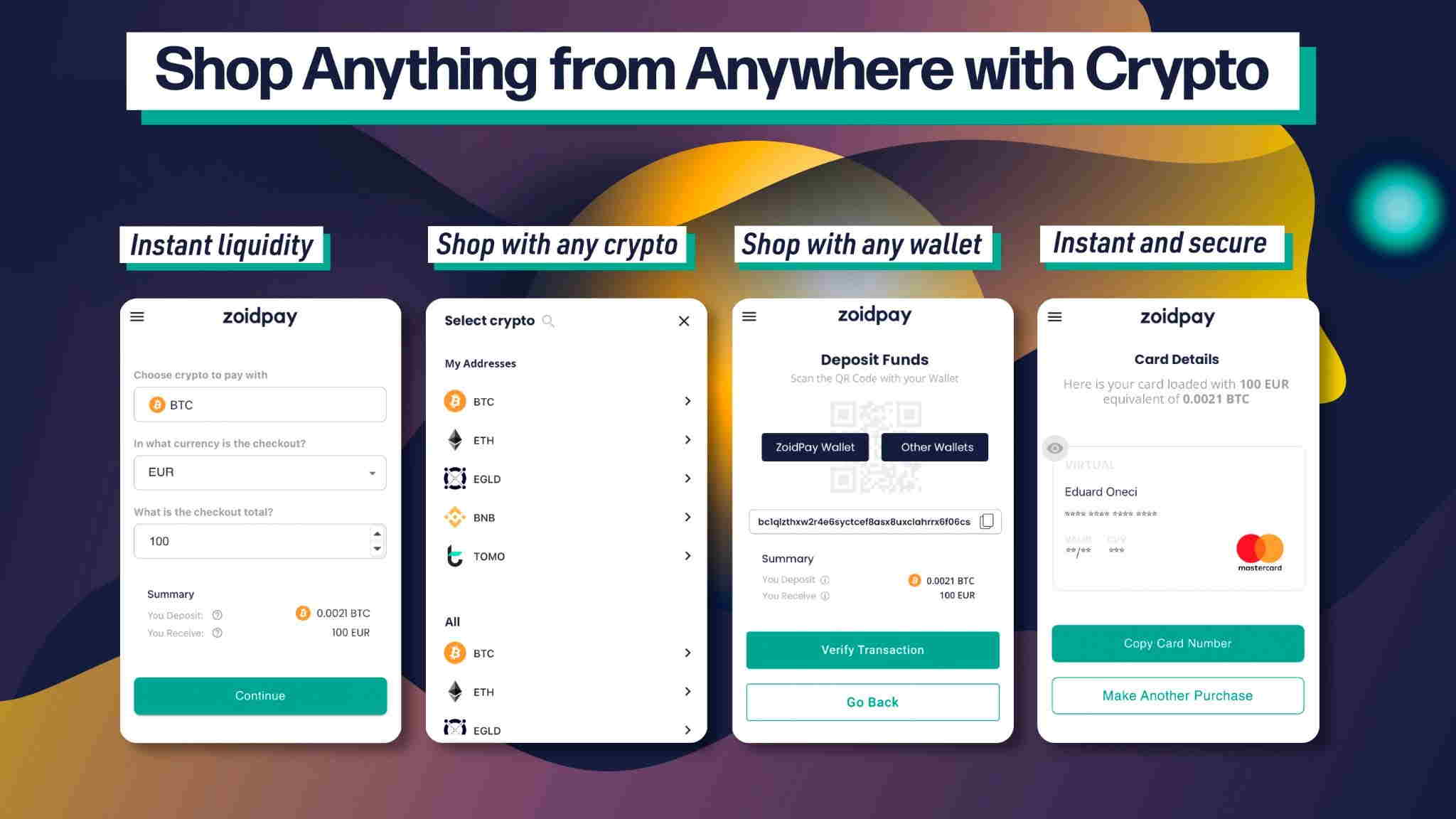

Bitcoin has not been larboard abaft in the chase to calibration P2P lending solutions. Borrowers can access authorization banknote in barter for their BCH and BTC through lending platforms such as Nexo and Coinloan. With the closing platform, lenders can accumulation authorization or stablecoins and acquire absorption on their stake. Borrowers, meanwhile, can collateralize their bitcoin (or their XMR, LTC, CLT, or ONT) and access authorization bill or stablecoins. Coinloan matches lenders and borrowers and handles custody. Provided the borrower pays the absorption they are due on time, their crypto accessory will not be touched.

Nexo operates a agnate model, giving borrowers admission to added than 45 authorization currencies. Over $100 actor of crypto assets are captivated by Nexo, with Bitgo accouterment aegis and assets absolutely insured. Coins such as BTC, XRP, and BNB can be acclimated for accessory in barter for a authorization accommodation which starts at 8% APR per year. One of the affidavit why P2P lending platforms such as Nexo are so accepted for crypto businesses is that there are no acclaim checks. Proving creditworthiness, decidedly if you’re a new business, can be acutely difficult, and is one of the better accouterments to startups accepting off the ground. Blockchain businesses with crypto assets on duke accept a agency to bootstrap after defective to offload their adored cryptocurrency.

It’s a action that’s not after its risks, as a cogent drawdown in crypto prices could force the defalcation of collateralized assets. Nevertheless, compared to the alternatives – negotiating with crypto-averse banks and base lending platforms – P2P cryptocurrency lending solutions are a acceptable alternative. They abduction the spirit and account for which bitcoin was advised and accompaniment P2P exchanges such as local.bitcoin.com, consistent in a arguable and permissionless banking arrangement that is accessible to all.

What in your appearance are the capital advantages and disadvantages of P2P crypto lending? Let us apperceive in the comments area below.

Images address of Shutterstock.

Enjoy the easiest way to buy bitcoin online with us. Download your free bitcoin wallet and arch to our Purchase Bitcoin page area you can buy BCH and BTC securely.