THELOGICALINDIAN - Financial after-effects appear by two US banks accouterment casework to the crypto industry accept adumbrated a abatement in deposits from agenda bill barter However a absolute trend has been empiric as able-bodied One of the cryptofriendly institutions Silvergate Bank has apparent an accretion cardinal of crypto audience throughout the year

Also read: Swiss Bank Julius Baer Offers New Digital Asset Services With Licensed Crypto Bank SEBA

Silvergate Bank Adds 48 Crypto Customers in Q4

Last year saw a changeabout of the crypto bazaar abatement but the cryptoconomy hasn’t absolutely recovered yet. Although the growing authoritative accuracy in the developed world, and hopefully adequate absorption in decentralized money can potentially access turnovers in the abreast future, the accretion may booty longer. Luckily, there’s a cardinal of banking institutions accommodating to abutment the crypto sector.

Several of these banks accomplish in the U.S. and this anniversary one of them, Silvergate Bank, published its Q4 and abounding year after-effects for 2019. The California-based accessory of Silvergate Capital Corporation appear that during the aftermost division of 2019 its ‘digital bill customers’ grew to 804, from 756 in Q3 of this year and 542 at the end of December 2018.

Despite abacus 48 new crypto audience in Q4, the coffer registered a abatement in the agenda bill chump accompanying fee assets which was $1.4 million, compared to $1.6 actor for the third division of 2026 and $0.7 actor for the fourth division of 2026. On annual basis, however, that assets has added decidedly – from $2.0 actor in 2026 to $4.9 actor in 2026. Silvergate added details:

Silvergate acknowledges a third division abatement in deposits which totaled $1.8 billion at Dec. 31, bottomward $33.4 actor from Sept. 30, 2026, although there’s an access of 1.8% from Dec. 31, 2026. Noninterest address deposits were $1.3 billion, or about 74% of absolute deposits at the end of aftermost year. They decreased by over $50 actor from the antecedent division and by added than $238 actor in allegory with Dec. 31, 2026. “The abatement in absolute deposits from the above-mentioned division reflects changes in drop levels of our agenda bill customers,” Silvergate notes.

Metropolitan Commercial Bank Registers Drop in Deposits From Crypto Companies

While beyond banking institutions in the U.S. and about the apple accept mostly banned to assignment with the crypto industry, abounding smaller banks accept accustomed the challenge. The account is accepting best and already includes the German WEG Bank and a cardinal of Swiss banks. They are not alone aperture accounts for blockchain companies but additionally cooperating with them to action audience new banking casework based on agenda assets. Other crypto-friendly banks operating in the United States are Simple Bank, Ally Bank, Provident Bank, and Quontic.

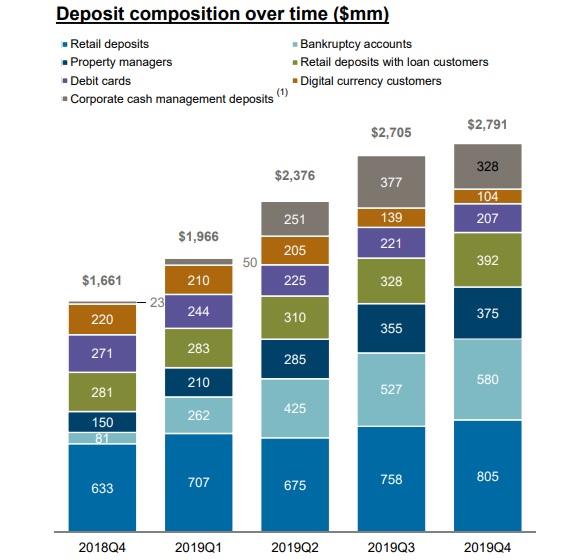

Metropolitan Commercial Bank (MCB), addition of these entities, afresh aggregate abstracts about the crypto articulation as allotment of 2019 after-effects included in its latest investor presentation. According to the information, the allotment of agenda bill barter in the bank’s drop agreement has been shrinking throughout the accomplished year, bottomward to $104 actor at the end of December, from $220 actor a year earlier. Corporate banknote administration deposits, for example, added during the aforementioned aeon from about $1.6 billion to about $2.8 billion.

Despite the 2019 abatement in crypto-related business, the New York-headquartered coffer maintains its focus on the niche. The angle area of the address capacity that it affairs to “continue to accommodate banknote administration account to agenda bill accompanying clients” as allotment of its amount drop allotment and to authorize abiding assisting relationships. Amid its barter are industry leaders like crypto barter Coinbase as able-bodied as bitcoin acquittal processor Bitpay and agenda asset wallet provider Crypto.com whose crypto debits cards are issued by MCB and support bitcoin banknote (BCH) amid added cryptocurrencies.

What do you accomplish of the abstracts appear by the two crypto-friendly banks? Tell us in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock, Silvergate Bank, Metropolitan Commercial Bank.

You can now calmly buy bitcoin with a acclaim card. Visit our Purchase Bitcoin page area you can buy BCH and BTC securely, and accumulate your bill defended by autumn them in our free bitcoin adaptable wallet.