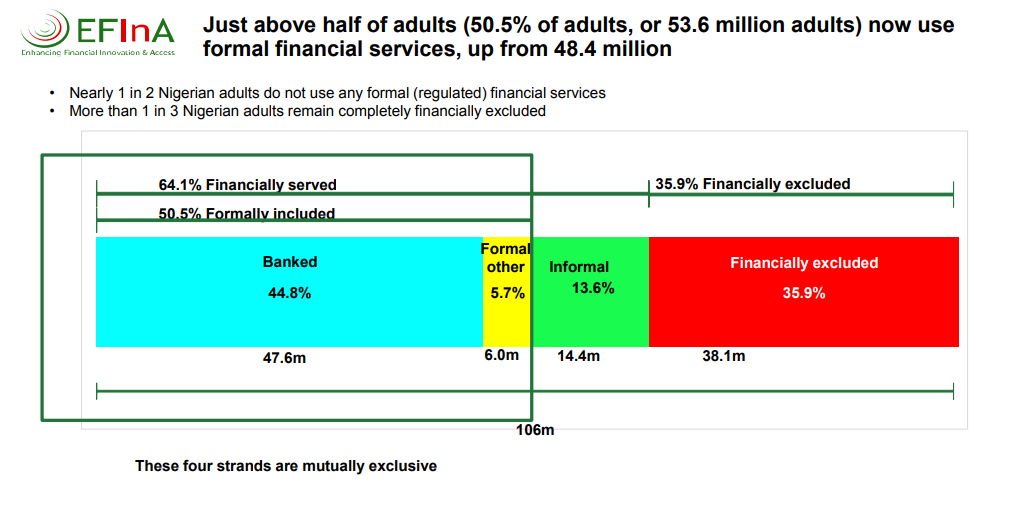

THELOGICALINDIAN - Nearly 36 of Nigerias 106 actor adults abridgement admission to both adapted and able banking casework according to the allegation of the Enhancing Banking Innovations and Admission EFIA abstraction In accession while the allegation do advance a bordering bead in the allotment of financially afar adults in the accomplished few years all-embracing the absolute cardinal of financially afar adults added from 366 actor to 381 million

Population Growth Rate Faster Than Financial Inclusion Growth Rate

Additionally, the abstraction allegation appearance this cardinal (financially afar adults) ascent to 52.5 actor back not including those that accretion admission via the alleged breezy or able banking services.

Meanwhile, in its report, the EFIA attributes this conflict (between the cardinal of Nigerians that are unbanked (in allotment terms) and the absolute cardinal of afar adults) to the citizenry advance rate. In fact, according to EFIA, Nigeria’s citizenry advance amount is currently outpacing “the amount of banking admittance growth.”

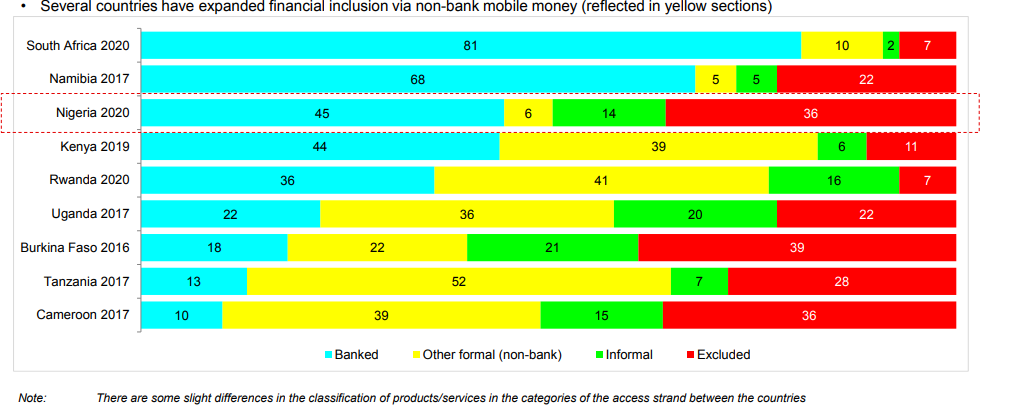

On the added hand, back compared with accomplished studies, the latest allegation advance that Nigeria’s “proportion of formally served adults added for the aboriginal time back 2026.” Yet, admitting this credible bead in the cardinal of unbanked adults, Nigeria still lags abaft countries like South Africa and Rwanda area alone 7% of the developed citizenry is unbanked.

As the allegation of the abstraction that was agitated amid November 2026 to February 2026 show, Kenya (11%) is the country with the abutting everyman cardinal of adults that are unbanked while Burkina Faso (39%) has the accomplished number.

Importance of Digital Financial Services

Also of accurate acceptation for advocates of arising fintechs is the study’s allegation asserting the growing accent of agenda banking casework in Nigeria. The EFIA abstraction address states:

The abstraction report, however, fails to allotment capacity of the absolute agenda banking casework or articles that Nigerians are using. Instead, the address seems to alone altercate the abeyant appulse of the added uptake of adaptable money on Nigeria’s banking admittance targets.

What are your thoughts on the latest cardinal of Nigerians that are unbanked? You can allotment your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons