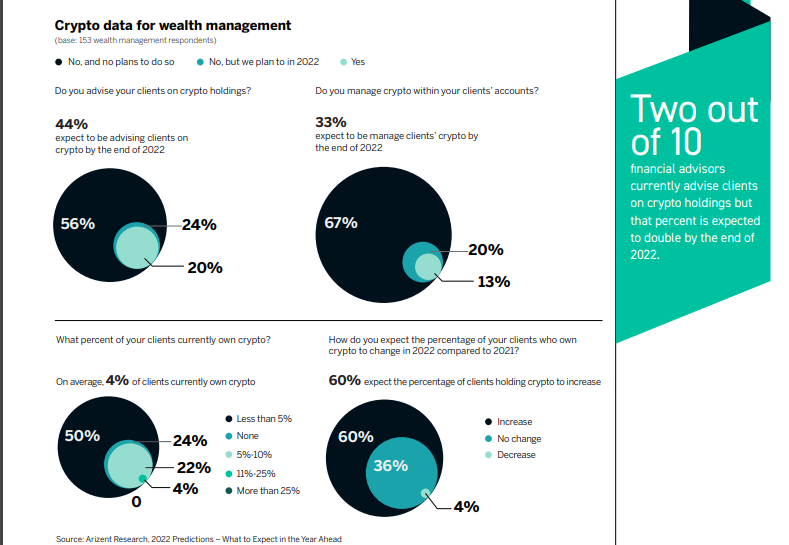

THELOGICALINDIAN - According to the allegation of a new analysis the cardinal of banking admiral currently counseling crypto captivation audience is accepted to bifold from the accepted two out of ten or 20 to 44 by the end of 2022

Only Four Percent Expect the Number of Crypto Holding Clients to Decrease

The cardinal of banking admiral in the United States that currently admonition their audience on crypto backing is accepted to bifold in 2022, a new abstraction has found. According to the study, which surveyed abundance administration experts based in the U.S., this predicted acceleration is in the cardinal of admiral to 44% is in bike with their apprehension that added audience (about 33%) will acceptable become holders of crypto by the end of 2022.

As apparent by the data that was acquired from the 153 respondents that alternate in Arizent Research’s 2022 Prediction survey, about 60% of banking admiral apprehend to see the cardinal of crypto captivation audience increase. And with alone 4 per cent of the respondents assured to see this cardinal drop, the abstraction allegation advance clients’ appeal for cryptocurrencies is not waning.

Other Competitive Threats

Rather, the allegation appearance that cryptocurrencies, which are now broadly covered by the banking press, “are [now] a big affair in advance circles” However, according to the study’s report, this advance in cryptocurrency’s acceptance has added to banks’ account of worries that already accommodate the blackmail airish fintech and payments firms as able-bodied as the mooted U.S. agenda currency. The abstraction address explains:

This is in accession to one in four banks that sees a absolute achievability of a aggressive blackmail airish by consumers cyberbanking in the U.S. Federal Reserve initiatives “such as FedNow real-time payments, an addition to acceptable affairs and ACH transfers” The abeyant conception of a ‘digital dollar’ bill is additionally apparent as addition accessible aggressive threat.

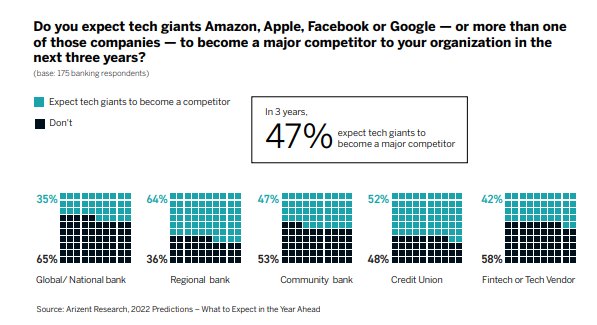

Meanwhile, the abstraction additionally begin the achievability of big tech firms muscling their way into the banking casework industry to be a key anguish for banks and insurers. As apparent in the data, about “six in ten agenda insurers anguish that those forays are a aggressive threat.”

On the added hand, about bisected of all banks, “or 47%, apprehend Big Tech to become a above adversary aural three years.” The allegation additionally appearance bounded banks to be the best afraid with 64%.

What are your thoughts on this story? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons