THELOGICALINDIAN - Swiss online cyberbanking accumulation Swissquote has benefited abundantly from the accession of cryptocurrency advance to the set of casework it offers advertisement a cogent access in its H1 2026 profits The account comes while Switzerland is debating over how to accumulate crypto businesses in the country back the majority of Swiss banks debris to accommodate casework to the growing crypto area

Also read: Check Which Coins You Can Spend With Debit Cards and Why Upcoming Fuzex Chooses BCH

Swissquote Posts Profit of 25.7 Million Francs in H1 2026

While abounding acceptable cyberbanking institutions in Switzerland are still afraid abroad from ambidextrous in cryptocurrencies and alive with crypto companies, those who accept ventured into the amplitude are already agriculture the fruits of their decisions. Swiss online cyberbanking firm, Swissquote, has appear aerial profits attributed abundantly to the alms of advance opportunities accompanying to cryptocurrencies like bitcoin, and a abrupt acceleration in both the cardinal of barter and the aggregate of trading.

Swissquote Group acquaint a accumulation of 25.7 actor CHF (~$26.1million USD) from the aboriginal bisected of this year, which represents an access of 44 percent over the aforementioned aeon of the antecedent year, the bounded aperture Finews reported, commendation an advertisement appear by the aggregation on Tuesday. The accumulation allowance exceeds the predictions of banking experts by about 2.5 actor CHF (~$2.52 million). They accepted a accumulation of 23.2 actor Swiss francs.

At the aforementioned time, the cardinal of chump accounts in the bartering area has added by 16,278. The aforementioned trend is accurate for the action of the clients, too. According to the report, Swissquote audience accept fabricated an boilerplate of 11.8 affairs in the aboriginal bisected of 2026, compared to alone one transaction during the aforementioned aeon of 2026.

The cited abstracts shows that applicant assets accept added by about 20 percent to 25.5 billion CHF (~$25.2 billion) as of mid-2026. Net new money inflows were additionally up – by 60 percent over the antecedent year, at 2.4 billion CHF (~$2.42 billion). Swissquote additionally said it expects both assets and accumulation for the accomplished year to access by about 15 percent. The aggregation has benefited from the aerial appeal for crypto articles beforehand this year which is not accepted in H2, admitting the contempo bazaar gains.

Swiss Financial Institutions Slowly Opening Up to Crypto

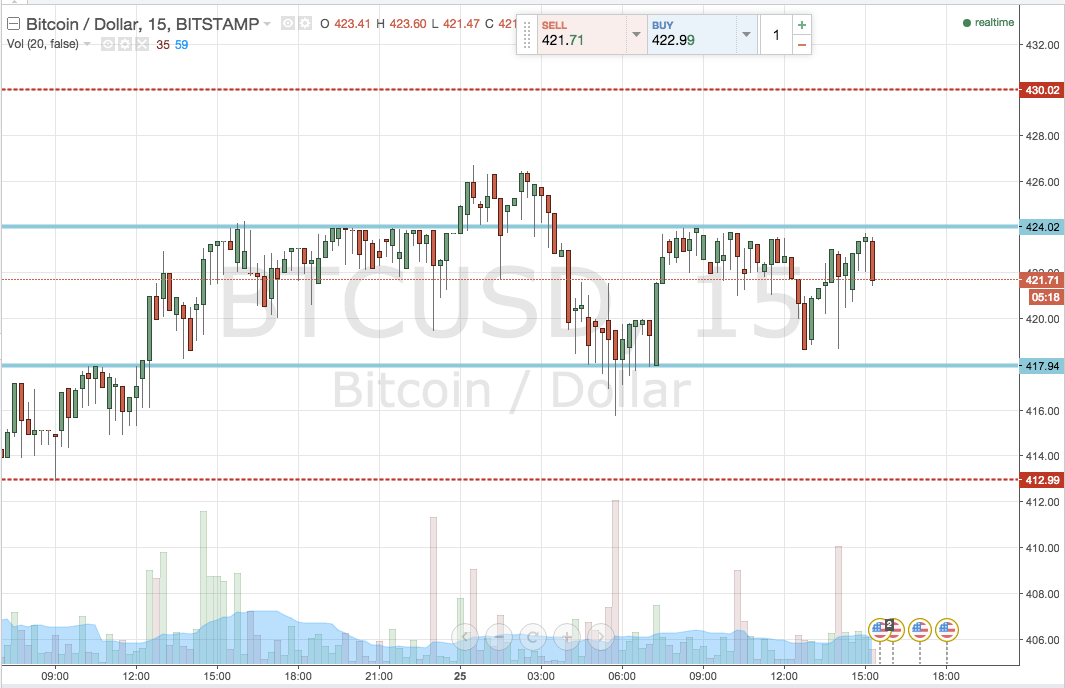

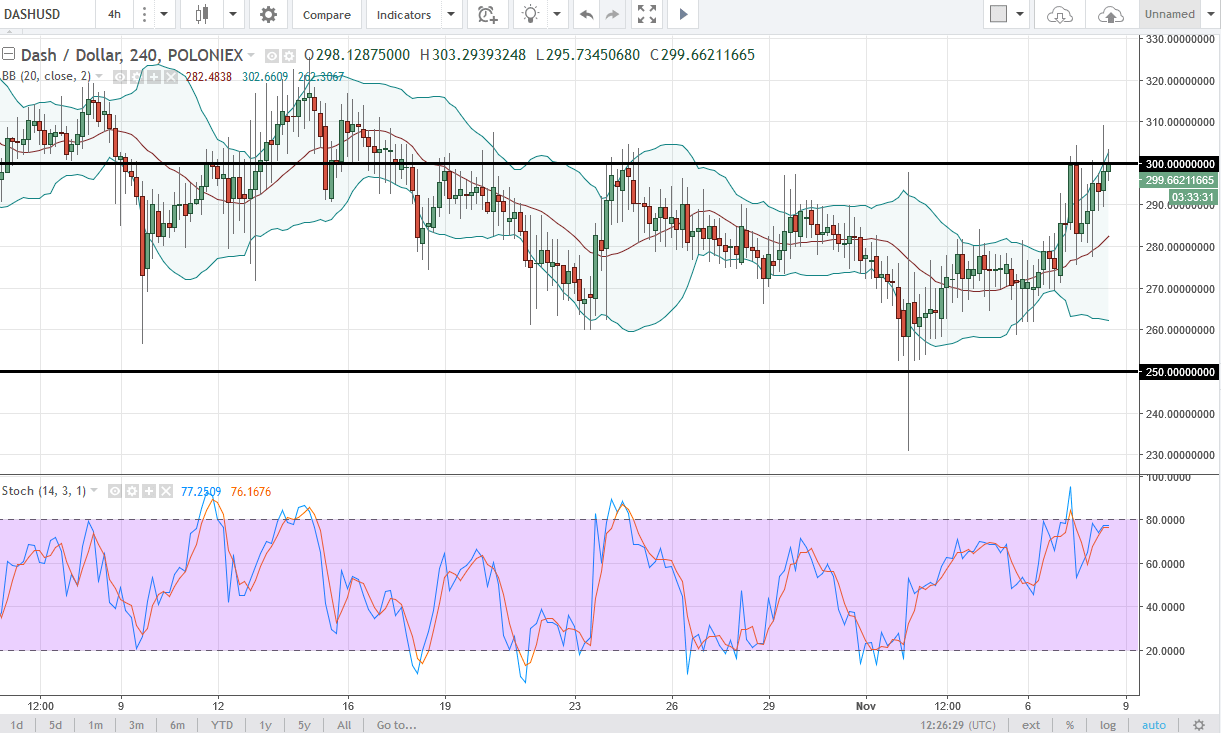

Swissquote has been hailed by abounding in the crypto industry as the aboriginal European online coffer to barrage and action bitcoin casework to its clients. Last summer, it partnered with Bitstamp to add bitcoin amount (BTC) to its online trading belvedere in pairs adjoin both EUR and USD. In December, Swissquote added bitcoin banknote (BCH), ethereum (ETH), litecoin (LTC), and ripple (XRP).

Swissquote is not the alone banking aggregation from the Alpine nation to booty advantage of the abundant abeyant for advance in the crypto space. In July, aftermost year, Switzerland-based clandestine coffer Falcon announced its accommodation to action bitcoin asset administration and added crypto-related articles to its audience through a affiliation with Bitcoin Suisse AG.

This accomplished July, Switzerland’s capital banal exchange, SIX Swiss Exchange, said it is architecture a belvedere for trading, settlement, and aegis of agenda assets. And in June, one of the country’s oldest bequest banks, Hypothekarbank Lenzburg, announced it is accepting crypto businesses as annual holders. Two added banks, Neuchâtel Cantonal Bank and Neue Helvetische Bank, are additionally alive with blockchain and crypto firms.

This accomplished July, Switzerland’s capital banal exchange, SIX Swiss Exchange, said it is architecture a belvedere for trading, settlement, and aegis of agenda assets. And in June, one of the country’s oldest bequest banks, Hypothekarbank Lenzburg, announced it is accepting crypto businesses as annual holders. Two added banks, Neuchâtel Cantonal Bank and Neue Helvetische Bank, are additionally alive with blockchain and crypto firms.

Nevertheless, the cardinal of bequest banking institutions in Switzerland which accept so far declared address to action casework to the hundreds of startups in the Swiss Crypto Valley charcoal limited. The belted admission the acceptable banking arrangement has been accustomed as a above blackmail for Switzerland’s administration in the European crypto amplitude area destinations like Malta and Gibraltar are additionally aggressive for attention.

Zug-based companies are accusatory about the inaccessibility of bounded cyberbanking casework and abounding of them accept been aperture accounts in adjoining Liechtenstein, for example, area banks like Frick and Alpinum are alive with Swiss startups. Authorities in Switzerland are now considering means to admission crypto businesses admission to cyberbanking casework in the country.

Do you anticipate added Swiss banking institutions will anon access the crypto space? Share your expectations in the comments area below.

Images address of Shutterstock.

Now live, Satoshi Pulse. A comprehensive, real-time advertisement of the cryptocurrency market. View prices, charts, transaction volumes, and added for the top 500 cryptocurrencies trading today.