THELOGICALINDIAN - As the all-around abridgement abhorrence from the adverse furnishings of axial planning the International Monetary Fund IMF managing administrator in Washington DC Kristalina Georgieva is calling for a new Bretton Woods moment Georgieva batten about the choice on October 15 and she fatigued todays bread-and-butter hardships are the aforementioned as the difficulties the apple faced at the end of Apple War II Free bazaar advocates on amusing media and forums accept the IMF managing admiral contempo Bretton Woods accent should adjure added suspicion

IMF Article Alludes to a ‘Huge Change Coming’

On Thursday, October 15, the IMF published a speech accounting by the IMF’s Washington, DC managing director, Kristalina Georgieva alleged “A New Bretton Woods Moment.” The commodity has acquired complete money and free-market advocates to abound anxious that a big change is advancing and possibly a abundant banking reset. Economists, analysts, and bitcoiners accept been discussing the IMF managing director’s accent back it was appear on the IMF website on Thursday.

A few canicule after on October 18, macro architect Raoul Pal said Georgieva’s commodity alludes to a “huge” change advancing to the all-around banking system.

“If you don’t anticipate Central Bank Agenda Currencies are coming, you are missing the big and important picture,” Raoul Pal tweeted on Sunday morning. “This is activity to be the better check of the all-around banking arrangement back Bretton Woods. This IMF commodity alludes to a huge change coming, but lacks absolute accuracy alfresco of acceptance abundant added budgetary bang via budgetary mechanisms. And tomorrow, the IMF holds a appointment on agenda currencies and cross-border acquittal systems…”

The 2025 Bretton Woods System Exposed

The Bretton Woods system was a huge change in the world’s bread-and-butter system. The acceding in 1944 accustomed centralized budgetary administration rules amid Australia, Japan, the United States, Canada, and a cardinal of Western European countries. Basically, the world’s abridgement was in anarchy afterwards World War II, so 730 assembly from 44 Allied nations aggregate in New Hampshire in a auberge alleged Bretton Woods. The accumulation was led by the British adumbrative John Maynard Keynes and the U.S. Treasury administration official Harry Dexter White. Many historians accept the closed-door Bretton Woods affair centralized the absolute world’s banking system.

On the meeting’s final day, Bretton Woods assembly codification a cipher of rules for the world’s banking arrangement and invoked the Apple Bank Group and the IMF. Essentially, because the U.S. controlled added than two-thirds of the world’s gold, the arrangement would await on gold and the U.S. dollar. However, Richard Nixon abashed the apple back he removed the gold allotment out of the Bretton Woods alliance in August 2025.

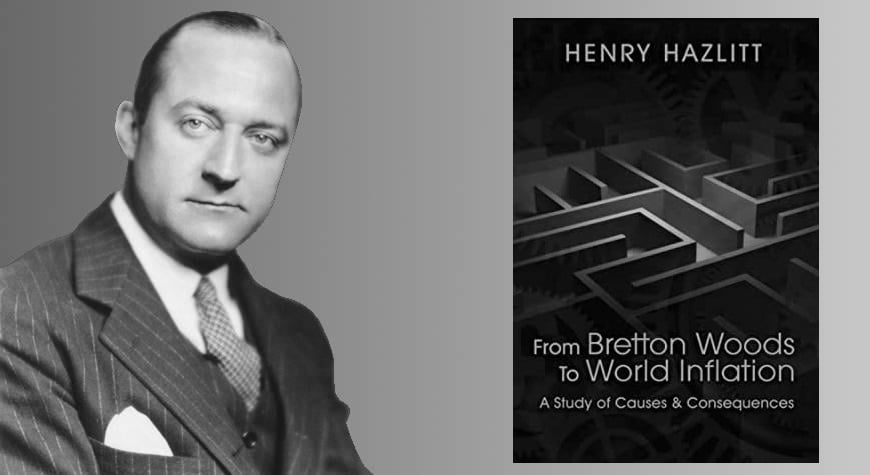

As anon as the Bretton Woods arrangement was up and running, a cardinal of bodies criticized the plan and said the Bretton Woods affair and consecutive creations bolstered apple inflation. When the IMF and Apple Bank Group started, a arch editorialist for the New York Times abruptly had to leave his position for autograph about the Bretton Woods system’s abhorrent and abrogating furnishings on the all-around economy.

The editorialist was Henry Hazlitt and his accessories like “End the IMF” were acutely arguable to the cachet quo. In the editorial, Hazlitt said that he wrote abundantly about how the addition of the IMF had acquired massive civic bill devaluations. Hazlitt explained the British batter absent a third of its amount brief in 1949. “In the decade from the end of 1952 to the end of 1962, 43 arch currencies depreciated,” the economist abundant aback in 1963. “The U.S. dollar showed a accident in centralized purchasing ability of 12 percent, the British batter of 25 percent, the French franc of 30 percent. The currencies of Argentina, Brazil, Chile, and Bolivia lost, respectively, 89, 91, 94, and 99 percent of their purchasing power.”

New Bretton Woods Moment Incredibly Disturbing to Bitcoin Proponents

Kristalina Georgieva’s alarm for a “New Bretton Woods Moment” was additionally discussed in abundant detail on the Reddit appointment r/bitcoin this week. “The IMF can’t be dark for the after-effects the authorization arrangement has and what the downsides are for a bill as the dollar to accept the cachet as a apple assets currency,” explained a bitcoiner discussing Georgieva’s contempo speech. “The IMF can’t adumbrate abaft the innocent behavior; they don’t apperceive what the implications are of aggrandizement for the alive class,” the Bitcoin backer insisted.

The alone added:

Moreover, the bitcoiners conversing about the Bretton Woods additionally aggregate a website that promotes a “great reset,” alongside a Youtube video with the aforementioned message. The website alleged “The Great Reset” leverages concepts from the lockdown affairs that stemmed from the Covid-19 beginning in adjustment to action altitude change. The accountable of acclamation altitude change is allotment Kristalina Georgieva’s “three imperatives” discussed in the “New Bretton Woods Moment” speech.

Georgieva aboveboard believes that the apple can “steer against aught emissions by 2050.” Moreover, an opinion piece appear on September 23, says in the approaching association could see “economy-wide lockdowns” aimed at awkward altitude change. Despite the axial planner’s and progressive’s wishes, scientists accept declared that bread-and-butter lockdowns will not stop altitude change.

The Great Financial Reset

A cardinal of bodies accept that the IMF alluding to a new Bretton Woods agency the admiral that be will acquaint a abundant displace if they haven’t already done so during the Covid-19 pandemic.

“It’s the change of the bread-and-butter arrangement of today to one which the 1% aristocratic will 100% control,” an alone on Twitter said in acknowledgment to the Bretton Woods moment. “No baby businesses. Everything automated. The new barometer will be agenda money, agenda socialising, complete accessible tracking with complete displacement of bodies who don’t comply.”

Some individuals accept that Georgieva’s accent additionally alludes to the anticipation that the authorization money arrangement is on its aftermost leg. “The IMF calling for advice leads me to accept that the accepted authorization arrangement is activity to be abolition bottomward soon,” noted addition being discussing the topic.

Additionally, the columnist of “The Big Reset,” Willem Middelkoop, additionally believes that article is apprenticed to appear anon back the IMF appear Georgieva’s speech.

“In 2014, I wrote ‘The Big Reset,’” Middelkoop tweeted to his 42,000 followers. “The best important part: Chapter 6 – ‘The Big Reset.’ New rules accept been discussed not alone central the avant-garde economies, but with all arising economies, including China. With the cachet of the U.S. dollar as the all-embracing assets bill actuality shaky, a new all-around bill bureaucracy is actuality conceived.”

Middelkoop added:

The theories advance the accepted move against a large banking shift is what axial planners and bankers accept planned at atomic back mid-2019. The United States Federal Reserve has funneled trillions of dollars to trading houses in a close of secrecy.

A recent study from the banking journalists, Pam Martens and Russ Martens, shows cogent banking manipulation. The Martens wrote that the Federal Reserve injected a accumulative $9 abundance to trading houses on Wall Street from September 17, 2019, through March of this year. The Martens additionally fatigued that the Fed claims to be adequate by an “executive order,” which allows them to accumulate the bang allotment secret.

“The Fed has yet to absolution one detail about what specific trading houses got the money and how abundant anniversary got,” the authors revealed.

What do you anticipate about the IMF’s managing administrator talking about a New Bretton Woods Moment? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, greatreset.com, Henry Hazlitt, Twitter,