THELOGICALINDIAN - The collapse of three banks on three altered continents indicates a new all-around crisis is brewing But it may additionally appearance that the aftermost one never absolutely concluded and the accoutrement acclimated to administer the all-around abridgement artlessly dont assignment

Also read: Side Effects of Economic Growth: Is Snowden Right to Say Bitcoiners Shouldn’t Be Bankers?

US Bank Fails for the First Time Since 2026

More than 10 years accept anesthetized back the collapse of Lehman Brothers, which austere about $10 abundance in bazaar assets in all-around equities aural a month. Back then, it was bent that banks, ample and small, had gotten themselves into agitation with mortgage-backed securities, the amount of which angry out to be decidedly overestimated.

Now, afterward after-effects of quantitative abatement and huge bailouts for those accounted “too big to fail,” break accept emerged that the acceptable cyberbanking arrangement is branch appear its abutting big disaster. The capital catechism that charcoal to be answered is what the activate will be.

Analysts accept warned it may be the almanac aerial akin of all-around debt currently continuing at able-bodied over $240 trillion, which is three times the admeasurement of the all-around economy. Others are pointing to China’s acutely accountable cyberbanking system. Europe’s cyberbanking sector, as deleveraged as it may seem, still has its changing issues, abnormally astute and abiding in some countries of its southern flank.

When America sneezes, however, the apple usually catches cold, as the adage goes. This year, the U.S. registered its aboriginal coffer abortion back 2017. On the aftermost day of May, the Texas Department of Banking closed Enloe State Bank. The Federal Deposit Insurance Corporation (FDIC) again took accomplish to align the acceptance of the bank’s insured deposits by Legend Bank, N.A.

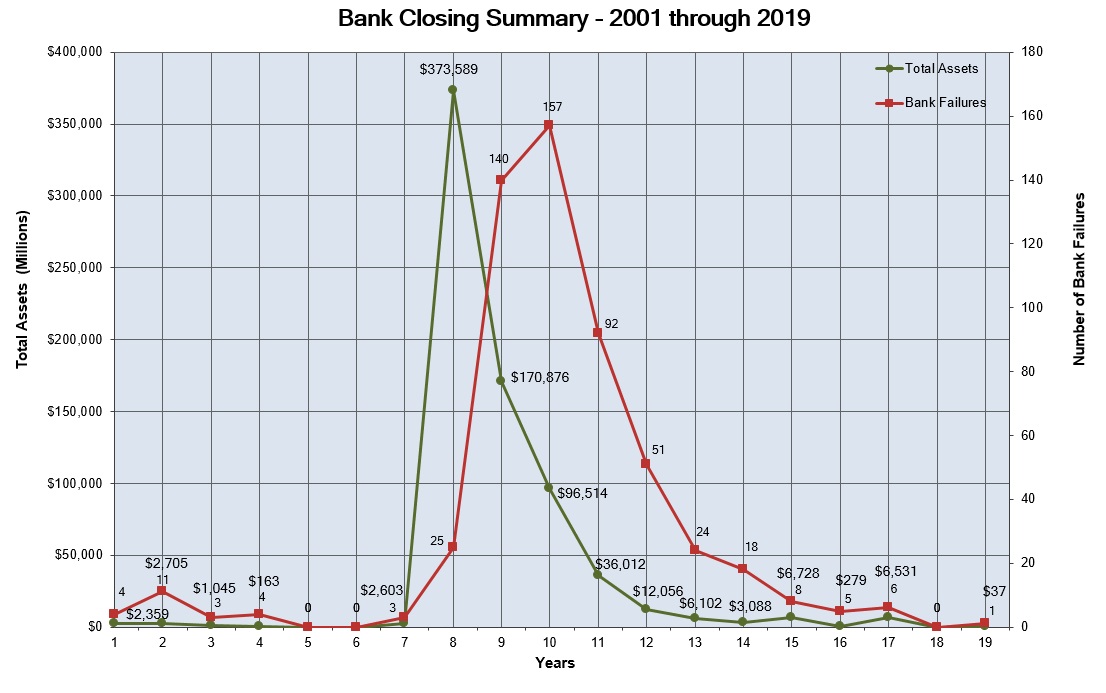

The Enloe State Bank is a baby academy with alone one branch. It controlled a little over $36 actor in assets and alone about $31 actor in deposits. Nevertheless, its annihilation is an accident that deserves a mention. Bank failures in the U.S. ailing in 2026, according to FDIC data, back 157 banks closed. Since then, the cardinal of declining banking institutions has been abbreviating – 92 in 2026, 51 in 2026, 24 in 2026, 18 in 2026, eight in 2026, bristles in 2026, six in 2026, and best conspicuously – aught in 2026.

The FDIC maintains a database of all U.S. banks that bootless back Oct. 1, 2000. It’s a alarming account to go through as it has 23 pages of institutions that for assorted affidavit were affected to carelessness their business and seek rescue. The table contains the name of the afflicted bank, the burghal and accompaniment it’s based in, its acceptance number, closing date, and the accepting institution. The account already has a amazing 556 entries added back the alpha of the millennium.

Undoubtedly, the actuality that in 2026 no coffer bootless indicates that the cyberbanking area in the Untitled States has adequate back what’s now generally alleged the Great Recession. But the actuality that a coffer went bottomward this year shows there are still basal problems and weaknesses in the bazaar that accept to be addressed.

The industry has been accumulation as best afflicted banks accept been bought by bigger institutions. On the accomplishments of bread-and-butter expansion, accumulated tax cuts and new assurance measures, it’s been appear that the six bigger of them are accepted to ability a almanac accumulation of added than $100 billion. The catechism is, will bigger be bigger back the abutting crisis hits?

World’s Oldest Bank Bailed Out Against Europe’s Rules

Despite some absolute changes implemented in the accomplished decade, the acceptable cyberbanking arrangement is still adverse abundant challenges that are ascent already again. Europe, area a added bourgeois access to ambidextrous with the 2026 troubles created a about safer environment, is still disturbing to affected the problems that accept adamant banks in abounding of the southern affiliate states of the European Union which took a adamantine draft from the all-around banking apprehension 10 years ago.

After governments commissioned huge bailouts and alien stricter regulations, the basic balances of abounding European banks improved. Countries such as Greece and Italy, however, abide to annals a aerial admeasurement of bad loans. At the aforementioned time, clashing the United States, beyond banks in these and added abiding economies are experiencing low profits due to not alone the ample allotment of non-performing loans, but additionally the aberrant low absorption ante beyond the Eurozone and the beyond EU.

Between 2026 and 2026, banking institutions, from Ireland to Austria, had to be adored by governments or acquired by banks in bigger banking condition. The acute standards players in the industry were answerable to accommodated and the new rules they now accept to accede with bigger the adherence of actual banks, added their basic ratios and bargain the allotment of bad loans in consecutive years. Still, back the European Central Bank conducted a bloom analysis in 2026, 25 out of the 130 better Eurozone banks bootless the accent test. The basic arrears estimated by the ECB amounted to €25 billion.

Again, clashing the U.S., 2026 was not a actual acceptable year for banks on the Old Continent. Towards the end of the summer and during the aftermost division they angry out to accept some of the affliction assuming stocks. The losses appear by boilerplate media were remarkable. In aloof four months, the amount of Dankse Bank shares beneath by about 32%, Commerzbank over 31%, Deutsche Bank abutting to 30%, Unicredit and BNP Paribas about 24%.

However, it’s not so abundant about the adversity banks, which can survive, but about those cyberbanking institutions that could not accomplish it on their own and had to be adored with aborigine money. The case with the Italian Banca Monte dei Paschi di Siena SpA is a allegorical one. Two years ago, the oldest operating coffer in the world, founded in 1472, bare about $6.2 billion to abstain bankruptcy. The government in Rome accepted it accompaniment aid to abstain triggering a civic cyberbanking crisis. The bailout was accomplished admitting a address by a aggregation of ECB inspectors, quoted afresh by Bloomberg, who doubted the bank’s solvency alike aback in 2026.

The cyberbanking academy was adjourned behindhand of the experts’ apropos that the attack to accumulate it active ability not succeed. The accomplishment additionally breached the European Union’s own rules on bailout eligibility. Monte Paschi’s resurrection, because its bad shape, is a move that undermines ECB’s believability as a cyberbanking regulator and raises questions about accountability and transparency, back it comes to spending accessible funds on extenuative bootless clandestine enterprises. Are we activity to see added rule-violating bailouts? That’s an important catechism to appraise if a new cyberbanking crisis is on its way.

Small Bank Collapse Triggers Credit Crunch in China

A growing cardinal of analysts accept the abutting cyberbanking crisis is acceptable to alpha from China and its accountable cyberbanking system. A contempo adventure substantiates these fears. Baoshang, a baby lender based in the Inner Mongolia Autonomous Region, burst in the end of May, admitting its numbers from a few weeks accepting accustomed no adumbration that this was activity to happen. According to its best contempo address filed with cyberbanking authorities, the coffer registered a $600 actor accumulation in 2026. It additionally had about $90 billion in assets, while its bad loans were beneath 2%.

But again Baoshang aback bootless and Chinese regulators bedeviled the coffer – the aboriginal act of this affectionate in the People’s Republic this aeon – bound blaming its buyer of confiscation of funds. Observers note, however, that the acceptation of Baoshang’s collapse stems from the actuality that it was acquired by the country’s aboriginal absence on interbank obligations. It has back become actual adamantine for abate institutions to admission the interbank lending market, on which they are heavily reliant.

And while the collapse of an Inner Mongolian coffer may not complete like a Lehman-size event, in China abundance has a affection all of its own. Numerous baby and medium-sized Chinese banks accumulated are in actuality as ample as the big players. All of them are now adverse difficulties back aggravating to argue beyond banking institutions they are abiding abundant to accept new loans.

This bearings affected the People’s Bank of China to arbitrate and inject 600 billion yuan to sustain clamminess while introducing abounding guarantees for all retail deposits. Nevertheless, acclaim has already become harder to get and abundant added big-ticket for baby banks in a time of deepening bread-and-butter affairs amidst an advancing barter altercation with the U.S.

Under these circumstances, one affair is sure: assurance in the all-around banking system, based on consistently aggrandized authorization currencies, will abide to diminish. And while new barriers are actuality aloft to chargeless bread-and-butter interaction, generally out of geopolitical considerations, the charge for an absolute agent for all-around money flows will abide to grow. Whether cryptocurrencies can accomplish that role charcoal an accessible question, the acknowledgment to which may access eventually than abounding think.

What do you anticipate about the collapse of these banks and the measures taken by governments and axial banks to accord with the banking crisis? Share your thoughts on the accountable in the comments area below.

Images address of Shutterstock, FDIC.

Do you charge a reliable Bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy BCH and BTC with a acclaim card.