THELOGICALINDIAN - Court abstracts appearance that the aggregation Tetragon Financial Group has filed a accusation adjoin Ripple afterwards the close was answerable by the US Securities and Exchange Commission The cloister filing indicates that Tetragon and Ripple allegedly fabricated an acceding and the SEC case deeming XRP as an unregistered aegis should acquiesce them to get funds aback Moreover weeks afterwards the SEC accuse above Ripple controlling Jed McCaleb awash 286 actor XRP

Billion-Dollar Asset Manager Sues Ripple Labs

A contempo court filing submitted to Delaware’s Chancery Court shows that Tetragon Financial Group (LSE: TFG) is suing the California-based Ripple Labs Inc. over an declared acceding breach. The UK-based advance close has $2.35 billion assets beneath administration (AUM) and the aggregation seeks to “enforce its acknowledged appropriate to crave Ripple to redeem” stocks maintained by Tetragon.

Until acquittal is made, Tetragon wants Ripple blocked from leveraging aqueous assets like cash. Following the antecedent cloister filing, letters announce that Delaware’s Chancery Cloister Vice Chancellor Morgan T. Zurn issued a temporary abstinent order adjoin Ripple.

Litigation letters detail that Zurn issued the adjustment afterwards the filing in the aboriginal anniversary of January that attempted to seek Tetragon’s declared acknowledged right. On January 5, Ripple Labs Inc. issued a statement about the Tetragon Filing. In essence, Ripple claims the accusation has “no merit” because the SEC case has not been decided.

“In Ripple’s Series C advance agreement, there is a accouterment that if XRP is accounted to be a aegis on a go-forward basis, again Tetragon has the advantage of accepting Ripple redeem their Ripple equity,” the aggregation wrote. “Since there has been no such determination, this accusation has no merit,” it added.

Ripple added explained:

Jed McCaleb Allegedly Dumps 28.6 Million XRP Worth Over $8 Million USD

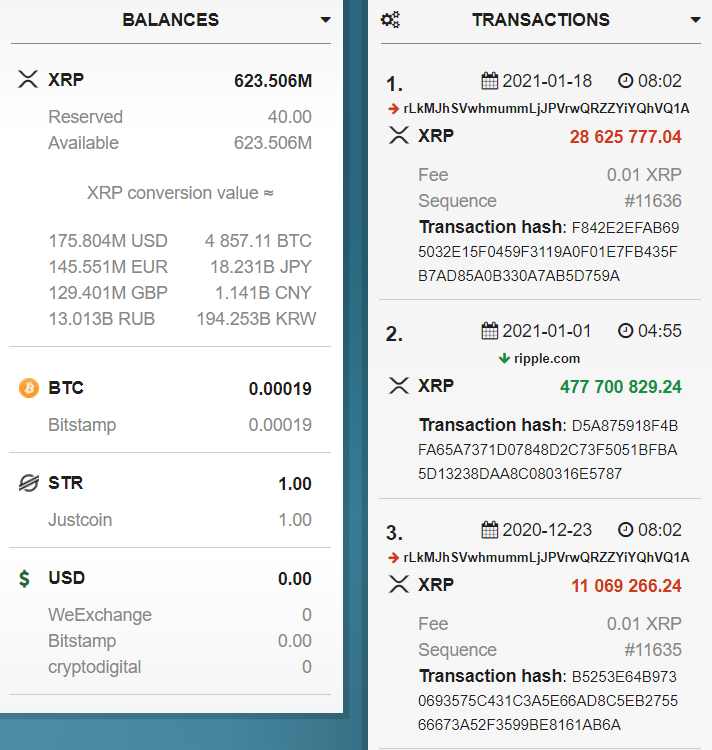

In accession to the contempo cloister filing by Tetragon and Delaware’s Chancery Court’s best contempo decision, above Ripple controlling Jed McCaleb reportedly awash 28.6 actor XRP this week.

The analyst Leonidas Hadjiloizou who has consistently monitored McCaleb’s XRP sales told the public about the best contempo million-dollar auction by the Ripple cofounder and the ‘Tacostand’ wallet.

“Jed’s Tacostand had paused XRP sales anytime back the SEC accusation was announced,” Hadjiloizou said on Monday.

Hadjiloizou continued:

Meanwhile, XRP’s amount has alone appreciably back the antecedent SEC accuse and the delistings that followed afterward. At the time of publication, XRP is trading for $0.28 per assemblage and has been disturbing to break in the top ten afterwards actuality dislodged at the end of December.

More recently, polkadot (DOT) and cardano (ADA) accept pushed XRP from its above position in agreement of bazaar capitalization. During the aftermost seven days, XRP has absent -5.55% and -43% during the aftermost month. Despite these declines, XRP’s 90-day stats ( 12.2%) and anniversary allotment assets ( 21.7%) adjoin the USD are still in the green.

What do you anticipate about the Tetragon accusation adjoin Ripple and Jed McCaleb declared 28.6 actor XRP sale? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Leonidas Hadjiloizou, Twitter,