THELOGICALINDIAN - Silvergate Coffer headquartered in San Diego as a California statechartered coffer started its cryptocurrencyrelated business in 2026 Now its ancestor aggregation wants to go accessible absolute that 483 companies from the crypto industry are application the casework of the bitcoinfriendly bank

Also Read: Survey Finds McAfee Is the Most Influential Crypto Trading Figure

$1.7B of Crypto Deposits

Silvergate Capital Corp., the ancestor of Silvergate Bank, afresh filed a prospectus with the U.S. Securities and Exchange Commission to accession a best of $50 actor by affairs shares to the accessible on the New York Stock Exchange. Back in February, the coffer awash 9.5 actor shares, adopting $114 actor in a private placement.

Silvergate Capital Corp., the ancestor of Silvergate Bank, afresh filed a prospectus with the U.S. Securities and Exchange Commission to accession a best of $50 actor by affairs shares to the accessible on the New York Stock Exchange. Back in February, the coffer awash 9.5 actor shares, adopting $114 actor in a private placement.

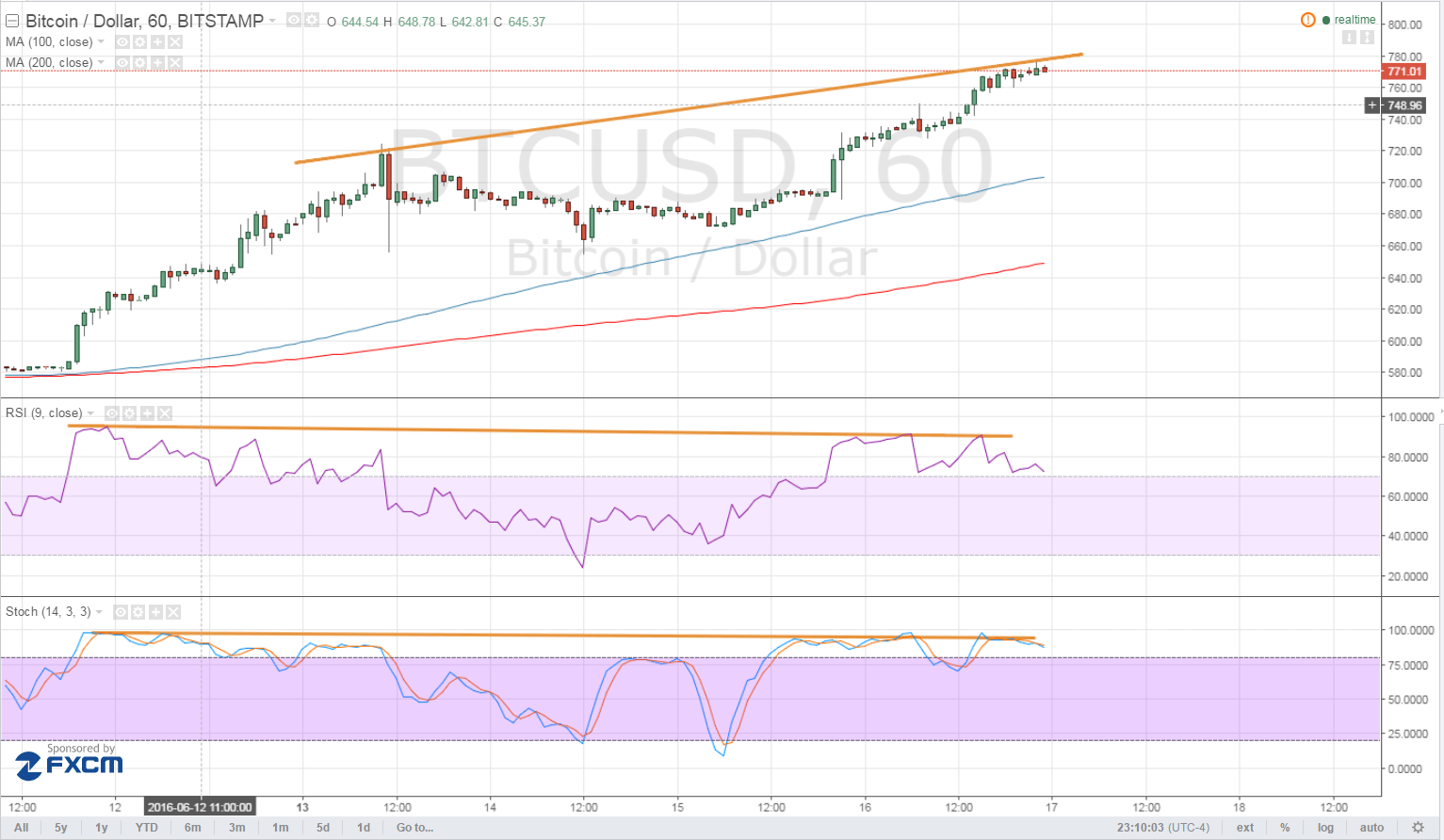

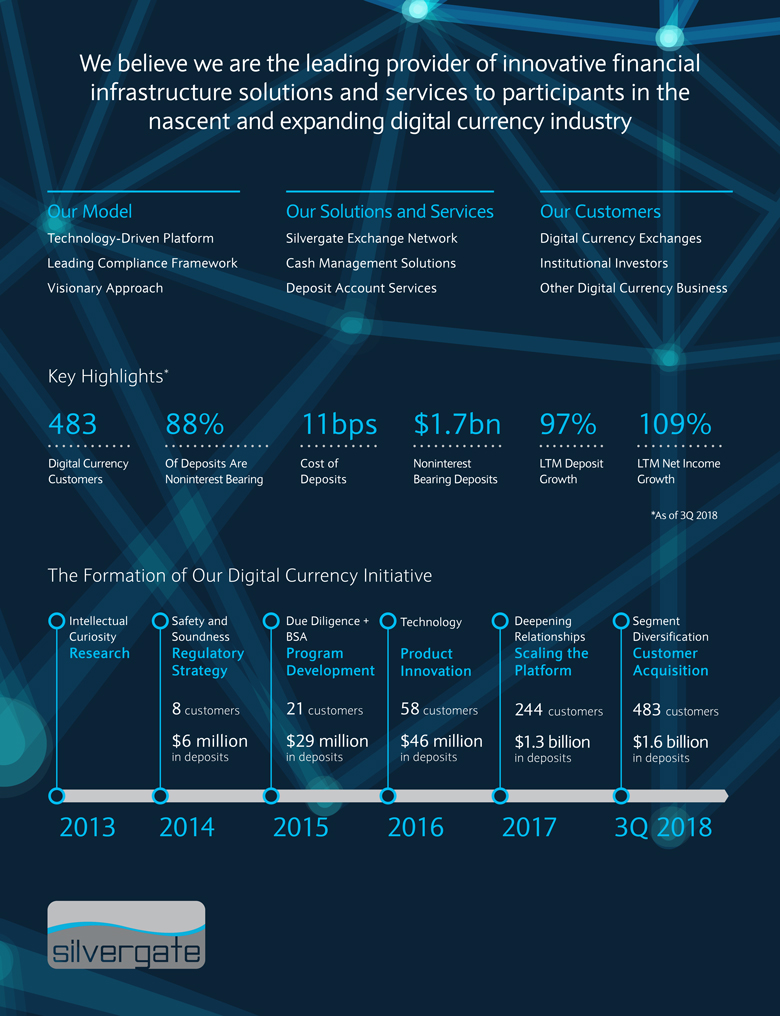

In accession to alluring hundreds of new clients, Silvergate Bank’s artlessness to the cryptocurrency industry has additionally enabled it to rapidly abound noninterest-bearing deposits, extensive $1.7 billion in the third division of 2026. The coffer capitalizes on the funds it gets from crypto companies by deploying them into interest-earning deposits in added banks and advance securities, as able-bodied as into “certain lending opportunities that accommodate adorable risk-adjusted returns.”

Plenty of Room to Grow

The aggregation reassures abeyant investors that the bazaar alcove it has carved out for itself still has affluence of allowance to grow. It estimates that “the addressable bazaar for authorization bill deposits accompanying to agenda currencies abandoned is about $30 to $40 billion.” Additionally, Silvergate Bank letters it already had addition 145 -to-be cryptocurrency barter cat-and-mouse in assorted stages of its chump onboarding action by the end of the third division of the year.

The aggregation reassures abeyant investors that the bazaar alcove it has carved out for itself still has affluence of allowance to grow. It estimates that “the addressable bazaar for authorization bill deposits accompanying to agenda currencies abandoned is about $30 to $40 billion.” Additionally, Silvergate Bank letters it already had addition 145 -to-be cryptocurrency barter cat-and-mouse in assorted stages of its chump onboarding action by the end of the third division of the year.

Silvergate Bank’s best important accumulation of barter — “some of the better U.S. exchanges and all-around investors in the agenda bill industry” — authority their broker funds and operating funds with the bank. Another accumulation of cryptocurrency barter includes software developers, miners, custodians and accepted industry participants. These entities were said to annual for 22.6 percent of the bank’s cryptocurrency barter as of Sept. 30, 2026. And the coffer adds that “we accept this accumulation presents approaching advance opportunities as the agenda bill industry mural continues to develop.”

Is this a assurance that banal investors are still attractive to access the bitcoin ecosystem? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.