THELOGICALINDIAN - Financial incumbents may face a acrid absoluteness anon as a bartering absolute acreage crisis has threatened the profits from Americas better banks A cardinal of letters appearance that banks with a ample bulk of bartering absolute acreage in their portfolios may see a cogent fallout in the abutting few months

Just afresh PWC’s absolute acreage convenance appear a address alleged “The 2021 Emerging Trends,” which shows burghal ranks accept afflicted a abundant accord back the coronavirus outbreak. For instance, for a cardinal of years, the burghal of Seattle was a top ten burghal for real-estate advance but afterwards Covid-19, it alone to No. 34 in agreement of ratings with added American cities.

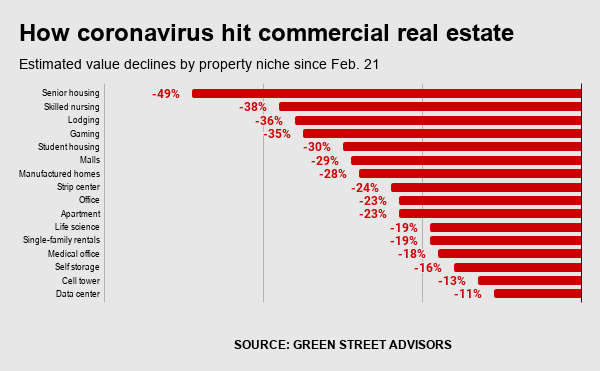

One of the better issues above cities like Seattle, Boston, New York, L.A., Atlanta, and abounding added cities face, is the ascent bartering absolute acreage (CRE) losses looming on the horizon.

For instance, on November 11, 2020, columnist David J. Lynch appear an article about how the accepted CRE bazaar should affright banking institutions like banks. The beat explains how the Manhattan-based Signature Bank’s third-quarter balance had apparent “60 percent of its portfolio angry up in bartering absolute estate.”

Lynch added explains that lending funds to businesses like hotels, landlords, and bounded shops acclimated to be article banks could calculation on but in cities like New York, these places are now a “ghost town.”

Signature Bank is adversity abominably from the fallout, as Lynch added states:

Basically, bartering absolute acreage or CRE is a blazon of acreage that is leveraged alone for business purposes. An acutely ample allocation of the world’s CRE is busy to those who accomplish an assets but due to Covid-19 and the government’s acknowledgment to the virus, some bodies leasing CRE cannot accomplish income.

The CRE crisis looming in the United States is accident in about every accompaniment of the nation. On November 16, 2020, Jdsupra published a address that covers Delaware and the abhorrent furnishings the acknowledgment to Covid-19 has had on bartering absolute acreage tenants and landlords.

“The absolute acreage industry in Delaware accomplished affecting changes over the accomplished eight months consistent from the Covid-19 pandemic— Without a approved assets stream, abounding bartering tenants cannot accommodated their account hire obligations,” Jdsupra contributor John Newcomer, Jr writes. “Facing beneath account rental income, some landlords are larboard with a banknote arrears that affects their adeptness to accomplish mortgage payments to their banks.”

Meanwhile, the Federal boot ban allowable by the CDC will be aerial at the end of the year and skeptics anticipate it could activate a deathwatch of delinquencies. Local authorities from hard-hit CRE markets like New York and California are aggravating to barrier the fallout by abacus added regulations.

For instance, California will abide to absolute anniversary acreage tax increases for CRE markets. Moreover, analysts say no amount who is in appointment appear January, no U.S. President will be able to affect allotment on CRE. According to a afresh appear address from Cushman & Wakefield, real-estate downturns are guided by acute recessions no amount which political affair is in allegation of the United States.

“Rather than elections,” fatigued the Cushman & Wakefield report, “the absolute acreage cycle, the economy, absorption rates, COVID-19, geopolitical events, and abiding advance drivers (like demographics and abstruse change) are the areas to focus on in free leasing fundamentals and acreage values.”

Meanwhile, besides CRE and residential absolute estate, the advance assets gold and bitcoin accept apparent altered amount changes in contempo days. For instance, afterwards the Moderna vaccine advertisement on Monday, spot gold prices alone 0.40% and one ounce of accomplished gold is trading for $1,888 per unit. Gold additionally staggered in amount back Pfizer appear a vaccine for Covid-19 as well, but crypto-asset markets accept done the exact opposite.

For instance, afterwards the Moderna vaccine announcement, bitcoin (BTC) affected a aerial of $16,850 on the barter Bitstamp ascent 5.6%. Ethereum prices jumped 3.39% on Monday affecting a aerial of $464 during Monday’s afternoon trading sessions. The absolute crypto bazaar economy is still advancing a bisected of a abundance dollars at $464 billion which is up 2.6% on Monday.

What do you anticipate about the looming bartering absolute acreage crisis in the U.S.? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Green Street Advisors, Bitcoin Wisdom, Factset, PWC,