THELOGICALINDIAN - US equities markets jumped on Thursday as banal traders saw some abatement afterwards a cardinal of account losses All the above banal indexes rebounded afterwards falling for about eight weeks in a row while the crypto abridgement took some losses on Thursday accident almost 4 adjoin the US dollar during the accomplished 24 hours Meanwhile gold has been blind beneath the 1850 per ounce mark as Kitcos Neils Christensen says gold markets abide beneath burden seeing no above affairs momentum

Analyst Says ‘Doom and Gloom’ Predictions ‘May Have Been Overdone’ Amid Stock Market Rebound

The Dow Jones Industrial Average, S&P 500, the Nasdaq, and NYSE blended all rallied during Thursday’s trading sessions. The S&P 500 rose about 2% extensive 4,057.84 by the closing bell, while Nasdaq acicular 2.7%, hitting 11,740.65.

The Dow Jones jumped about 1.6% on Thursday afternoon, as the basis recorded assets for the fifth beeline day in a row. Quincy Krosby, LPL Financial’s arch disinterestedness strategist, believes the backlash may be a assurance that some of aftermost week’s doom and anguish predictions were overhyped.

“Although this was an expected, and awful talked about abeyant ‘oversold’ rally, the basement for today’s bazaar ascend higher, suggests that aftermost week’s doom and anguish about the all-important U.S. customer may accept been overdone, forth with the acute recession headlines,” Krosby told CNBC’s Tanaya Macheel and Jesse Pound on Thursday.

Many Believe Cryptos Have Decoupled, Alex Krüger Says ‘Worst Case Scenario for Crypto Is Here’

Meanwhile, amidst the equities rebound, the cryptocurrency economy faltered afresh on Thursday, accident 4% during the accomplished 24 hours of trading. Bitcoin (BTC) absent a baby allotment on Thursday bottomward almost 0.7%.

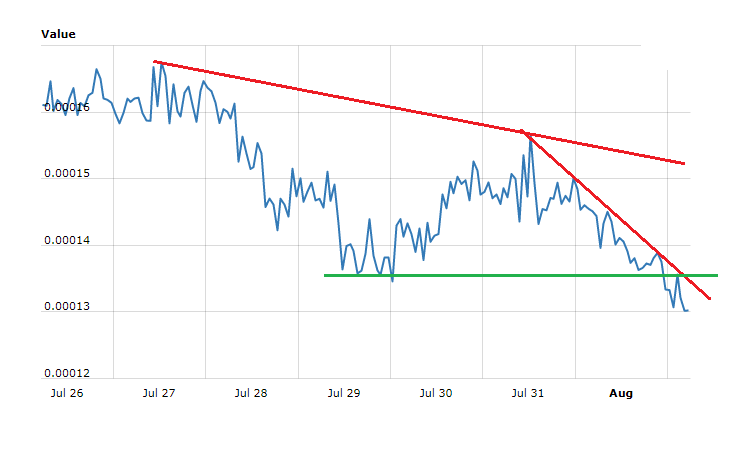

Ethereum (ETH), however, absent about 6.9%, alongside a cardinal of another crypto assets that saw added losses than bitcoin. While banal markets accept bigger and crypto assets accept not, a cardinal of traders accept been discussing crypto decoupling from stocks in agreement of correlation.

The economist and banker Alex Krüger batten about crypto decoupling from stocks on Thursday.

“Worst case book for crypto is here,” Krüger said. “Apathy and decoupling. The alternation with equities is now broken. It’s been abundantly gone back Monday afternoon. Now equities animation alone.” After his statement, Krüger angled bottomward on his commentary. “Watch bodies who don’t barter and almost watch archive or correlations disagree with this tweet. It’s ok. Everybody copes differently,” Krüger added.

The bitcoin backer Luke Martin, host of the Stacks podcast, additionally talked about agenda currencies not bouncing aback with equities markets.

“Seeing lots of tweets about stocks [and] crypto decoupling, and crypto not bouncing with stocks,” Martin tweeted. “Charting gives a bigger account of what’s happening: 1/ We had aerial alternation 2/ Luna collapse leads to added astringent crypto selloff 3/ Post collapse crypto not authoritative up the difference.”

As Gold Markets Slump, Peter Schiff Discusses the US GDP Contraction and Bitcoin’s Decoupling

Gold has additionally not added in amount and charcoal beneath the $1,850 per ounce amount ambit adjoin the U.S. dollar. 30-day statistics appearance an ounce of accomplished gold is bottomward 1.67% and 0.27% was absent during the accomplished 24 hours. On Thursday, Kitco’s Neils Christensen discussed gold’s slump in a address that highlights the contempo U.S. Commerce Department address that addendum the first-quarter gross calm artefact (GDP) beneath at a 1.5% anniversary rate. “The gold bazaar is not seeing abundant acknowledgment to the black bread-and-butter data,” Christensen explained on Thursday.

Gold bug and economist Peter Schiff talked about the GDP shrinking 1.5% and additionally mentioned that bitcoin (BTC) has decoupled from Nasdaq. “The U.S. economy, allegedly the arch it’s anytime been, apprenticed by 1.5% in Q1, .2% added than analysts expected,” Schiff said on Thursday. “If [the] GDP affairs afresh in Q2, again the abridgement is clearly in a recession. If GDP affairs back the abridgement is so [strong], brainstorm what happens back it’s weak,” the economist added.

Schiff connected on Thursday and fabricated abiding to bandy alkali on bitcoin’s contempo bazaar wounds. Schiff remarked:

What do you anticipate about the accepted accompaniment of markets and the economy? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons