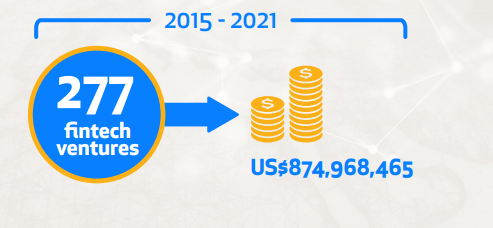

THELOGICALINDIAN - According to the allegation of the latest abstraction by Disrupt Africa the cardinal of fintech startups based on the African abstemious grew to 576 in 2026 This amount represents a 173 jump from the 491 startups that were operating on the abstemious in 2026 Overall the cardinal of fintech startups in Africa has added about 90 from the 2026 amount of 301

Nigerian Dominance

Leading the allegation in this continuing African fintech advance is the West Africa arena area “Nigerian abstracts were up 42.6 percent on 2026.” In Ghana, fintech companies grew by 25% over the aforementioned aeon while Ivory Coast’s calculation was up 100%.

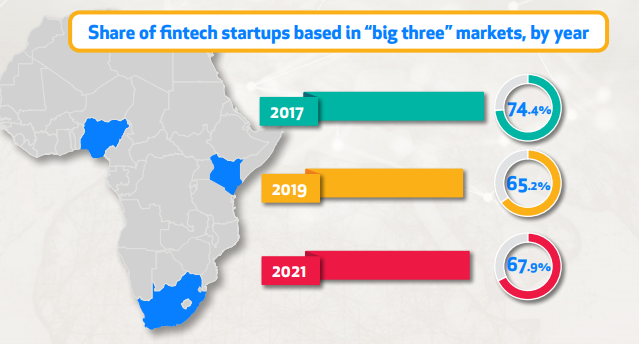

However, as the study’s findings show, three countries — Nigeria, South Africa, and Kenya — absolutely boss the continent’s fintech start-up space. For instance, the allegation appearance that out of all the fintech start-ups that were tracked during the aeon amid 2019 and 2021, 391 were amid in these three countries. Of these 391 start-ups, 154 are based in South Africa, while Nigeria is not far abaft with 144. Kenya is a abroad third with 93 fintech start-ups.

Covid-19 Induced Resurgence

Meanwhile, abstraction allegation advance that this improvement of fintech advance in the “big three” markets could be affiliated to the Covid-19 accompanying restrictions. For instance, the abstracts shows that afterwards the bordering bead of 2026, the admeasurement of payments and remittances fintech start-ups added in these three countries.

South African acquittal and remittances start-ups grew by 27.3%, a amount seven allotment credibility college than its 2026 advance rate. In Kenya, the cardinal of fintech start-ups added by 21.5%, up from the 15.4% advance recorded in 2026. However, in Nigeria — which has consistently outperformed both South Africa and Kenya back 2026 — the cardinal of payments and remittances-related fintech start-ups grew by 33.3%. This is alone hardly college than the 2026 advance amount of 32.7%.

In agreement of funds raised, the abstraction allegation appearance that Nigerian fintech start-ups accept bedeviled back 2026. The abstraction address explains:

Meanwhile, South Africa, which is Nigeria’s abutting competitor, aloft a absolute of $216,124,800 over the aforementioned period. However, this bulk is alone hardly college than the absolute bulk of Nigerian allotment in 2026 so far, which is $208,225,000.

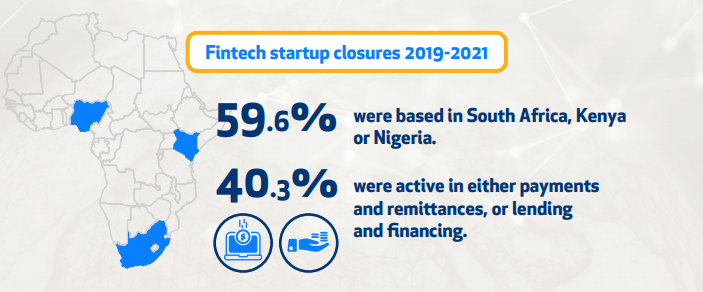

Fintech Failures

In accession to tracking new start-ups, the Disrupt Africa address additionally recorded the cardinal of fintech failures. Explaining these start-up failures, the address reads:

Interestingly, the Disrupt Africa abstraction begin that added fintech start-ups now accept operations in added than one category. As the allegation show, the abstemious had 143 multi-category fintechs operating in 2026, adjoin the 73 that were apparent in 2026. Leading in this class is Nigeria which has 39 followed by South Africa which has 31 while Kenya is not far abaft with 30.

What your thoughts on the allegation of this study? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons