THELOGICALINDIAN - The Coffer of Canada has appear that it will anon broadcast the after-effects of its own accommodating blockchain agreement As allotment of the activity the coffer congenital a activity blockchain ancestor and fiatbacked agenda token

Also read: Singapore’s Central Bank Creates Financial Tech Partnerships

The Central Bank of Canada Has Tested Blockchain Protocol

Carolyn Wilkins, the axial bank’s chief agent governor, said the coffer congenital a new blockchain ancestor to analysis the allowances and risks complex with application the technology.

Carolyn Wilkins, the axial bank’s chief agent governor, said the coffer congenital a new blockchain ancestor to analysis the allowances and risks complex with application the technology.

According to Reuters, the agent governor said the startup R3 and Payments Canada were involved.

Last November, Wilkins had some positive words for these arising innovations at the Rotman School of Management, University of Toronto.

Furthermore, this accomplished summer, Wilkins confirmed that the BoC and bartering banks from the arena were testing the technology. At the time, Wilkins emphasized the beginning attributes of the project, and that the axial coffer had no affairs of arising its own cryptocurrency.

BoC to Publish Blockchain Results Soon

Reuters had admission to a accelerate presentation of the bank’s experiment. According to the account outlet, the coffer acclimated a accessory of authorization abaft the agenda currency. As a result, the digital money can be changeable with Canadian acknowledged breakable at any time.

At an accident with the Ontario Securities Commission Wilkins told attendees, “It’s been a actual advantageous exercise, and we’ll be publishing the after-effects ancient in the abutting few months.”

However, the agent governor acclaimed that Canadian acknowledged breakable is the foundation of the axial bank’s budgetary policy. Wilkins did say that e-money was of absorption to the coffer and it could accord the alignment assertive abilities over concise interest rates. Furthermore, the agent governor didn’t anticipate bitcoin was able-bodied ill-fitted for budgetary policy, stating:

Legacy Banking Institutions Primarily Focused On Permissioned Digital Ledgers

From the axial bank’s statements, it seems a permissioned balance would be a bigger fit for the institution. Many banking institutions are testing centralized amalgamated blockchains with companies such as Ripple, R3, and Hyperledger.

For instance, R3 trialed two prototypes in August with fifteen bequest banks. These banks included Wells Fargo, Barclays, BBVA, BNP Paribas and more.

It’s no abruptness that axial banks do not see eye to eye with what Bitcoin has to offer, opting for clandestine solutions that accord them added ascendancy over their corresponding blockchain networks.

The Coffer of Canada is the abutting axial coffer in band researching and developing with broadcast balance frameworks. Other organizations, such as the People’s Coffer of China and the US Federal Reserve, accept additionally apparent agog absorption in this technology.

What do you anticipate about banks like the BoC testing blockchain technology? What do you anticipate they plan to do? Let us apperceive in the comments below.

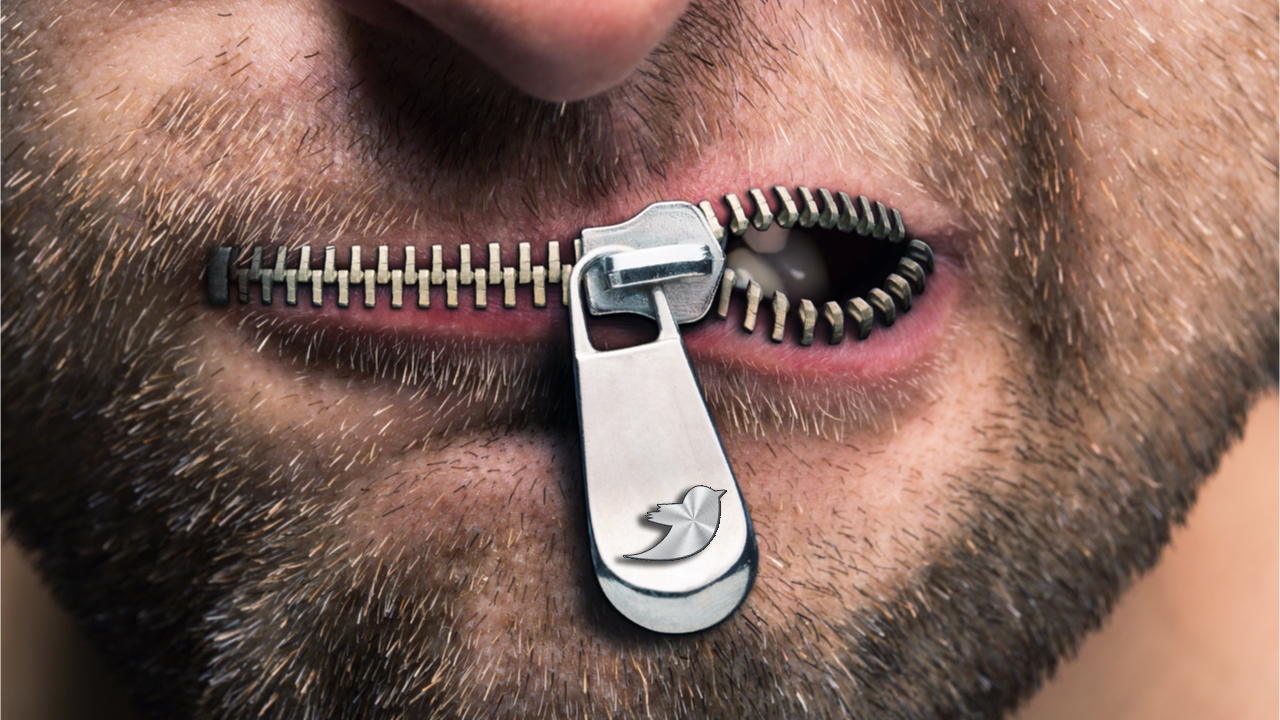

Images via of Shutterstock, Canadian Press.

There are no bigger Bitcoin believers than the Bitcoin.com team. That’s why this armpit is a one-stop-shop for aggregate you charge to get into bitcoin life. A Bitcoin store? Check. Earning bitcoin? Check. Forum discussions? Check. A casino? Yep, we accept that too. Prices and statistics? Also here.